Related Research Articles

Vinod Khosla is an Indian-American billionaire businessman and venture capitalist. He is a co-founder of Sun Microsystems and the founder of Khosla Ventures. Khosla made his wealth from early venture capital investments in areas such as networking, software, and alternative energy technologies. He is considered one of the most successful and influential venture capitalists.

Venture capital (VC) is a form of private equity financing provided by firms or funds to startup, early-stage, and emerging companies, that have been deemed to have high growth potential or that have demonstrated high growth in terms of number of employees, annual revenue, scale of operations, etc.. Venture capital firms or funds invest in these early-stage companies in exchange for equity, or an ownership stake. Venture capitalists take on the risk of financing start-ups in the hopes that some of the companies they support will become successful. Because startups face high uncertainty, VC investments have high rates of failure. Start-ups are usually based on an innovative technology or business model and they are often from high technology industries, such as information technology (IT), clean technology or biotechnology.

Kleiner Perkins, formerly Kleiner Perkins Caufield & Byers (KPCB), is an American venture capital firm which specializes in investing in incubation, early stage and growth companies. Since its founding in 1972, the firm has backed entrepreneurs in over 900 ventures, including America Online, Amazon.com, Tandem Computers, Compaq, Electronic Arts, JD.com, Square, Genentech, Google, Netscape, Sun Microsystems, Nest, Palo Alto Networks, Synack, Snap, AppDynamics, and Twitter. By 2019 it had raised around $9 billion in 19 venture capital funds and four growth funds.

Sequoia Capital is an American venture capital firm headquartered in Menlo Park, California which specializes in seed stage, early stage, and growth stage investments in private companies across technology sectors. As of 2022, the firm had approximately US$85 billion in assets under management.

Stephen T. Jurvetson is an American billionaire businessman and venture capitalist. Formerly a partner of the firm Draper Fisher Jurvetson (DFJ), he was an early investor in Hotmail, Memphis Meats, Mythic and Nervana Systems. He is currently a board member of SpaceX among others. He later co-founded the firm Future Ventures with Maryanna Saenko, who worked with him at DFJ.

Vinod Dham is an Indian-American engineer, entrepreneur, and venture capitalist. He is known as the 'Father of the Pentium Chip' for his contribution to the development of Intel's Pentium micro-processor. He is also a mentor and advisor, and sits on the boards of companies, including startups funded through his India-based fund Indo-US Venture Partners, where he is the founding managing director.

Sevin Rosen Funds (SRF) is a Texas-based venture capital firm credited with pioneering the personal computing revolution in the 1980s and also venture investing in Dallas. It was established in 1981 by L. J. Sevin, a former Texas Instruments engineer, and Ben Rosen, and was one of the leading investors on the US West Coast.

Hugh Redmond Brady is an Irish academic, the 17th President of Imperial College London, and a professor of medicine. He was the 13th President and Vice-Chancellor of the University of Bristol. He is also President Emeritus of University College, Dublin (UCD), having served as UCD's eighth President from 2004 to 2013.

Founders Fund is a San Francisco based venture capital firm formed in 2005 and has roughly $12 billion in total assets under management as of 2023. Founders Fund was the first institutional investor in Space Exploration Technologies (SpaceX) and Palantir Technologies, and early investor in Facebook. The firm's partners have been founders, early employees and investors at companies including PayPal, Palantir Technologies, Anduril Industries and SpaceX.

Łukasz Nosek is a Polish-American entrepreneur, notable for being a co-founder of PayPal.

Tom Baruch is an American businessman and venture capitalist (VC) based out of San Francisco, California. He was a founding partner of the VC funds CMEA Capital, Formation 8 and is now the managing director of his family office: Baruch Future Ventures (BFV).

Paul Bragiel is an internet entrepreneur and currently a managing partner of Bragiel Brothers.

Genesis Partners is an Israeli venture capital firm, founded in 1996 by Eddy Shalev and Eyal Kishon.

Naval Ravikant is an American entrepreneur and investor. He is the co-founder, chairman and former CEO of AngelList. He has invested early-stage in over 200 companies including Uber, FourSquare, Twitter, Wish.com, Poshmark, Postmates, Thumbtack, Notion, SnapLogic, Opendoor, Clubhouse, Stack Overflow, Bolt, OpenDNS, Yammer, and Clearview AI, with over 70 total exits and more than 10 Unicorn companies.

