Related Research Articles

The Government National Mortgage Association (GNMA),or Ginnie Mae,is a government-owned corporation of the United States Federal Government within the Department of Housing and Urban Development (HUD). It was founded in 1968 and works to expand affordable housing by guaranteeing housing loans (mortgages) thereby lowering financing costs such as interest rates for those loans. It does that through guaranteeing to investors the on-time payment of mortgage-backed securities (MBS) even if homeowners default on the underlying mortgages and the homes are foreclosed upon.

The Federal National Mortgage Association (FNMA),commonly known as Fannie Mae,is a United States government-sponsored enterprise (GSE) and,since 1968,a publicly traded company. Founded in 1938 during the Great Depression as part of the New Deal,the corporation's purpose is to expand the secondary mortgage market by securitizing mortgage loans in the form of mortgage-backed securities (MBS),allowing lenders to reinvest their assets into more lending and in effect increasing the number of lenders in the mortgage market by reducing the reliance on locally based savings and loan associations. Its brother organization is the Federal Home Loan Mortgage Corporation (FHLMC),better known as Freddie Mac.

The Federal Home Loan Mortgage Corporation (FHLMC),commonly known as Freddie Mac,is a publicly traded,government-sponsored enterprise (GSE),headquartered in Tysons,Virginia. The FHLMC was created in 1970 to expand the secondary market for mortgages in the US. Along with its sister organization,the Federal National Mortgage Association,Freddie Mac buys mortgages,pools them,and sells them as a mortgage-backed security (MBS) to private investors on the open market. This secondary mortgage market increases the supply of money available for mortgage lending and increases the money available for new home purchases. The name "Freddie Mac" is a variant of the FHLMC initialism of the company's full name that was adopted officially for ease of identification.

The Federal Home Loan Banks are 11 U.S. government-sponsored banks that provide liquidity to financial institutions to support housing finance and community investment.

A government-sponsored enterprise (GSE) is a type of financial services corporation created by the United States Congress. Their intended function is to enhance the flow of credit to targeted sectors of the economy,to make those segments of the capital market more efficient and transparent,and to reduce the risk to investors and other suppliers of capital. The desired effect of the GSEs is to enhance the availability and reduce the cost of credit to the targeted borrowing sectors primarily by reducing the risk of capital losses to investors:agriculture,home finance and education. Well known GSEs are the Federal National Mortgage Association,known as Fannie Mae,and the Federal Home Loan Mortgage Corporation,or Freddie Mac.

The Office of Federal Housing Enterprise Oversight (OFHEO) was an agency within the Department of Housing and Urban Development of the United States of America. It was charged with ensuring the capital adequacy and financial safety and soundness of two government sponsored enterprises—the Federal National Mortgage Association and the Federal Home Loan Mortgage Corporation. It was established by the Federal Housing Enterprises Financial Safety and Soundness Act of 1992.

In the United States,a conforming loan is a mortgage loan that both meets the underwriting guidelines of Fannie Mae and Freddie Mac and that does not exceed the conforming loan limit. The most well-known guideline is the size of the loan,which for 2024 was generally limited to $766,550 for one-unit single family homes in the continental US. Other guidelines include borrower's loan-to-value ratio,debt-to-income ratio,credit score and history,documentation requirements,etc.

In the United States,a jumbo mortgage is a mortgage loan that may have high credit quality,but is in an amount above conventional conforming loan limits. This standard is set by the two government-sponsored enterprises (GSE),Fannie Mae and Freddie Mac,and sets the limit on the maximum value of any individual mortgage they will purchase from a lender. Fannie Mae (FNMA) and Freddie Mac (FHLMC) are large agencies that purchase the bulk of U.S. residential mortgages from banks and other lenders,allowing them to free up liquidity to lend more mortgages. When FNMA and FHLMC limits don't cover the full loan amount,the loan is referred to as a "jumbo mortgage". Traditionally,the interest rates on jumbo mortgages are higher than for conforming mortgages,however with GSE fees increasing,Jumbo loans have recently seen lower interest rates than conforming loans.

The American subprime mortgage crisis was a multinational financial crisis that occurred between 2007 and 2010 that contributed to the 2007–2008 global financial crisis. The crisis led to a severe economic recession,with millions losing their jobs and many businesses going bankrupt. The U.S. government intervened with a series of measures to stabilize the financial system,including the Troubled Asset Relief Program (TARP) and the American Recovery and Reinvestment Act (ARRA).

The United States Housing and Economic Recovery Act of 2008 was designed primarily to address the subprime mortgage crisis. It authorized the Federal Housing Administration to guarantee up to $300 billion in new 30-year fixed rate mortgages for subprime borrowers if lenders wrote down principal loan balances to 90 percent of current appraisal value. It was intended to restore confidence in Fannie Mae and Freddie Mac by strengthening regulations and injecting capital into the two large U.S. suppliers of mortgage funding. States are authorized to refinance subprime loans using mortgage revenue bonds. Enactment of the Act led to the government conservatorship of Fannie Mae and Freddie Mac.

The Federal Housing Finance Agency (FHFA) is an independent federal agency in the United States created as the successor regulatory agency of the Federal Housing Finance Board (FHFB),the Office of Federal Housing Enterprise Oversight (OFHEO),and the U.S. Department of Housing and Urban Development government-sponsored enterprise mission team,absorbing the powers and regulatory authority of both entities,with expanded legal and regulatory authority,including the ability to place government-sponsored enterprises (GSEs) into receivership or conservatorship.

