In economics, internationalization or internationalisation is the process of increasing involvement of enterprises in international markets, although there is no agreed definition of internationalization. Internationalization is a crucial strategy not only for companies that seek horizontal integration globally but also for countries that addresses the sustainability of its development in different manufacturing as well as service sectors especially in higher education which is a very important context that needs internationalization to bridge the gap between different cultures and countries. There are several internationalization theories which try to explain why there are international activities.

In the field of management, strategic management involves the formulation and implementation of the major goals and initiatives taken by an organization's managers on behalf of stakeholders, based on consideration of resources and an assessment of the internal and external environments in which the organization operates. Strategic management provides overall direction to an enterprise and involves specifying the organization's objectives, developing policies and plans to achieve those objectives, and then allocating resources to implement the plans. Academics and practicing managers have developed numerous models and frameworks to assist in strategic decision-making in the context of complex environments and competitive dynamics. Strategic management is not static in nature; the models can include a feedback loop to monitor execution and to inform the next round of planning.

Marketing management is the strategic organizational discipline that focuses on the practical application of marketing orientation, techniques and methods inside enterprises and organizations and on the management of marketing resources and activities. Compare marketology, which Aghazadeh defines in terms of "recognizing, generating and disseminating market insight to ensure better market-related decisions".

In business, a competitive advantage is an attribute that allows an organization to outperform its competitors.

Competitive analysis in marketing and strategic management is an assessment of the strengths and weaknesses of current and potential competitors. This analysis provides both an offensive and defensive strategic context to identify opportunities and threats. Profiling combines all of the relevant sources of competitor analysis into one framework in the support of efficient and effective strategy formulation, implementation, monitoring and adjustment.

Porter's Five Forces Framework is a method of analysing the competitive environment of a business. It draws from industrial organization (IO) economics to derive five forces that determine the competitive intensity and, therefore, the attractiveness of an industry in terms of its profitability. An "unattractive" industry is one in which the effect of these five forces reduces overall profitability. The most unattractive industry would be one approaching "pure competition", in which available profits for all firms are driven to normal profit levels. The five-forces perspective is associated with its originator, Michael E. Porter of Harvard University. This framework was first published in Harvard Business Review in 1979.

Porter's generic strategies describe how a company pursues competitive advantage across its chosen market scope. There are three/four generic strategies, either lower cost, differentiated, or focus. A company chooses to pursue one of two types of competitive advantage, either via lower costs than its competition or by differentiating itself along dimensions valued by customers to command a higher price. A company also chooses one of two types of scope, either focus or industry-wide, offering its product across many market segments. The generic strategy reflects the choices made regarding both the type of competitive advantage and the scope. The concept was described by Michael Porter in 1980.

The word ‘dynamics’ appears frequently in discussions and writing about strategy, and is used in two distinct, though equally important senses.

Marketing strategy refers to efforts undertaken by an organization to increase its sales and achieve competitive advantage. In other words, it is the method of advertising a company's products to the public through an established plan through the meticulous planning and organization of ideas, data, and information.

A value chain is a progression of activities that a business or firm performs in order to deliver goods and services of value to an end customer. The concept comes from the field of business management and was first described by Michael Porter in his 1985 best-seller, Competitive Advantage: Creating and Sustaining Superior Performance.

The idea of [Porter's Value Chain] is based on the process view of organizations, the idea of seeing a manufacturing organization as a system, made up of subsystems each with inputs, transformation processes and outputs. Inputs, transformation processes, and outputs involve the acquisition and consumption of resources – money, labour, materials, equipment, buildings, land, administration and management. How value chain activities are carried out determines costs and affects profits.

Michael Eugene Porter is an American businessman and professor at Harvard Business School. He was one of the founders of the consulting firm The Monitor Group and FSG, a social impact consultancy. He is credited with creating Porter's five forces analysis, a widely-used management framework. He is generally regarded as the father of the modern strategy field. He is also regarded as one of the world's most influential thinkers on management and competitiveness as well as one of the most influential business strategists. His work has been recognized by governments, non-governmental organizations and universities.

In strategic management, situation analysis refers to a collection of methods that managers use to analyze an organization's internal and external environment to understand the organization's capabilities, customers, and business environment. The situation analysis can include several methods of analysis such as the 5C analysis, SWOT analysis and Porter's five forces analysis.

VRIO is a business analysis framework for strategic management. As a form of internal analysis, VRIO evaluates all the resources and capabilities of a firm. It was first proposed by Jay Barney in 1991.

The resource-based view (RBV), often referred to as the "resource-based view of the firm", is a managerial framework used to determine the strategic resources a firm can exploit to achieve sustainable competitive advantage.

In economics, competition is a scenario where different economic firms are in contention to obtain goods that are limited by varying the elements of the marketing mix: price, product, promotion and place. In classical economic thought, competition causes commercial firms to develop new products, services and technologies, which would give consumers greater selection and better products. The greater the selection of a good is in the market, the lower prices for the products typically are, compared to what the price would be if there was no competition (monopoly) or little competition (oligopoly).

Context analysis is a method to analyze the environment in which a business operates. Environmental scanning mainly focuses on the macro environment of a business. But context analysis considers the entire environment of a business, its internal and external environment. This is an important aspect of business planning. One kind of context analysis, called SWOT analysis, allows the business to gain an insight into their strengths and weaknesses and also the opportunities and threats posed by the market within which they operate. The main goal of a context analysis, SWOT or otherwise, is to analyze the environment in order to develop a strategic plan of action for the business.

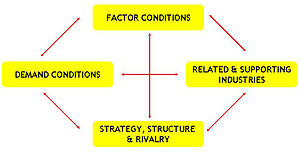

A business cluster is a geographic concentration of interconnected businesses, suppliers, and associated institutions in a particular field. Clusters are considered to increase the productivity with which companies can compete, nationally and globally. Accounting is a part of the business cluster. In urban studies, the term agglomeration is used. Clusters are also important aspects of strategic management.

The six forces model is an analysis model used to give a holistic assessment of any given industry and identify the structural underlining drivers of profitability and competition. The model is an extension of the Porter's five forces model proposed by Michael Porter in his 1979 article published in the Harvard Business Review "How Competitive Forces Shape Strategy". The sixth force was proposed in the mid-1990s. The model provides a framework of six key forces that should be considered when defining corporate strategy to determine the overall attractiveness of an industry.

Hypercompetition, a term first coined in business strategy by Richard D’Aveni, describes a dynamic competitive world in which no action or advantage can be sustained for long. Hypercompetition is a key feature of the new global digital economy. Not only is there more competition, there is also tougher and smarter competition. It is a state in which the rate of change in the competitive rules of the game are in such flux that only the most adaptive, fleet, and nimble organizations will survive. Hypercompetitive markets are also characterized by a “quick-strike mentality” to disrupt, neutralize, or moot the competitive advantage of market leaders and important rivals.

Porter's four corners model is a predictive tool designed by Michael Porter that helps in determining a competitor's course of action. Unlike other predictive models which predominantly rely on a firm's current strategy and capabilities to determine future strategy, Porter's model additionally calls for an understanding of what motivates the competitor. This added dimension of understanding a competitor's internal culture, value system, mindset, and assumptions helps in determining a much more accurate and realistic reading of a competitor's possible reactions in a given situation.