Related Research Articles

The U.S. Securities and Exchange Commission (SEC) is an independent agency of the United States federal government, created in the aftermath of the Wall Street Crash of 1929. The primary purpose of the SEC is to enforce the law against market manipulation.

Cleary Gottlieb Steen & Hamilton LLP is an international white shoe law firm headquartered at One Liberty Plaza in New York City. It employs over 1,200 lawyers worldwide.

Davis Polk & Wardwell LLP is a white-shoe, international law firm headquartered in New York City with 980 attorneys worldwide and offices in Washington, D.C., Northern California, London, Paris, Madrid, Hong Kong, Beijing, Tokyo, and São Paulo. The firm has consistently been recognized as a global leader in banking & financial services as well as in capital markets.

Giovanni Prezioso born in 1957 in Boston to Dr. and Mrs. Fausto Maria Prezioso of Towson, Md, became General Counsel of the US Securities and Exchange Commission in April 2002.

Linda Chatman Thomsen was the director of the Division of Enforcement for the U.S. Securities and Exchange Commission from 2005 until early 2009. Since arriving at the SEC in 1995, she worked under four SEC Chairmen: Arthur Levitt, Harvey Pitt, William H. Donaldson, and Christopher Cox. William Donaldson named her director of the Division of Enforcement on May 12, 2005. She is the first woman to serve as director of the Division of Enforcement. Thomsen is known for her role in the suits by the SEC against Enron and Martha Stewart, and for not having investigated Bernard Madoff. She succeeded Stephen M. Cutler. She is now a senior counsel at Davis Polk & Wardwell.

Dewey & LeBoeuf LLP was a global law firm headquartered in New York City. Some of the firm's leaders were indicted for fraud for their role in allegedly cooking the company's books to obtain loans while hiding the firm's financial plight. The firm was formed in 2007 through the merger of Dewey Ballantine and LeBoeuf, Lamb, Greene & MacRae. Dewey & LeBoeuf was known for its corporate, insurance, litigation, tax, and restructuring practices. At the time of its bankruptcy filing, it employed over 1,000 lawyers in 26 offices around the world.

Schulte Roth & Zabel, LLP is a full service law firm with offices in New York City, Washington, D.C., and London.

Bernard Lawrence Madoff was an American fraudster and financier who ran the largest Ponzi scheme in history, worth about $64.8 billion. He was at one time chairman of the NASDAQ stock exchange. He advanced the proliferation of electronic trading platforms and the concept of payment for order flow, which has been described as a "legal kickback".

Harry M. Markopolos is an American former securities industry executive and a forensic accounting and financial fraud investigator.

H. David Kotz, also known as Harold David Kotz, is a managing director at Berkeley Research Group.

Andrew Neill Vollmer is an American lawyer. He retired as partner in the securities department at law firm WilmerHale. Prior to April 2009, he had been Deputy General Counsel for the United States Securities and Exchange Commission (SEC) and acting General Counsel. He succeeded Meyer Eisenberg as Deputy General Counsel, who retired from the Commission in early January 2006 and former General Counsel Brian Cartwright who left the Commission for the private sector in January 2009.

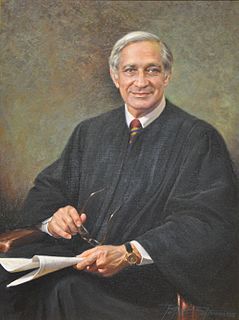

Harold Leventhal was a United States Circuit Judge of the United States Court of Appeals for the District of Columbia Circuit.

The Madoff investment scandal was a major case of stock and securities fraud discovered in late 2008. In December of that year, Bernie Madoff, the former NASDAQ chairman and founder of the Wall Street firm Bernard L. Madoff Investment Securities LLC, admitted that the wealth management arm of his business was an elaborate multi-billion-dollar Ponzi scheme.

Irving H. Picard is a partner in the law firm BakerHostetler. He is known for his recovery of funds from the Madoff investment scandal from investors, Bernie Madoff and his family, and their spouses and estates.

