Related Research Articles

A savings and loan association (S&L), or thrift institution, is a financial institution that specializes in accepting savings deposits and making mortgage and other loans. The terms "S&L" and "thrift" are mainly used in the United States; similar institutions in the United Kingdom, Ireland and some Commonwealth countries include building societies and trustee savings banks. They are often mutually held, meaning that the depositors and borrowers are members with voting rights, and have the ability to direct the financial and managerial goals of the organization like the members of a credit union or the policyholders of a mutual insurance company. While it is possible for an S&L to be a joint-stock company, and even publicly traded, in such instances it is no longer truly a mutual association, and depositors and borrowers no longer have membership rights and managerial control. By law, thrifts can have no more than 20 percent of their lending in commercial loans—their focus on mortgage and consumer loans makes them particularly vulnerable to housing downturns such as the deep one the U.S. experienced in 2007.

The savings and loan crisis of the 1980s and 1990s was the failure of 32% of savings and loan associations (S&Ls) in the United States from 1986 to 1995. An S&L or "thrift" is a financial institution that accepts savings deposits and makes mortgage, car and other personal loans to individual members.

The Community Reinvestment Act is a United States federal law designed to encourage commercial banks and savings associations to help meet the needs of borrowers in all segments of their communities, including low- and moderate-income neighborhoods. Congress passed the Act in 1977 to reduce discriminatory credit practices against low-income neighborhoods, a practice known as redlining.

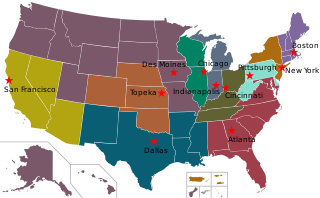

The Federal Home Loan Banks are 11 U.S. government-sponsored banks that provide liquidity to financial institutions to support housing finance and community investment.

The Office of Thrift Supervision (OTS) was a United States federal agency under the Department of the Treasury that chartered, supervised, and regulated all federally chartered and state-chartered savings banks and savings and loans associations. It was created in 1989 as a renamed version of the Federal Home Loan Bank Board, another federal agency. Like other U.S. federal bank regulators, it was paid by the banks it regulated. The OTS was initially seen as an aggressive regulator, but was later lax. Declining revenues and staff led the OTS to market itself to companies as a lax regulator in order to get revenue.

David Kemp Karnes was an American politician, businessman, and attorney. He was a United States Senator from Nebraska from 1987 to 1989, and was president and chief executive officer of The Fairmont Group Incorporated, a merchant banking/consulting company with offices in Omaha and the District of Columbia. Karnes also served in an "of counsel" capacity to the national law firm of Kutak Rock and practiced out of the firm's Omaha, Nebraska and Washington, D.C. offices. Karnes was also involved in numerous civic, educational, and charitable organizations both in Nebraska and nationally.

Lewis William Seidman was an American economist, financial commentator, and former head of the U.S. Federal Deposit Insurance Corporation, best known for his role in helping work to correct the Savings and Loan Crisis in the American financial sector from 1988 to 1991 as head of the Resolution Trust Corporation. He also worked as an economic adviser during three separate administrations of United States presidents: Gerald Ford, Ronald Reagan, and George H. W. Bush. He was lauded by both Republicans and Democrats for his work in cleaning up the frauds of the Savings and Loan disaster, but was pushed out of American government by the George H.W. Bush administration for disclosing the full extent of the crisis to the United States Congress and taxpayers.

The presidency of Ronald Reagan was marked by numerous scandals, resulting in the investigation, indictment or conviction of over 138 administration officials, the largest number for any president of the United States.

The Financial Institutions Reform, Recovery, and Enforcement Act of 1989 (FIRREA), is a United States federal law enacted in the wake of the savings and loan crisis of the 1980s.

The early 1980s recession was a severe economic recession that affected much of the world between approximately the start of 1980 and 1982. It is widely considered to have been the most severe recession since World War II until the 2007–2008 financial crisis.

The Federal Home Loan Bank Act, Pub. L.Tooltip Public Law 72–304, 47 Stat. 725, enacted July 22, 1932, is a United States federal law passed under President Herbert Hoover in order to lower the cost of home ownership. It established the Federal Home Loan Bank Board to charter and supervise federal savings and loan institutions. It also created the Federal Home Loan Banks which lend to building and loan associations, cooperative banks, homestead associations, insurance companies, savings banks, community development financial institutions, and insured depository institutions in order to finance home mortgages.

IndyMac, a contraction of Independent National Mortgage Corporation, was an American bank based in California that failed in 2008 and was seized by the United States Federal Deposit Insurance Corporation (FDIC).

Andrew Marshall Saul is an American businessman and political candidate who served as commissioner of the United States Social Security Administration from 2019 to 2021. Saul was fired from the position by President Joe Biden on July 9, 2021, after refusing to offer his requested resignation. Saul stated that his discharge was illegal.

The Keating Five were five United States Senators found guilty of corruption in 1989, igniting a major political scandal as part of the larger savings and loan crisis of the late 1980s and early 1990s. The five senators—Alan Cranston, Dennis DeConcini, John Glenn, John McCain, and Donald W. Riegle, Jr. —were accused of improperly intervening in 1987 on behalf of Charles H. Keating, Jr., chairman of the Lincoln Savings and Loan Association, which was the target of a regulatory investigation by the Federal Home Loan Bank Board (FHLBB). The FHLBB subsequently backed off taking action against Lincoln.

