Related Research Articles

The Big Four are the four largest professional services networks in the world: Deloitte, EY, KPMG, and PwC. They are the four largest global accounting networks as measured by revenue. The four are often grouped because they are comparable in size relative to the rest of the market, both in terms of revenue and workforce; they are considered equal in their ability to provide a wide scope of professional services to their clients; and, among those looking to start a career in professional services, particularly accounting, they are considered equally attractive networks to work in, because of the frequency with which these firms engage with Fortune 500 companies.

International Financial Reporting Standards, commonly called IFRS, are accounting standards issued by the IFRS Foundation and the International Accounting Standards Board (IASB). They constitute a standardised way of describing the company's financial performance and position so that company financial statements are understandable and comparable across international boundaries. They are particularly relevant for companies with shares or securities publicly listed.

The historical cost of an asset at the time it is acquired or created is the value of the costs incurred in acquiring or creating the asset, comprising the consideration paid to acquire or create the asset plus transaction costs. Historical cost accounting involves reporting assets and liabilities at their historical costs, which are not updated for changes in the items' values. Consequently, the amounts reported for these balance sheet items often differ from their current economic or market values.

The International Accounting Standards Committee (IASC) was founded in June 1973 in London at the initiative of Sir Henry Benson, former president of the Institute of Chartered Accountants in England and Wales. The IASC was created by national accountancy bodies from a number of countries with a view to harmonizing the international diversity of company reporting practices. Between its founding in 1973 and its dissolution in 2001, it developed a set of International Accounting Standards (IAS) that gradually acquired a degree of acceptance in countries around the world. Although the IASC came to include some organizations representing preparers and users of financial statements, it largely remained an initiative of the accountancy profession. On 1 April 2001, it was replaced by the International Accounting Standards Board (IASB), an independent standard-setting body. The IASB adopted the extant corpus of IAS which it continued to develop as International Financial Reporting Standards.

Deloitte Touche Tohmatsu Limited, commonly referred to as Deloitte, is a multinational professional services network. Deloitte is the largest professional services network by revenue and number of employees in the world and is considered one of the Big Four accounting firms, along with EY, KPMG, and PwC.

Michael H. Sutton is a director of Krispy Kreme Corporation. Sutton was the Chief Accountant of the U.S. Securities and Exchange Commission (SEC) from 1995 to 1998, and a director of American International Group from 2005 to 2009.

Howard Irwin Ross was a Canadian accountant, academic administrator, and Chancellor of McGill University.

The New Zealand Institute of Chartered Accountants (NZICA) was the operating name for the Institute of Chartered Accountants of New Zealand. The Institute represented over 33,000 members in New Zealand and overseas. Most accountants in New Zealand belonged to the institute.

Charles H. Noski was the Chairman of the Board of Directors of Wells Fargo & Company from March 2020 to August 2021. He previously held a variety of positions, including the position of CFO at AT&T, Bank of America, and Northrop Grumman, as well as the positions of director and chairman of the audit committee of Microsoft.

Sir David Philip Tweedie is a British accountant. He is the former chairman of the International Accounting Standards Board (2001-2011) and the ninetieth member of The Accounting Hall of Fame.

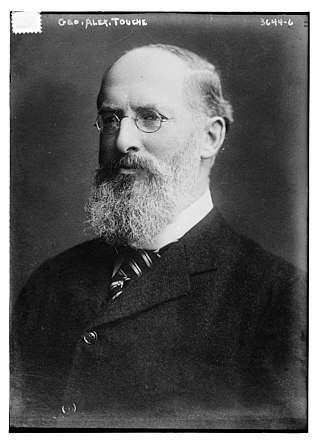

Sir George Alexander Touche, 1st Baronet was a British accountant and politician. He founded one of the firms which amalgamated to create Deloitte Touche Tohmatsu.

Robin Buchanan is a Director of companies and an adviser to family offices, private equity firms, businesses and voluntary organisations.

William Welch Deloitte was a British accountant and the founder of the professional services firm that subsequently became Deloitte Touche Tohmatsu in the United States and Coopers & Lybrand Deloitte in the United Kingdom. He was born in London, England. He was one of the fathers of the accountancy profession.

Sir Douglas Jardine Flint, is a British banker and former chairman of HSBC Holdings. He served from 2011 to 2017, having previously been finance director since 1995. He is chairman of Abrdn.

Chief Akintola Williams was a Nigerian accountant. He was the first Nigerian to qualify as a chartered accountant.

Sir John Calman Shaw was a Scottish businessman, chairman of the board of directors and Governor of the Bank of Scotland from 1999–2001, deputy governor from 1991–1999 and a non-executive director from 1990–2001.

Peter Wong Hong-yuen, GBS, OBE, JP was a member of the Legislative Council of Hong Kong (1988–95).

Howard Darryl Leigh, Baron Leigh of Hurley is a British businessman, Conservative Party politician, and since September 2013 a member of the House of Lords. He is the Co-founder and Senior Partner of Cavendish Corporate Finance.

Catherine Engelbert is an American business executive and Commissioner of the Women's National Basketball Association (WNBA). Before joining the WNBA, she had been with Deloitte for 33 years, including as its first female CEO from 2015 to 2019.

Narain Dass Gupta is Member of Parliament Rajya Sabha from NCT of Delhi, practicing chartered accountant, and former president of the Institute of Chartered Accountants of India (ICAI). He is a financial policy expert who has written several books on taxation.

References

- ↑ MORPETH

- ↑ "Accounting Plan Would Reflect Inflation in U.K. In this role, he was instrumental in setting down the definitive standards by which the Accounting Profession is governed. Firms' Profits, Payouts Seen Affected by Proposals, Expected to Be Adopted". The Wall Street Journal . 1 December 1976.[ dead link ]

- ↑ "British Tax-Law Change A Boon to U.S. Concerns; British Tax-Law Shift a Boon" By ROBERT D. HERSHEY Jr The New York Times 5 September 1979, Wednesday Page D1,

- ↑ "Britain Institutes Inflation Accounting; Two American Approaches British Business Begins Accounting for Inflation" The New York Times 21 April 1980, Monday Page D1,

- ↑ "Standards for Inflation Accounting Sought in Britain; Rules Become Basic Question" The New York Times 5 September 1977, Monday Page 22,