David McCourt is an Irish-American entrepreneur with experience within the telecom and cable television industries. He was an early contributor to the development of transatlantic fiber networks and has founded or bought over 20 companies in nine countries.

Women in venture capital or VC are investors who provide venture capital funding to startups. Women make up a small fraction of the venture capital private equity workforce. A widely used source for tracking the number of women in venture capital is the Midas List which has been published by Forbes since 2001. Research from Women in VC, a global community of women venture investors, shows that the percentage of female VC partners is just shy of 5 percent.

Theresia Gouw is an entrepreneur and venture capital investor in the technology sector. She worked at Bain & Company, Release Software and Accel Partners before co-founding Aspect Ventures, a female-led venture capital firm, in 2014. Gouw was named one of the 40 most influential minds in tech by Time Magazine. and has been recognized seven times on the Forbes Midas List as one of the "world's smartest tech investors". According to Forbes, Gouw is the richest female venture capitalist, with a net worth of approximately $500 million, primarily due to her involvement with Accel (company)'s early investment in Facebook.

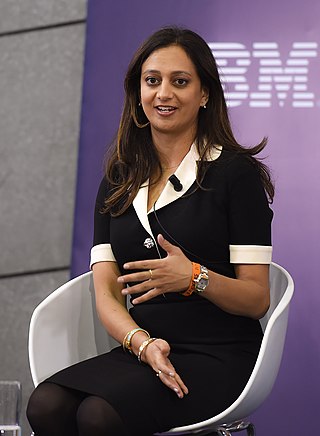

Jalak Jobanputra is an American businesswomen and entrepreneur. She founded the early-stage venture capital fund, FuturePerfect Ventures in 2014. Prior to founding the fund, Jobanputra was a director at Omidyar Network and a senior vice president at the New York City Investment Fund.

Ashmeet Sidana is an American businessman, entrepreneur and venture capitalist. He is the Founder, Chief Engineer and Managing Partner of Engineering Capital.

Molten Ventures, formerly Draper Esprit, is a venture capital firm, investing in high growth technology companies with global ambitions, with offices in London, Cambridge and Dublin. It is listed on the London Stock Exchange and is a constituent of the FTSE 250 Index.

References

- 1 2 3 4 Keane, Jonathan (28 June 2021). "Irishman Conrad Burke leading new Bill Gates-backed fund". Silicon Republic. Retrieved 6 September 2022.

- 1 2 3 4 5 "Business 100 (2011): Conrad Burke". Irish America Magazine. Retrieved 30 October 2023.

- ↑ "Bray-born entrepreneur joins hi-tech venture fund backed by Bill Gates". independent.ie. Retrieved 6 September 2022.

- ↑ "Bray businessman a leading light in solar energy in USA". Bray People. 6 December 2007. Retrieved 4 November 2023.

- ↑ "Celebrating Success and Exceptional Achievement". UCD Connections. 1 September 2022. Retrieved 12 October 2022.

- ↑ "'We'll emerge from this crisis as a more confident nation'". Bray People. 16 October 2013. Retrieved 4 November 2023.

- ↑ "Conrad Burke Joins Capella's Board". Light Reading (Press release). 13 April 2005. Retrieved 30 October 2023.

- 1 2 "DuPont acquires silicon ink developer Innovalight". Optics.org. 25 July 2011. Retrieved 30 October 2023.

- ↑ "Solar Ink to create a solar revolution?". Renewable Energy Magazine. 2005. Archived from the original on 8 November 2023. Retrieved 30 October 2023.

- ↑ "Home". MetaVC Partners. Retrieved 6 September 2022.

- ↑ "Bray man Conrad Burke's Bill Gates-backed materials fund MetaVC raises €56m". Irish Independent. 16 April 2023. Retrieved 4 November 2023.

- ↑ "Conrad sees light as solar business picks up award". Bray People. Retrieved 6 September 2022.

- ↑ "UCD Alumni Award in Science 2022". UCD Alumni Awards. Retrieved 12 October 2022.