The economy of South Korea is a highly developed mixed economy. By nominal GDP, ₩2.24 quadrillion, it has the 4th largest economy in Asia and the 12th largest in the world. South Korea is notable for its rapid economic development from an underdeveloped nation to a developed, high-income country in a few generations. This economic growth has been described as the Miracle on the Han River, which has allowed it to join OECD and the G-20. South Korea remains one of the fastest-growing developed countries in the world following the Great Recession and the COVID-19 recession. It is included in the group of Next Eleven countries as having the potential to play a dominant role in the global economy by the middle of the 21st century.

The economy of Taiwan is a highly developed free-market economy. It is the 8th largest in Asia and 20th-largest in the world by purchasing power parity, allowing Taiwan to be included in the advanced economies group by the International Monetary Fund. Taiwan is notable for its rapid economic development from an underdeveloped nation to a developed, high-income country in a few generations. This economic growth has been described as the Taiwan Miracle. It is gauged in the high-income economies group by the World Bank. Taiwan is one of the most technologically advanced computer microchip and high-tech electronics industries makers in the world.

The United States is a highly developed/advanced market economy. It is the world's largest economy by nominal GDP, and the second-largest by purchasing power parity (PPP) behind China. It has the world's seventh-highest per capita GDP (nominal) and the eighth-highest per capita GDP (PPP) as of 2022. The U.S. accounted for 25.4% of the global economy in 2022 in nominal terms, and around 15.6% in PPP terms. The U.S. dollar is the currency of record most used in international transactions and is the world's reserve currency, backed by a large U.S. treasuries market, its role as the reference standard for the petrodollar system, and its linked eurodollar. Several countries use it as their official currency and in others it is the de facto currency.

Protectionism, sometimes referred to as trade protectionism, is the economic policy of restricting imports from other countries through methods such as tariffs on imported goods, import quotas, and a variety of other government regulations. Proponents argue that protectionist policies shield the producers, businesses, and workers of the import-competing sector in the country from foreign competitors. Opponents argue that protectionist policies reduce trade and adversely affect consumers in general as well as the producers and workers in export sectors, both in the country implementing protectionist policies and, in the countries, protected against.

The economy of Asia comprises about 4.7 billion people living in 50 different nations. Asia is the fastest growing economic region, as well as the largest continental economy by both GDP Nominal and PPP in the world. Moreover, Asia is the site of some of the world's longest modern economic booms, starting from the Japanese economic miracle (1950–1990), Miracle on the Han River (1961–1996) in South Korea, economic boom (1978–2013) in China, Tiger Cub Economies (1990–2020) in ASEAN, and economic boom in India (1991–present).

Yiwu is a county-level city under the jurisdiction of Jinhua in Central Zhejiang Province, East China. As of the 2020 census, the city had 1,859,390 inhabitants and its built-up area, joined with that of the neighboring Dongyang, was home to 2,947,340 inhabitants. The city is famous for its light industry commodity trade and vibrant market and as a regional tourist destination.

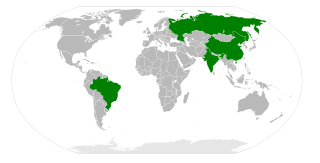

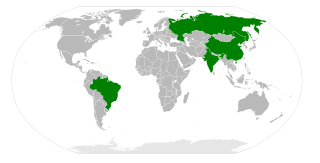

BRIC is a grouping acronym referring to the developing countries of Brazil, Russia, India, and China, which are identified as rising economic powers. It is typically rendered as "the BRIC", "the BRIC countries", "the BRIC economies", or alternatively as the "Big Four". The term was coined by economist Jim O'Neill in 2001 as an acronym for the four countries he identified as being at a similar stage of newly advanced economic development.

The economy of New York City encompasses the largest municipal and regional economy in the United States. In 2022, the New York metropolitan area generated a gross metropolitan product (GMP) of US$2.1 trillion, with a population of 23.6 million people. Anchored by Wall Street in Lower Manhattan, New York City has been characterized as the world's premier financial center. The city is home to the New York Stock Exchange (NYSE) and Nasdaq, the world's two largest stock exchanges by both market capitalization and trading activity.

The flying geese paradigm is a view of Japanese scholars regarding technological development in Southeast Asia which sees Japan as a leading power. It was developed in the 1930s, but gained wider popularity in the 1960s, after its author, Kaname Akamatsu, published his ideas in the Journal of Developing Economies.

The Great Divergence or European miracle is the socioeconomic shift in which the Western world overcame pre-modern growth constraints and emerged during the 19th century as the most powerful and wealthy world civilizations, eclipsing previously dominant or comparable civilizations from the Middle East and Asia such as the Ottoman Empire, Mughal India, Safavid Iran, Qing China and Tokugawa Japan, among others.

