Henry John Heinz was an American entrepreneur of Palatine descent who, at the age of 25, co-founded a small horseradish concern in Sharpsburg, Pennsylvania. This business failed, but his second business expanded into tomato ketchup and other condiments, and ultimately became the internationally known H. J. Heinz Company of Pittsburgh, Pennsylvania.

The H. J. Heinz Company was an American food processing company headquartered at One PPG Place in Pittsburgh, Pennsylvania. The company was founded by Henry J. Heinz in 1869. Heinz manufactures thousands of food products in plants on six continents, and markets these products in more than 200 countries and territories. The company claims to have 150 number-one or number-two brands worldwide. Heinz ranked first in ketchup in the US with a market share in excess of 50%; the Ore-Ida label held 46% of the frozen potato sector in 2003.

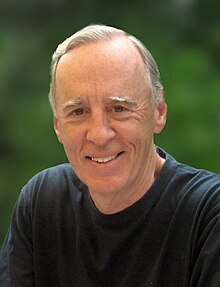

John Sculley III is an American businessman, entrepreneur and investor in high-tech startups. Sculley was vice-president (1970–1977) and president of PepsiCo (1977–1983), until he became chief executive officer (CEO) of Apple Inc. on April 8, 1983, a position he held until leaving in 1993. In May 1987, Sculley was named Silicon Valley's top-paid executive, with an annual salary of US$10.2 million.

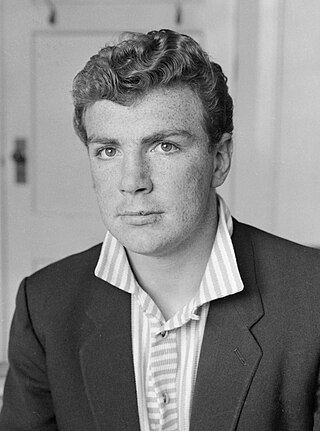

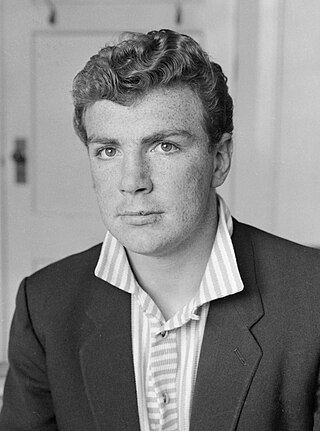

Sir Anthony Joseph Francis O'Reilly is an Irish former businessman and international rugby union player. He is known for his involvement in the Independent News & Media Group, which he led from 1973 to 2009, and as former CEO and chairman of the H.J. Heinz Company. He was the leading shareholder of Waterford Wedgwood. Perhaps Ireland's first billionaire, as of 26 May 2014 O'Reilly was being pursued in the Irish courts for debts amounting to €22 million by AIB, following losses amounting to hundreds of millions of euros in his unsuccessful attempt to stop Denis O'Brien from assuming control of Independent News & Media.

Waterford Crystal is a manufacturer of lead glass or "crystal", especially in cut glass, named after the city of Waterford, Ireland. In January 2009, the main Waterford Crystal manufacturing base on the edge of Waterford was closed due to the insolvency of Waterford Wedgwood PLC, and in June 2010, Waterford Crystal relocated almost back to the roots of glass-making in the city centre. The Mall location holds both a manufacturing facility that melts over 750 tonnes of crystal a year - although most Waterford Crystal is now produced outside Ireland - and a visitor centre with the world's largest collection of Waterford Crystal. As of 2015, the brand is owned by the Fiskars Corporation.

William Vincent Campbell Jr. was an American businessman and chairman of the board of trustees of Columbia University and chairman of the board of Intuit. He was VP of Marketing and board director for Apple Inc. and CEO for Claris, Intuit, and GO Corporation. Campbell coached, among others, Larry Page, Sergey Brin, Eric Schmidt, and Sundar Pichai at Google, Steve Jobs at Apple, Jeff Bezos at Amazon, Jack Dorsey and Dick Costolo at Twitter, and Sheryl Sandberg at Facebook.

Waterford Wedgwood plc was an Irish holding company for a group of firms that specialized in the manufacture of high-quality porcelain, bone china and glass products, mostly for use as tableware or home decor. The group was dominated by Irish businessman Tony O'Reilly and his family, including his wife Chryss Goulandris and her family, with the two families together having invested hundreds of millions of euros in it. The group's financial record was mixed, and significant cost-cutting had been ongoing for many years.

Wedgwood is an English fine china, porcelain and luxury accessories manufacturer that was founded on 1 May 1759 by the potter and entrepreneur Josiah Wedgwood and was first incorporated in 1895 as Josiah Wedgwood and Sons Ltd. It was rapidly successful and was soon one of the largest manufacturers of Staffordshire pottery, "a firm that has done more to spread the knowledge and enhance the reputation of British ceramic art than any other manufacturer", exporting across Europe as far as Russia, and to the Americas. It was especially successful at producing fine earthenware and stoneware that were accepted as equivalent in quality to porcelain but were considerably cheaper.

