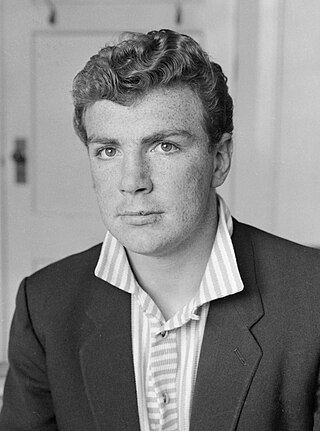

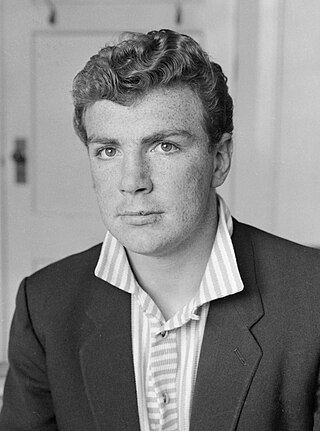

Sir Anthony John Francis O'Reilly was an Irish businessman and international rugby union player. He was known for his try scoring in rugby, his involvement in the Independent News & Media Group, which he led from 1973 to 2009, and as CEO and chairman of the H.J. Heinz Company. He was the leading shareholder of Waterford Wedgwood and a founder and major supporter of The Ireland Funds. A citizen of both Ireland and the United Kingdom, he was knighted as a Knight Bachelor for his services to Northern Ireland.

Waterford Crystal is a manufacturer of lead glass or "crystal", especially in cut glass, named after the city of Waterford, Ireland. In January 2009, the main Waterford Crystal manufacturing base on the edge of Waterford was closed due to the insolvency of Waterford Wedgwood PLC, and in June 2010, Waterford Crystal relocated almost back to the roots of glass-making in the city centre. The Mall location holds both a manufacturing facility that melts over 750 tonnes of crystal a year – although most Waterford Crystal is now produced outside Ireland – and a visitor centre with the world's largest collection of Waterford Crystal. As of 2015, the brand is owned by the Fiskars Corporation.

Lazard Inc. is a financial advisory and asset management firm that engages in investment banking, asset management and other financial services, primarily with institutional clients. It is the world's largest independent investment bank, with principal executive offices in New York City, Paris and London.

Fiskars Group, is a Finnish consumer goods company founded in 1649 in Fiskars, a locality now in the town of Raseborg, Finland, about 100 kilometres (62 mi) west of Helsinki. It is one of the oldest continuously operating companies in the World. Fiskars' global headquarters are located in the Keilaniemi district of Espoo, near Helsinki.

Mediobanca is an Italian investment bank founded in 1946 at the initiative of Raffaele Mattioli and Enrico Cuccia to facilitate the post-World War II reconstruction of Italian industry. Cuccia led Mediobanca from 1946 to 1982. Today, it is an international banking group with offices in Milan, Frankfurt, London, Madrid, Luxembourg, New York and Paris.

Wedgwood is an English fine china, porcelain and luxury accessories manufacturer that was founded on 1 May 1759 by the potter and entrepreneur Josiah Wedgwood and was first incorporated in 1895 as Josiah Wedgwood and Sons Ltd. It was rapidly successful and was soon one of the largest manufacturers of Staffordshire pottery, "a firm that has done more to spread the knowledge and enhance the reputation of British ceramic art than any other manufacturer", exporting across Europe as far as Russia, and to the Americas. It was especially successful at producing fine earthenware and stoneware that were accepted as equivalent in quality to porcelain, though considerably less expensive.

Royal Doulton is an English ceramic and home accessories manufacturer that was founded in 1815. Operating originally in Vauxhall, London, and later moving to Lambeth, in 1882 it opened a factory in Burslem, Stoke-on-Trent, in the centre of English pottery. From the start, the backbone of the business was a wide range of utilitarian wares, mostly stonewares, including storage jars, tankards and the like, and later extending to drain pipes, lavatories, water filters, electrical porcelain and other technical ceramics. From 1853 to 1901, its wares were marked Doulton & Co., then from 1901, when a royal warrant was given, Royal Doulton.