Richard A. D'Aveni is an American academic, thought leader, business consultant, bestselling author and the Bakala Professor of Strategy at the Tuck School of Business at Dartmouth College. He is best known for creating a new paradigm in business strategy and coining the term “hypercompetition” which led Fortune to liken him to a modern version of Sun Tzu.

The economy of East Asia comprises 1.6 billion people living in six different countries and regions. The region includes several of the world's largest and most prosperous economies: Japan, South Korea, China, Taiwan, Hong Kong, and Macau. It is home to some of the most economically dynamic places in the world, being the site of some of the world's most extended modern economic booms, including the Japanese economic miracle (1950–1990), Miracle on the Han River (1961–1996) in South Korea, the Taiwan miracle in Taiwan (1960–1996) and the Chinese economic miracle (1978–2015) in mainland China.

China has an upper middle income, developing, mixed, socialist market economy, that incorporates industrial policies and strategic five-year plans. It is the world's second largest economy by nominal GDP, behind the United States, and the world's largest economy since 2016 when measured by purchasing power parity (PPP). Due to a volatile currency exchange rate, China's GDP as measured in dollars fluctuates sharply. China accounted for 19% of the global economy in 2022 in PPP terms, and around 18% in nominal terms in 2022. Historically, China was one of the world's foremost economic powers for most of the two millennia from the 1st until the 19th century. The economy consists of public sector enterprise, state-owned enterprises (SOEs) and mixed-ownership enterprises, as well as a large domestic private sector and openness to foreign businesses in a system. Private investment and exports are the main drivers of economic growth in China; but the Chinese government has also emphasized domestic consumption.

Karen Gordon Mills is an American businessperson and former government official who served as the 23rd Administrator of the U.S. Small Business Administration (SBA). She was nominated by President-elect Barack Obama on December 19, 2008, confirmed unanimously by the Senate on April 2, 2009, and sworn in on April 6, 2009. During her tenure, her office was elevated to the rank of Cabinet-level officer, expanding her power on policy decisions and granting her inclusion in the President's cabinet meetings. On February 11, 2013, she announced her resignation as Administrator and left the post on September 1, 2013.

While beginning in the United States, the Great Recession spread to Asia rapidly and has affected much of the region.

The Lost Decade was a period of economic stagnation in Japan caused by the asset price bubble's collapse in late 1991. The term originally referred to the 1990s, but the 2000s and the 2010s have been included by commentators as the phenomenon continued.

The Mumbai Consensus is a term used to refer to India's particular model of economic development, with a "people-centric" approach to managing its economy which may be taken up by other developing nations in time. Indian model of economic growth, which relied on its domestic market more than exports, boosted domestic consumption rather than investment, pursued service-oriented industries rather than low-skilled manufacturing industries, has greatly differed from the typical Asian strategy of exporting labor-intensive, low-priced manufactured goods to the West. This model of economic development remains distinct from the Beijing Consensus with an export-led growth economy, and the Washington Consensus focused instead on encouraging the spread of democracy and free trade.

Manufacturing is a vital economic sector in the United States. The United States is the world's third largest manufacturer with a record high real output in Q1 2018 of $2.00 trillion well above the 2007 peak before the Great Recession of $1.95 trillion. The U.S. manufacturing industry employed 12.35 million people in December 2016 and 12.56 million in December 2017, an increase of 207,000 or 1.7%. Though still a large part of the US economy, in Q1 2018 manufacturing contributed less to GDP than the 'Finance, insurance, real estate, rental, and leasing' sector, the 'Government' sector, or 'Professional and business services' sector.

In Praise of Hard Industries is a book about the economic impact of fewer manufacturing jobs in the United States written by Irish journalist and author Eamonn Fingleton. It was published in 1999. The book was reissued in a 2003 paperback edition under the title Unsustainable: How Economic Dogma Is Destroying American Prosperity.

Made in China 2025 is a national strategic plan and industrial policy of the Chinese Communist Party (CCP) to further develop the manufacturing sector of China, issued by CCP general secretary Xi Jinping and Chinese Premier Li Keqiang's cabinet in May 2015. As part of the Thirteenth and Fourteenth Five-year Plans, China aims to move away from being the "world's factory"—a producer of cheap low-tech goods facilitated by lower labour costs and supply chain advantages. The industrial policy aims to upgrade the manufacturing capabilities of Chinese industries, growing from labor-intensive workshops into a more technology-intensive powerhouse.