EPAM Systems, Inc. is an American-Belarusian company that specializes in product development, digital platform engineering, and digital product design. One of the world's largest manufacturers of custom software and consulting providers. The company's headquarters is located in Newtown, Pennsylvania, and its branches are represented in more than 30 countries.

Hub Culture is an invitation-led social network service that operates the global digital currency Ven. Founded in 2002, it had 32,000 members by 2021.

Brett King is an Australian futurist, author, and co-founder and CEO of Moven, a New York-based mobile banking startup. He is regarded as an influencer in financial services globally, and his book Augmented was cited by Chinese leader Xi Jinping as recommended reading on artificial intelligence. His book Bank 4.0 was awarded Top Book by a Foreign Author in Russia for the year 2019, as judged by an independent panel audited by PricewaterhouseCoopers. He was inducted into the Fintech Hall of Fame in 2020 for his contribution to the industry.

Ripple Labs, Inc. is an American technology company which develops the Ripple payment protocol and exchange network. Originally named Opencoin and renamed Ripple Labs in 2015, the company was founded in 2012 and is based in San Francisco, California.

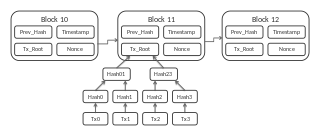

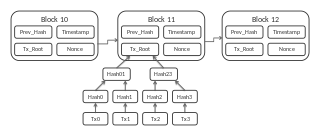

A blockchain is a growing list of records, called blocks, that are linked together using cryptography. Each block contains a cryptographic hash of the previous block, a timestamp, and transaction data. The timestamp proves that the transaction data existed when the block was published in order to get into its hash. As blocks each contain information about the block previous to it, they form a chain, with each additional block reinforcing the ones before it. Therefore, blockchains are resistant to modification of their data because once recorded, the data in any given block cannot be altered retroactively without altering all subsequent blocks.

Financial technology is the technology and innovation that aims to compete with traditional financial methods in the delivery of financial services. It is an emerging industry that uses technology to improve activities in finance. The use of smartphones for mobile banking, investing, borrowing services, and cryptocurrency are examples of technologies aiming to make financial services more accessible to the general public. Financial technology companies consist of both startups and established financial institutions and technology companies trying to replace or enhance the usage of financial services provided by existing financial companies. A subset of fintech companies that focus on the insurance industry are collectively known as insurtech or insuretech companies.

Synechron Inc. is a New York-based information technology and consulting company focused on the financial services industry including capital markets, insurance, banking and digital.

Veem is a San Francisco-based online global payments platform founded in 2014 by Marwan Forzley and Aldo Carrascoso. It was formerly known as Align Commerce, changing its name to Veem on 8 March 2017. The company services 100 countries and 70 currencies including USD, CAD, GBP, EUR, HKD, CNY, and AUD. Customers in 100 countries can receive payments, and customers in 25 of those can send payments.

The Industries of the Future is a 2016 non-fiction book written by Alec Ross, an American technology policy expert and the former Senior Advisor for Innovation to Secretary of State Hillary Clinton during her time as Secretary of State. Ross is also a senior fellow at Columbia University, a former night-shift janitor, and a Baltimore teacher. Ross launched a campaign for the Governor of Maryland in 2017. The book explores the forces that will change the world in robotics, genetics, digital currency, coding and big data.

Onfido is a technology company that helps businesses verify people's identities using a photo-based identity document, a selfie and artificial intelligence algorithms. It was founded in July 2012 by three former students at Oxford University: Cofounder Husayn Kassai, Cofounder Eamon Jubbawy, and Chief Architect Ruhul Amin. Onfido is headquartered in London and has over 650 employees in offices in San Francisco, Albuquerque, New York, Lisbon, Paris, Berlin, Amsterdam, Delhi, Mumbai, Bangalore and Singapore.

Fintech Valley Vizag is an initiative of the Government of Andhra Pradesh to promote business infrastructure in the state, and attract investors and multinational corporations to set up offices. Fintech Valley was founded by N. Chandrababu Naidu then Chief Minister of the Andhra Pradesh state in December 2016 with the goal of enhancing Visakhapatnam City as a financial technology capital in Andhra Pradesh.

David Mark Siegel is an American computer scientist, entrepreneur, and philanthropist. He co-founded Two Sigma, where he currently serves as co-chairman. Siegel has written for Business Insider, The New York Times, Financial Times and similar publications on topics including machine learning, the future of work, and the impact of algorithms used by search and social media companies.

Jennifer Zhu Scott is an entrepreneur and investor based in Hong Kong, specialized in blockchain, Artificial Intelligence (AI) and other deep tech.

Government by algorithm is an alternative form of government or social ordering, where the usage of computer algorithms, especially of artificial intelligence and blockchain, is applied to regulations, law enforcement, and generally any aspect of everyday life such as transportation or land registration. The term 'government by algorithm' appeared in academic literature as an alternative for 'algorithmic governance' in 2013. A related term, algorithmic regulation is defined as setting the standard, monitoring and modification of behaviour by means of computational algorithms — automation of judiciary is in its scope.

Regulation of algorithms, or algorithmic regulation, is the creation of laws, rules and public sector policies for promotion and regulation of algorithms, particularly in artificial intelligence and machine learning. For the subset of AI algorithms, the term regulation of artificial intelligence is used. The regulatory and policy landscape for artificial intelligence (AI) is an emerging issue in jurisdictions globally, including in the European Union. Regulation of AI is considered necessary to both encourage AI and manage associated risks, but challenging. Another emerging topic is the regulation of blockchain algorithms and is mentioned alongside with regulation of AI algorithms. Many countries have enacted regulations of high frequency trades, which is shifting due to technological progress into the realm of AI algorithms.

Noah Raford is an American futurist and specialist in public policy, strategy and emerging technologies. He is a founding executive of the Dubai Future Foundationand the Museum of the Future, and is currently the Futurist-in-Chief and Chief of Global Affairs at the Dubai Future Foundation. He was responsible for several global and regional firsts, including the world's first fully functional 3D printed building and the first blockchain strategy in the MENA region.

Trade finance technology refers to the use of technology, innovation, and software to support and digitally transform the trade finance industry. TradeTech can be seen as a subcategory under FinTech. As digital information becomes more readily accessible, convenient, and available, the trade finance industry is being gradually modernised and digitally transformed. TradeTech puts a particular emphasis on the application of technology and software to modernise trade finance.

Singapore FinTech Festival (SFF) is the largest FinTech festival in the world and a knowledge platform for the global FinTech community.

Woxsen University received its status as a State Private University in the year 2020 and is one of the first private universities of the state of Telangana, India. Woxsen is amongst the leading educational institutes in India, spanning over 200-acre residential campus and comprises of constituent schools such as School of Business, School of Technology, School of Arts & Design, School of Liberal Arts and Humanities & School of Architecture and Planning

Nii Osae Osae Dade is a Ghanaian entrepreneur and a computer scientist. He is the co-founder and director of both Mazzuma and Utopia Technologies: two companies in the digital commerce space for emerging markets. He is the Director of Software engineering for Mazzuma.