Proposed deletion of [[:{{{1}}}]]

The article [[:{{{1}}}]] has been proposed for deletion because of the following concern:

Contents

- Proposed deletion of [[:{{{1}}}]]

- Productivity caused deflation

- Deflation with increasing gold supply

- See also

- References

article is redundant with the articles on the topics, the Long Depression and Deflation, and considered by itself, poorly written and sourced

You may prevent the proposed deletion by removing the {{proposed deletion/dated}} notice, but please explain why in your edit summary or on the article's talk page.

Please consider improving the page to address the issues raised. Removing {{proposed deletion/dated}} will stop the proposed deletion process, but other deletion processes exist. In particular, articles for deletion allows discussion to reach consensus for deletion based on established criteria.

If the proposed deletion has already been carried out, you may request undeletion of the article at any time.

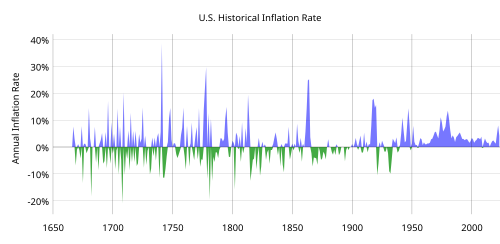

The Great Deflation or the Great Sag refers to the period from 1870 until 1890 in which the world prices of goods, materials and labor decreased, although at a low rate of less than 2% annually. [1] This was one of the few sustained periods of deflationary growth in the history of the United States.[ citation needed ]

Many businesses suffered, such as warehousing, especially in the London area, due to improvements in transportation, like efficient steam shipping and the opening of the Suez Canal, and also because of the international telegraph network. Displaced workers found new employment in the expanding economy as real incomes grew. [2]

By contrast to the mild deflation of the so-called Great Deflation, the deflation of the 1930s Great Depression was so severe that deflation today is associated with depressions, although economic data suggest this correlation was an outlier. [3]