The Uniform Commercial Code (UCC), first published in 1952, is one of a number of Uniform Acts that have been established as law with the goal of harmonizing the laws of sales and other commercial transactions across the United States through UCC adoption by all 50 states, the District of Columbia, and the Territories of the United States.

In finance, a futures contract is a standardized legal agreement to buy or sell something at a predetermined price at a specified time in the future, between parties not known to each other. The asset transacted is usually a commodity or financial instrument. The predetermined price the parties agree to buy and sell the asset for is known as the forward price. The specified time in the future—which is when delivery and payment occur—is known as the delivery date. Because it is a function of an underlying asset, a futures contract is a derivative product.

The Incoterms or International Commercial Terms are a series of pre-defined commercial terms published by the International Chamber of Commerce (ICC) relating to international commercial law. They are widely used in international commercial transactions or procurement processes and their use is encouraged by trade councils, courts and international lawyers. A series of three-letter trade terms related to common contractual sales practices, the Incoterms rules are intended primarily to clearly communicate the tasks, costs, and risks associated with the global or international transportation and delivery of goods. Incoterms inform sales contracts defining respective obligations, costs, and risks involved in the delivery of goods from the seller to the buyer, but they do not themselves conclude a contract, determine the price payable, currency or credit terms, govern contract law or define where title to goods transfers.

A credit default swap (CDS) is a financial swap agreement that the seller of the CDS will compensate the buyer in the event of a debt default or other credit event. That is, the seller of the CDS insures the buyer against some reference asset defaulting. The buyer of the CDS makes a series of payments to the seller and, in exchange, may expect to receive a payoff if the asset defaults.

A financial transaction is an agreement, or communication, carried out between a buyer and a seller to exchange an asset for payment.

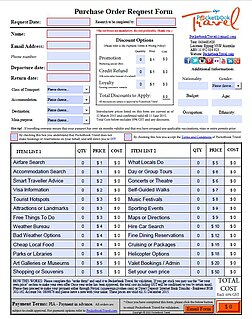

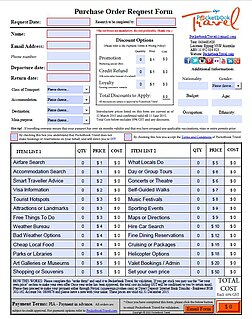

A purchase order (PO) is a commercial document and first official offer issued by a buyer to a seller indicating types, quantities, and agreed prices for products or services. It is used to control the purchasing of products and services from external suppliers. Purchase orders can be an essential part of enterprise resource planning system orders.

An invoice, bill or tab is a commercial document issued by a seller to a buyer, relating to a sale transaction and indicating the products, quantities, and agreed prices for products or services the seller had provided the buyer.

A letter of credit (LC), also known as a documentary credit or bankers commercial credit, or letter of undertaking (LoU), is a payment mechanism used in international trade to provide an economic guarantee from a creditworthy bank to an exporter of goods. Letters of credit are used extensively in the financing of international trade, where the reliability of contracting parties cannot be readily and easily determined. Its economic effect is to introduce a bank as an underwriter, where it assumes the counterparty risk of the buyer paying the seller for goods.

In banking and finance, clearing denotes all activities from the time a commitment is made for a transaction until it is settled. This process turns the promise of payment into the actual movement of money from one account to another. Clearing houses were formed to facilitate such transactions among banks.

A credit note or credit memo is a commercial document issued by a seller to a buyer. Credit notes act as a source document for the sales return journal. In other words the credit note is evidence of the reduction in sales. A credit memo, a contraction of the term "credit memorandum", is evidence of a reduction in the amount that a buyer owes a seller under the terms of an earlier invoice.

In a contract of carriage, the consignee is the entity who is financially responsible for the receipt of a shipment. Generally, but not always, the consignee is the same as the receiver.

In trade finance, forfaiting is a service providing medium-term financial support for export/import of capital goods. The third party providing the support is termed the forfaiter. The forfaiter provides medium-term finance to, and will commonly also take on certain risks from, the importer; and takes on all risk from the exporter, in return for a margin. Payment may be by negotiable instrument, enabling the forfaiter to lay off some risks. Like factoring, forfaiting involves sale of financial assets from the seller's receivables. Key differences are that forfait supports the buyer (importer) as well as the seller (exporter), and is available only for export/import transactions and in relation to capital goods. The word forfaiting is derived from the French word forfait, meaning to relinquish the right.

A banker's acceptance is an instrument representing a promised future payment by a bank. The payment is accepted and guaranteed by the bank as a time draft to be drawn on a deposit. The draft specifies the amount of funds, the date of the payment, and the entity to which the payment is owed. After acceptance, the draft becomes an unconditional liability of the bank. Banker's acceptances are distinguished from ordinary time drafts in that ownership is transferable prior to maturity, allowing them to be traded in the secondary market.

An acceptance credit is a type of letter of credit that is paid by a time draft authorizing payment on or after a specific date, if the terms of the letter of credit have been complied with. The bank "accepts" bills of exchange drawn on the bank by the debtor, discounts them and agrees to pay for them when they mature.

Buyer credit is a short term credit available to an importer (buyer) from overseas lenders such as banks and other financial institution for goods they are importing. The overseas banks usually lend the importer (buyer) based on the letter of comfort issued by the importer's bank. For this service the importer's bank or buyer's credit consultant charges a fee called an arrangement fee.

The ECGC Limited is a company wholly owned by the Government of India based in Mumbai, Maharashtra. It provides export credit insurance support to Indian exporters and is controlled by the Ministry of Commerce. Government of India had initially set up Export Risks Insurance Corporation (ERIC) in July 1957. It was transformed into Export Credit and Guarantee Corporation Limited (ECGC) in 1964 and to Export Credit Guarantee Corporation of India in 1983.

International Commercial Law is a body of legal rules, conventions, treaties, domestic legislation and commercial customs or usages, that governs international commercial or business transactions. A transaction will qualify to be international if elements of more than one country are involved.

Trade finance signifies financing for trade, and it concerns both domestic and international trade transactions. A trade transaction requires a seller of goods and services as well as a buyer. Various intermediaries such as banks and financial institutions can facilitate these transactions by financing the trade. Trade finance manifest itself in the form of letters of credit (LOC), guarantees or insurance and is usually provided by intermediaries.

Iran Mercantile Exchange (IME) is a commodities exchange located in Tehran, Iran.

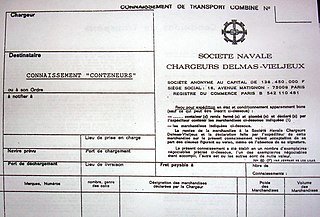

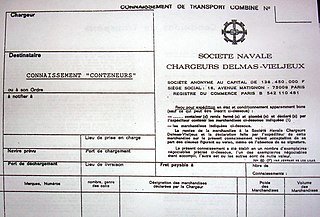

A bill of lading is a document issued by a carrier to acknowledge receipt of cargo for shipment. Although the term historically related only to carriage by sea, a bill of lading may today be used for any type of carriage of goods. Bills of lading are one of three crucial documents used in international trade to ensure that exporters receive payment and importers receive the merchandise. The other two documents are a policy of insurance and an invoice. Whereas a bill of lading is negotiable, both a policy and an invoice are assignable. In international trade outside the United States, bills of lading are distinct from waybills in that the latter are not transferable and do not confer title. Nevertheless, the UK Carriage of Goods by Sea Act 1992 grants "all rights of suit under the contract of carriage" to the lawful holder of a bill of lading, or to the consignee under a sea waybill or a ship's delivery order.