Royal Doulton is an English ceramic and home accessories manufacturer that was founded in 1815. Operating originally in Vauxhall, London, and later moving to Lambeth, in 1882 it opened a factory in Burslem, Stoke-on-Trent, in the centre of English pottery. From the start, the backbone of the business was a wide range of utilitarian wares, mostly stonewares, including storage jars, tankards and the like, and later extending to drain pipes, lavatories, water filters, electrical porcelain and other technical ceramics. From 1853 to 1901, its wares were marked Doulton & Co., then from 1901, when a royal warrant was given, Royal Doulton.

Henry John Heinz II was an American business executive and CEO of the H. J. Heinz Company based in Pittsburgh, Pennsylvania, US. His grandfather Henry J. Heinz founded the company in the nineteenth century, and he worked in a variety of positions within the company before becoming CEO.

St. John Anthony O'Reilly, generally Tony O'Reilly, Junior is a businessman with Irish and Australian citizenship, the third son and sixth child of former Heinz Chairman & CEO and Irish media magnate Tony O'Reilly and Australian Susan Cameron. He is the former CEO of the Irish based oil and gas exploration company Providence Resources PLC and the former Chairman and CEO of Arcon, an Irish-based zinc mining company. He is currently the CEO of UK and Ireland focused geo energy transition company dCarbonX. He is married for the second time, with three children and three stepchildren and lives in Malta.

Chryss Goulandris, Lady O'Reilly, also known as Chryssanthie or Christina, is one of the richest women associated with Ireland, and holds both USA and Greek citizenship. For many years, she owned a major horse breeding operation located in Ireland, France and other countries and was Chairperson of the Irish National Stud for over a decade. She is the wife of former media and industrial magnate Tony O'Reilly, and is heavily involved with The Ireland Funds.

Jack Edwin McGregor is a former Pennsylvania State Senator from Pittsburgh and the founder of the National Hockey League's Pittsburgh Penguins. He currently resides in Bridgeport, Connecticut where he serves as counsel to Cohen and Wolf, P.C. as an advisor to companies looking to create business opportunities in the Bridgeport region. He also serves as a consultant to existing companies wishing to expand their market share in the area.

David A. Steinberg is the founder and chief executive officer of Zeta Global, one of multiple successful companies that he has founded. Zeta Global is a big-data and artificial intelligence driven marketing company that integrates data, technology, and marketing technology, aiming to help brands acquire, grow and retain customers.

Franciscan Ceramics are ceramic tableware and tile products produced by Gladding, McBean & Co. in Los Angeles, California, US from 1934 to 1962, International Pipe and Ceramics (Interpace) from 1962 to 1979, and Wedgwood from 1979 to 1983. Wedgwood closed the Los Angeles plant, and moved the production of dinnerware to England in 1983. Waterford Glass Group plc purchased Wedgwood in 1986, becoming Waterford Wedgwood. KPS Capital Partners acquired all of the holdings of Waterford Wedgwood in 2009. The Franciscan brand became part of a group of companies known as WWRD, an acronym for "Wedgwood Waterford Royal Doulton." WWRD continues to produce the Franciscan patterns Desert Rose and Apple.

3G Capital is a Brazilian global investment firm and private partnership built on an owner-operator approach to investing over a long-term horizon. Founded in 2004, 3G Capital evolved from the Brazilian investment office of Jorge Paulo Lemann, Carlos Alberto Sicupira, and Marcel Herrmann Telles. 3G Capital is led by Alex Behring, Co-Founder and Co-Managing Partner, and Daniel Schwartz, Co-Managing Partner.

KPS Capital Partners is an American investment company that manages KPS Special Situation Funds, a family of investment funds. KPS specifically invests out of two funds raised in October 2019: KPS Special Situations Fund V and KPS Mid-Cap Fund.

Alexandre "Alex" Behring da Costa, born in 1967, is a Brazilian entrepreneur, investor, and philanthropist. He is a Co-Founder and Co-Managing Partner of 3G Capital, a global investment firm and private partnership known for its long-term investments in Anheuser-Busch InBev, Restaurant Brands International, Kraft Heinz, and Hunter Douglas.

David L. Lucchino is co-founder and chief executive officer of Frequency Therapeutics, a biotechnology company based in Lexington, MA.

WWRD Holdings Limited is a company that was created by KPS Capital Partners in 2009 out of the remains of Irish firm Waterford Wedgwood plc, and it has been owned since 2015 by Finnish home products maker Fiskars. The company owns Waterford Crystal, Wedgwood and Royal Doulton, among other brands, and the name WWRD is an acronym for 'Waterford Wedgwood Royal Doulton'.