Genevievette Walker-Lightfoot is a former U.S. Securities and Exchange Commission (SEC) attorney. She worked on the Bernard Madoff investigation in 2004, as the Lead Investigator for the SEC on the case. She discovered key elements of the Madoff Ponzi scheme and reported them to her superiors. She was moved off the case prior to being able to complete the investigation.

Gary J. Aguirre is an American lawyer, former investigator with the United States Securities and Exchange Commission (SEC) and whistleblower.

David C. Williams was the vice chairman of the Board of Governors of the United States Postal Service from September 13, 2018, to April 30, 2020, and served as Inspector General (IG) for the U.S. Postal Service, in the United States Postal Service Office of Inspector General, from 2003 to 2016.

Shana Diane Madoff, sometimes referred to as Shana Madoff Skoller Swanson, is an American former attorney who is now a yoga teacher.

Eric J. Swanson is an American lawyer who worked at the U.S. Securities and Exchange Commission (SEC) and dated and eventually married the niece of Bernard Madoff while the SEC was investigating Madoff's investment firm for what was eventually revealed to be a massive Ponzi scheme. Swanson is currently the Senior Vice President, General Counsel, and Secretary of BATS Global Markets, the third-largest stock exchange in the United States.

David Paul Weber is an American criminalist, and the former Assistant Inspector General for Investigations at the U.S. Securities and Exchange Commission (SEC). Weber was a whistleblower who reported allegations about foreign espionage against the stock exchanges, and misconduct in the Bernard L. Madoff and R. Allen Stanford Ponzi scheme investigations. In June 2013, the SEC settled with Weber his whistleblower protection and U.S. District Court lawsuits, paying him one of the largest federal employee whistleblower settlements ever. In 2014, In Bed with Wall Street author Larry Doyle named Weber as one of his "top 5 whistleblowers". On July 30, 2015, Weber was recognized by six United States Senators and one member of the House of Representatives at the First Congressional Celebration of National Whistleblower Appreciation Day. On August 5, 2021, Weber met with the President, Speaker of the House, and Senators at the signing of H.R. 3325, the awarding of the Congressional Gold Medal for those officers who lost their lives at the Capitol Insurrection, as he represents one of the deceased police officers and his widow. Weber is now a forensic accounting professor at the Perdue School, Salisbury University. As part of his teaching duties, he is a special investigator for the Maryland State's Attorneys Offices in two adjoining counties, and a Virginia financial crimes state prosecutor in the neighboring Virginia county. He supervises his students who act as intern investigators on financial crime cases.

References

- 1 2 "David M. Becker Named SEC General Counsel and Senior Policy Director". United States Securities and Exchange Commission . Retrieved May 4, 2012.

- 1 2 "Cleary Gottlieb Steen & Hamilton LLP | Lawyers | David M. Becker". Cgsh.com. Archived from the original on February 17, 2013. Retrieved March 1, 2013.

- 1 2 3 David S. Hilzenrath (May 9, 2011). "David Becker, former SEC official with Madoff problem, rejoins law firm". Washington Post.

- ↑ "SEC General Counsel David Becker to Leave Commission". United States Securities and Exchange Commission . Retrieved May 4, 2012.

- 1 2 3 Story, Louise; Morgenson, Gretchen (September 20, 2011). "S.E.C. Hid Its Lawyer's Madoff Ties". The New York Times.

- ↑ Sarah N. Lynch, Carol Bishopric, and Tim Dobbyn (September 21, 2011). "Some lawmakers doubt ex-SEC lawyer broke the law". Reuters. Retrieved February 23, 2013.

{{cite news}}: CS1 maint: multiple names: authors list (link) - ↑ Frankel, Alison. "Former SEC GC Becker gives $556k gift to Madoff investors". Reuters. Archived from the original on March 5, 2012. Retrieved February 18, 2013.

- ↑ Schmidt, Robert (November 3, 2011). "Justice Dept. Won't Probe Ex-SEC Official Becker, Lawyer Says". Bloomberg. Retrieved February 18, 2013.

- ↑ "Testimony of David M. Becker" (PDF). United States House of Representatives . Retrieved May 4, 2012.

- ↑ "David M. Becker", ClearyGottlieb.com. Retrieved July 27, 2019.