In September 2008,the Federal Housing Finance Agency (FHFA) announced that it would take over the Federal National Mortgage Association and the Federal Home Loan Mortgage Corporation. Both government-sponsored enterprises,which finance home mortgages in the United States by issuing bonds,had become illiquid as the market for those bonds collapsed in the subprime mortgage crisis. The FHFA established conservatorships in which each enterprise's management works under the FHFA's direction to reduce losses and to develop a new operating structure that will allow a return to self-management.

James B. Lockhart III is an American U.S. Navy officer,business executive,and,since September 2009,Vice Chairman of WL Ross &Co,which manages $9 billion of private equity investments,a hedge fund and a Mortgage Recovery Fund. It is a subsidiary of Invesco,a Fortune 500 investment management firm. He coordinates WL Ross's investments in financial services firms and mortgages. Lockhart serves co-chairs the Bipartisan Policy Center's Commission on Retirement Security and Personal Savings.

Government policies and the subprime mortgage crisis covers the United States government policies and its impact on the subprime mortgage crisis of 2007-2009. The U.S. subprime mortgage crisis was a set of events and conditions that led to the 2007–2008 financial crisis and subsequent recession. It was characterized by a rise in subprime mortgage delinquencies and foreclosures,and the resulting decline of securities backed by said mortgages. Several major financial institutions collapsed in September 2008,with significant disruption in the flow of credit to businesses and consumers and the onset of a severe global recession.

Loan modification is the systematic alteration of mortgage loan agreements that help those having problems making the payments by reducing interest rates,monthly payments or principal balances. Lending institutions could make one or more of these changes to relieve financial pressure on borrowers to prevent the condition of foreclosure. Loan modifications have been practiced in the United States since the 1930s. During the Great Depression,loan modification programs took place at the state level in an effort to reduce levels of loan foreclosures.

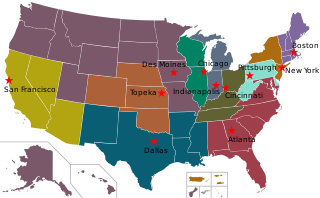

The mortgage industry of the United States is a major financial sector. The federal government created several programs,or government sponsored entities,to foster mortgage lending,construction and encourage home ownership. These programs include the Government National Mortgage Association,the Federal National Mortgage Association and the Federal Home Loan Mortgage Corporation.

The Home Affordable Refinance Program (HARP) is a federal program of the United States,set up by the Federal Housing Finance Agency in March 2009,to help underwater and near-underwater homeowners refinance their mortgages. Unlike the Home Affordable Modification Program (HAMP),which assists homeowners who are in danger of foreclosure,this program benefits homeowners whose mortgage payments are current,but who cannot refinance due to dropping home prices in the wake of the U.S. housing market correction.

People of the State of California v. Federal Housing Finance Agency was a California state case in which several California-based plaintiffs filed suit against the Federal Housing Finance Agency (FHFA) for creating a lending rule that impeded the Property Assessed Clean Energy (PACE) program,a program in which property owners repay energy-related property improvements gradually over time as an addition to their property tax.

The Budget and Accounting Transparency Act of 2014 is a bill that would modify the budgetary treatment of federal credit programs. The bill would require that the cost of direct loans or loan guarantees be recognized in the federal budget on a fair-value basis using guidelines set forth by the Financial Accounting Standards Board. The bill would also require the federal budget to reflect the net impact of programs administered by Fannie Mae and Freddie Mac. The changes made by the bill would mean that Fannie Mae and Freddie Mac were counted on the budget instead of considered separately and would mean that the debt of those two programs would be included in the national debt. These programs themselves would not be changed,but how they are accounted for in the United States federal budget would be. The goal of the bill is to improve the accuracy of how some programs are accounted for in the federal budget.

Collins v. Yellen,594 U.S. ___ (2021),was a United States Supreme Court case dealing with the structure of the Federal Housing Finance Agency (FHFA). The case follows on the Court's prior ruling in Seila Law LLC v. Consumer Financial Protection Bureau,which found that the establishing structure of the Consumer Financial Protection Bureau (CFPB),with a single director who could only be removed from office "for cause",violated the separation of powers;the FHFA shares a similar structure as the CFPB. The case extends the legal challenge to the federal takeover of Fannie Mae and Freddie Mac in 2008.

References

- ↑ "Archived copy" (PDF). Archived from the original (PDF) on 2012-02-16. Retrieved 2012-02-01.

{{cite web}}: CS1 maint: archived copy as title (link) - ↑ Freddie Mac Betting Against Struggling Homeowners : NPR

- ↑ DeMarco 2012, p. 2.

- 1 2 "Federal Housing Finance Agency - Meet the Director". Archived from the original on 2008-12-20. Retrieved 2013-05-02.

- ↑ Taxes in a model of bank portfolio choice, by DeMarco, Edward Joseph Ph.D., University of Maryland College Park, 1991, 270 pages; AAT 9222675

- ↑ "Edward J. DeMarco". The Washington Post. July 17, 2012. Archived from the original on August 1, 2012.

- ↑ DeMarco 2012, Table 1, p. 8.

- ↑ DeMarco 2012, pp. 4ff.

- ↑ "Fire Ed DeMarco". Paul Krugman Blog. 2012-07-31. Retrieved 2023-03-24.

- ↑ Krugman, Paul (August 2, 2012). "Debt, Depression, DeMarco". The New York Times. Retrieved August 2, 2012.

- ↑ Kavoussi, Bonnie (9 August 2012). "Van Jones: Firing FHFA Chief Ed DeMarco Could Be 'The Biggest Stimulus Program In America'". Huffington Post. Retrieved 10 August 2012.