A commodity market is a market that trades in the primary economic sector rather than manufactured products, such as cocoa, fruit and sugar. Hard commodities are mined, such as gold and oil. Futures contracts are the oldest way of investing in commodities. Commodity markets can include physical trading and derivatives trading using spot prices, forwards, futures, and options on futures. Farmers have used a simple form of derivative trading in the commodity market for centuries for price risk management.

In economics, fungibility is the property of a good or a commodity whose individual units are essentially interchangeable and each of whose parts is indistinguishable from another part.

Of all the precious metals, gold is the most popular as an investment. Investors generally buy gold as a way of diversifying risk, especially through the use of futures contracts and derivatives. The gold market is subject to speculation and volatility as are other markets. Compared to other precious metals used for investment, gold has been the most effective safe haven across a number of countries.

Silver may be used as an investment like other precious metals. It has been regarded as a form of money and store of value for more than 4,000 years, although it lost its role as legal tender in developed countries when the use of the silver standard came to a final end in 1935. Some countries mint bullion and collector coins, however, such as the American Silver Eagle with nominal face values. In 2009, the main demand for silver was for industrial applications (40%), jewellery, bullion coins, and exchange-traded products. In 2011, the global silver reserves amounted to 530,000 tonnes.

Virtual currency, or virtual money, is a digital currency that is largely unregulated and issued and usually controlled by its developers and used and accepted electronically among the members of a specific virtual community. In 2014, the European Banking Authority defined virtual currency as "a digital representation of value that is neither issued by a central bank or a public authority, nor necessarily attached to a fiat currency, but is accepted by natural or legal persons as a means of payment and can be transferred, stored or traded electronically." A digital currency issued by a central bank is referred to as a central bank digital currency.

A cryptocurrency, crypto-currency, or crypto is a digital currency designed to work as a medium of exchange through a computer network that is not reliant on any central authority, such as a government or bank, to uphold or maintain it.

Cormac Kinney is a serial fintech entrepreneur, known for Diamond Standard, a regulator-approved fungible diamond commodity, Heatmaps, cited in 5,800 US Patents, and a publisher social network acquired by News Corp.

Ethereum is a decentralized, open-source blockchain with smart contract functionality. Ether is the native cryptocurrency of the platform. Among cryptocurrencies, Ether is second only to Bitcoin in market capitalization.

Counterparty is a peer-to-peer financial platform and distributed, open source Internet protocol built on top of the Bitcoin blockchain and network. It was one of the most well-known "Bitcoin 2.0" platforms in 2014, along with Mastercoin, Ethereum, Colored Coins, Ripple and BitShares. It is a "metacoin"-type protocol. It provides such features as tradable user-created currencies, additional financial instruments and a decentralized asset exchange. In November of 2014, Counterparty added support for the Ethereum Virtual Machine to the Counterparty protocol and allowing all Ethereum decentralized applications to be run on the Bitcoin blockchain within the Counterparty protocol.

An initial coin offering (ICO) or initial currency offering is a type of funding using cryptocurrencies. It is often a form of crowdfunding, although a private ICO which does not seek public investment is also possible. In an ICO, a quantity of cryptocurrency is sold in the form of "tokens" ("coins") to speculators or investors, in exchange for legal tender or other cryptocurrencies such as Bitcoin or Ether. The tokens are promoted as future functional units of currency if or when the ICO's funding goal is met and the project successfully launches.

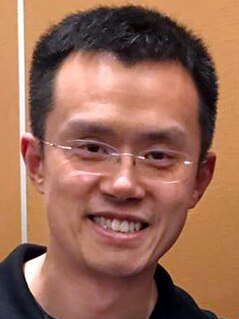

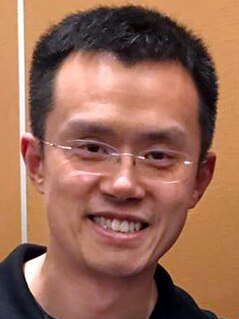

Binance is a cryptocurrency exchange which is the largest exchange in the world in terms of daily trading volume of cryptocurrencies. It was founded in 2017 and is registered in the Cayman Islands.

Changpeng Zhao, commonly known as "CZ", is a Chinese-Canadian business executive. Zhao is the founder and CEO of Binance, the world's largest cryptocurrency exchange by trading volume as of April 2018. CZ was born in Jiangsu, a coastal province in China. His parents moved to Canada soon after he was born. As a teenager, he started working to help with the household expenses. In the 1980’s, he joined McDonald’s.

A non-fungible token (NFT) is a non-interchangeable unit of data stored on a blockchain, a form of digital ledger, that can be sold and traded. Types of NFT data units may be associated with digital files such as photos, videos, and audio. Because each token is uniquely identifiable, NFTs differ from blockchain cryptocurrencies, such as Bitcoin.

Stablecoins are cryptocurrencies where the price is designed to be pegged to a cryptocurrency, fiat money, or to exchange-traded commodities.

Stephane De Baets is a Belgian investment, real estate, and hospitality entrepreneur. He is founder and president of the international asset management firm Elevated Returns, which controls the Aspen St. Regis Resort in Aspen, Colorado and other commercial properties in the United States, Europe, and Southeast Asia.

Tezos is a decentralized open-source blockchain that can execute peer-to-peer transactions and serve as a platform for deploying smart contracts. The native cryptocurrency for the Tezos blockchain is the tez which has the symbol XTZ.

A security token offering (STO) / tokenized IPO is a type of public offering in which tokenized digital securities, known as security tokens, are sold in security token exchanges. Tokens can be used to trade real financial assets such as equities and fixed income, and use a blockchain virtual ledger system to store and validate token transactions.

Paxos Trust Company is a New York-based financial institution and technology company specializing in blockchain. The company's product offerings include a cryptocurrency brokerage service, asset tokenization services, and settlement services. ItBit, a bitcoin exchange run by Paxos, was the first bitcoin exchange to be licensed by the New York State Department of Financial Services, granting the company the ability to be the custodian and exchange for customers in the United States.

Decentralized finance (DeFi) offers financial instruments without relying on intermediaries such as brokerages, exchanges, or banks by using smart contracts on a blockchain. DeFi platforms allow people to lend or borrow funds from others, speculate on price movements on assets using derivatives, trade cryptocurrencies, insure against risks, and earn interest in savings-like accounts. DeFi uses a layered architecture and highly composable building blocks. Some applications promote high interest rates but are subject to high risk. As of October 2021, the value of assets used in decentralized finance amounted to $100 billion.

Uniswap is a cryptocurrency exchange which uses a decentralized network protocol. Uniswap is also the name of the company that initially built the Uniswap protocol. The protocol facilitates automated transactions between cryptocurrency tokens on the Ethereum blockchain through the use of smart contracts. As of October 2020, Uniswap was estimated to be the largest decentralized exchange and the fourth-largest cryptocurrency exchange overall by daily trading volume.