Golden Gate Capital is an American private equity firm based in San Francisco. The firm makes investments in a number of select industries, including technology, financial services, retail and industrial, through leveraged buyout transactions, as well as significant minority purchases and growth capital investments. As of April 2018, it had over $15 billion in assets under management.

Johnson Brothers was a British tableware manufacturer and exporter that was noted for its early introduction of "semi-porcelain" tableware. It was among the most successful Staffordshire potteries which produced tableware, much of it exported to the United States, from the 1890s through to the 1960s. They were also important manufacturers of large bathroom ceramics. Some of its designs, such as "Eternal Beau", "Dawn", "Old Britain Castles" and "Historic America", achieved widespread popularity and are still collected today. The company's success was due in part to its ability to identify and follow trends that appealed to its customers in the United States, and in part to the high quality of its designs, produced by skilled artists.

Edinburgh Crystal was a cut glass manufactured in Scotland from c. 1820s to 2006, and was also the name of the manufacturing company. In addition to drinking glasses, Edinburgh Crystal made decanters, bowls, baskets, and bells, in several ranges.

Anthony Cameron O'Reilly, generally known as Cameron O'Reilly, is a Dublin-born businessman with Irish and Australian citizenship, the son of an Irish father, media magnate Tony O'Reilly and an Australian mother, Susan Cameron. Having managed one of Australia's largest press groups, he is currently managing director of Landis+Gyr, formerly the Bayard Group, which includes the world's largest electricity metering supplier, and has revenues of over US$1.2 billion.

St. John Anthony O'Reilly, generally Tony O'Reilly, Junior is a businessman with Irish and Australian citizenship, the third son and sixth child of former Heinz Chairman & CEO and Irish media magnate Tony O'Reilly and Australian Susan Cameron. He is the former CEO of the Irish-based oil and gas exploration company Providence Resources PLC and the former chairman and CEO of Arcon, an Irish-based zinc mining company. He is currently the CEO of UK and Ireland focused geo energy transition company dCarbonX. He is married for the second time, with three children and three stepchildren and lives in Malta.

Chryssanthie, Lady O'Reilly was a Greek-American businesswoman who was one of the richest women associated with Ireland. For many years, she owned a major horse breeding operation located in Ireland, France and other countries and was chairperson of the Irish National Stud for over a decade. She was the wife of former media and industrial magnate Tony O'Reilly, and was heavily involved with The Ireland Funds.

Partners Group Holding AG is a Swiss-based global private equity firm with US$149 billion in assets under management in private equity, private infrastructure, private real estate and private debt.

Guggenheim Partners, LLC is a global investment and advisory financial services firm that engages in investment banking, asset management, capital markets services, and insurance services.

Franciscan Ceramics are ceramic tableware and tile products produced by Gladding, McBean & Co. in Los Angeles, California, US from 1934 to 1962, International Pipe and Ceramics (Interpace) from 1962 to 1979, and Wedgwood from 1979 to 1983. Wedgwood closed the Los Angeles plant, and moved the production of dinnerware to England in 1983. Waterford Glass Group plc purchased Wedgwood in 1986, becoming Waterford Wedgwood. KPS Capital Partners acquired all of the holdings of Waterford Wedgwood in 2009. The Franciscan brand became part of a group of companies known as WWRD, an acronym for "Wedgwood Waterford Royal Doulton." WWRD continues to produce the Franciscan patterns Desert Rose and Apple.

David Sculley is an American businessman and former President & CEO of H.J. Heinz U.S.A. (1985–90). In 1996, David joined his brothers to form the private investment firm, Sculley Brothers, with its head office in New York City. He is the youngest brother of John Sculley, former President & CEO of Pepsi and Apple and Arthur Sculley, former head of J.P. Morgan’s Private Bank.

KPS Capital Partners is an American investment company that manages KPS Special Situation Funds, a family of investment funds. KPS specifically invests out of two funds raised in October 2019: KPS Special Situations Fund V and KPS Mid-Cap Fund.

WWRD Holdings Limited is a company that was created by KPS Capital Partners in 2009 out of the remains of Irish firm Waterford Wedgwood plc, and it has been owned since 2015 by Finnish home products maker Fiskars. The company owns Waterford Crystal, Wedgwood and Royal Doulton, among other brands, and the name WWRD is an acronym for 'Waterford Wedgwood Royal Doulton'.