Peter J. Wallison is an American lawyer and the Arthur F. Burns Fellow in Financial Policy Studies at the American Enterprise Institute. He specializes in financial markets deregulation. He was White House Counsel during the Tower Commission's inquiry into the Iran Contra Affair. He was a dissenting member of the 2010 Financial Crisis Inquiry Commission, frequent commentator in the mass media on the federal takeover of Fannie Mae and Freddie Mac and the financial crisis of 2007–2008 and wrote Hidden in Plain Sight (2015) about the crisis and its legacy.

William Kurt Black is an American lawyer, academic, author, and a former bank regulator. Black's expertise is in white-collar crime, public finance, regulation, and other topics in law and economics. He developed the concept of "control fraud", in which a business or national executive uses the entity he or she controls as a "weapon" to commit fraud.

CenTrust Bank, A State Savings Bank was an American savings and loan association based in Miami, Florida that failed in 1990. Its failure in 1990 was one of the largest and costliest failures of the savings and loan crisis.

American Savings and Loan Association was an American savings and loan based in Stockton, California. In 1988 it was the largest thrift failure and the federal government's costliest resolution during the savings and loan crisis at an estimated cost of $5.4 billion.

Gibraltar Savings Association was a Houston, Texas based savings and loan. Its failure in 1988 and resolution was one of the most expensive in the savings and loan crisis at an estimated cost of $2.875 billion.

Anita Miller is an American urbanist working in the field of urban revitalization and policy areas such as reverse mortgages, tenant management, anti-redlining initiatives and comprehensive community development. She is the first woman to have served as a senior program officer at the Ford Foundation and as a board member of a federal financial regulatory agency.

References

- 1 2 3 4 5 Granelli, James S. (1993-09-08). "Ex-Regulator Edwin Gray, Foe of Keating, Quits Post : Banking: Troubled Miami thrift he headed was sold to investors without federal help". Los Angeles Times. Retrieved 10 June 2021.

- ↑ Day, Kathleen (1986-05-11). "FHLBB's Gray Fights On". Washington Post. Retrieved 10 June 2021.

- 1 2 3 Noble, Kenneth B. (1983-05-29). "POLITICAL FOOT SOLDIER; REAGAN'S FRIEND AT THE BANK BOARD". The New York Times. Retrieved 10 June 2021.

- 1 2 3 Maraniss, David; Atkinson, Rick (1989-06-11). "IN TEXAS, THRIFTS WENT ON A BINGE OF GROWTH". Washington Post. Retrieved 10 June 2021.

- 1 2 "President-elect Ronald Reagan Friday appointed Edwin J. Gray and..." UPI. 17 January 1981. Retrieved 10 June 2021.

- ↑ Burke, John P. (2000). Presidential Transitions: From Politics To Practice. Boulder: Lynne Rienner Publishers. p. 98. ISBN 1555879160.

- ↑ "Appointment of Kevin R. Hopkins as Director of the White House Office of Policy Information | The American Presidency Project". www.presidency.ucsb.edu. The American Presidency Project (University of California Santa Barbara). Retrieved 10 June 2021.

- ↑ "PN81-1 - Nomination of Edwin J. Gray for Federal Home Loan Bank Board, 98th Congress (1983-1984)". www.congress.gov. United States Congress. 1983-03-23. Retrieved 10 June 2021.

- ↑ "PN81-2 - Nomination of Edwin J. Gray for Federal Home Loan Bank Board, 98th Congress (1983-1984)". www.congress.gov. United States Congress. 1983-03-23. Retrieved 10 June 2021.

- 1 2 "Keating Five". keatingfive.org. Retrieved 10 June 2021.

- ↑ Furlong, Tom (1985-02-05). "Everything's Black and White When It Comes to Ed Gray". Los Angeles Times. Retrieved 10 June 2021.

- ↑ Yost, Pete (17 February 1993). "Savings and loan crisis". Associated Press. Retrieved 10 June 2021.

- 1 2 Nash, Nathaniel C. (1989-07-09). "Showdown Time for Danny Wall". The New York Times .

- ↑ Nowicki, Dan and Muller, Bill (2007-03-01). "John McCain Report: The Keating Five". The Arizona Republic . Retrieved 2007-11-23.

{{cite news}}: CS1 maint: multiple names: authors list (link) - ↑ Nash, Nathaniel C. (1985-11-04). "BANK BOARD'S EMBATTLED CHIEF". The New York Times. Retrieved 10 June 2021.

- ↑ Black, William K. (2012-04-03). "We Were Regulators Once: Ed Gray's Finest Hour". rtiholtz.com. The Big Picture (Barry Ritholtz). Retrieved 10 June 2021.

- ↑ Fritz, Sara (1990-03-25). "Mr. Ed's Revenge : Once the Washington Press Corps Mocked Ed Gray. But then He Helped Topple the Speaker of the House and Put Alan Cranston on the Run". Los Angeles Times. Retrieved 10 June 2021.