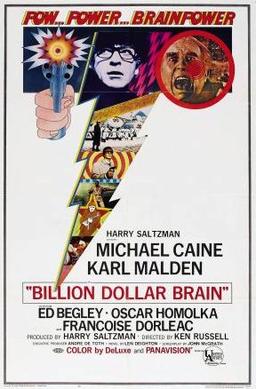

Harry Palmer is the name given to the anti-hero protagonist of several films based on spy novels written by Len Deighton, in which the main character is an unnamed intelligence officer. For convenience, the novels are also often referred to as the "Harry Palmer" novels.

The Federal Old-Age and Survivors Insurance Trust Fund and Federal Disability Insurance Trust Fund are trust funds that provide for payment of Social Security benefits administered by the United States Social Security Administration.

Warren Edward Buffett is an American businessman, investor, and philanthropist who currently serves as the co-founder, chairman and CEO of Berkshire Hathaway. As a result of his investment success, Buffett is one of the best-known investors in the world. As of June 2024, he had a net worth of $135 billion, making him the tenth-richest person in the world.

The national debt of the United States is the total national debt owed by the federal government of the United States to Treasury security holders. The national debt at any point in time is the face value of the then-outstanding Treasury securities that have been issued by the Treasury and other federal agencies. The terms "national deficit" and "national surplus" usually refer to the federal government budget balance from year to year, not the cumulative amount of debt. In a deficit year the national debt increases as the government needs to borrow funds to finance the deficit, while in a surplus year the debt decreases as more money is received than spent, enabling the government to reduce the debt by buying back some Treasury securities. In general, government debt increases as a result of government spending and decreases from tax or other receipts, both of which fluctuate during the course of a fiscal year. There are two components of gross national debt:

A millionaire is an individual whose net worth or wealth is equal to or exceeds one million units of currency. Depending on the currency, a certain level of prestige is associated with being a millionaire. Many national currencies have, or have had at various times, a low unit value, in many cases due to past inflation. It is much easier and less significant to be a millionaire in those currencies, thus a millionaire in Hong Kong or Taiwan, for example, may be merely averagely wealthy, or perhaps less wealthy than average. A millionaire in Zimbabwe in 2007 could have been extremely poor. Because of this, the term 'millionaire' generally refers to those whose assets total at least one million units of a high-value currency, such as the United States dollar, euro, or pound sterling.

The foreign exchange market is a global decentralized or over-the-counter (OTC) market for the trading of currencies. This market determines foreign exchange rates for every currency. It includes all aspects of buying, selling and exchanging currencies at current or determined prices. In terms of trading volume, it is by far the largest market in the world, followed by the credit market.

The Vanguard Group, Inc., is an American registered investment advisor based in Malvern, Pennsylvania, with about $7.7 trillion in global assets under management, as of April 2023. It is the largest provider of mutual funds and the second-largest provider of exchange-traded funds (ETFs) in the world after BlackRock's iShares. In addition to mutual funds and ETFs, Vanguard offers brokerage services, educational account services, financial planning, asset management, and trust services. Several mutual funds managed by Vanguard are ranked at the top of the list of US mutual funds by assets under management. Along with BlackRock and State Street, Vanguard is considered to be one of the Big Three index fund managers that play a dominant role in corporate America.

Andreas Eschbach is a German writer, primarily of science fiction. His stories that are not clearly in the SF genre usually feature elements of the fantastic.

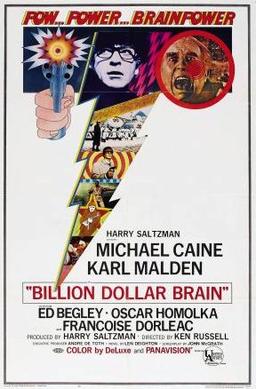

Billion Dollar Brain is a 1967 British espionage film directed by Ken Russell and based on the 1966 novel Billion-Dollar Brain by Len Deighton. The film features Michael Caine as secret agent Harry Palmer, the anti-hero protagonist. The "brain" of the title is a sophisticated computer with which an anti-communist organisation controls its worldwide anti-Soviet spy network.

Quantitative easing (QE) is a monetary policy action where a central bank purchases predetermined amounts of government bonds or other financial assets in order to stimulate economic activity. Quantitative easing is a novel form of monetary policy that came into wide application after the financial crisis of 2007–2008. It is used to mitigate an economic recession when inflation is very low or negative, making standard monetary policy ineffective. Quantitative tightening (QT) does the opposite, where for monetary policy reasons, a central bank sells off some portion of its holdings of government bonds or other financial assets.

The Emergency Economic Stabilization Act of 2008, also known as the "bank bailout of 2008" or the "Wall Street bailout", was a United States federal law enacted during the Great Recession, which created federal programs to "bail out" failing financial institutions and banks. The bill was proposed by Treasury Secretary Henry Paulson, passed by the 110th United States Congress, and was signed into law by President George W. Bush. It became law as part of Public Law 110-343 on October 3, 2008. It created the $700 billion Troubled Asset Relief Program (TARP), which utilized congressionally appropriated taxpayer funds to purchase toxic assets from failing banks. The funds were mostly redirected to inject capital into banks and other financial institutions while the Treasury continued to examine the usefulness of targeted asset purchases.

In monetary economics, the currency in circulation in a country is the value of currency or cash that has ever been issued by the country’s monetary authority less the amount that has been removed. More broadly, money in circulation is the total money supply of a country, which can be defined in various ways, but always includes currency and also some types of bank deposits, such as deposits at call.

Cost of Conflict is a tool which attempts to calculate the price of conflict to the human race. The idea is to examine this cost, not only in terms of the deaths and casualties and the economic costs borne by the people involved, but also the social, developmental, environmental and strategic costs of conflict. In most cases organizations measure and analyze the economic and broader development costs of conflict. While this conventional method of assessing the impact of conflict is fairly in-depth, it does not provide a comprehensive overview of a country or region embroiled in conflict. One of the earliest studies assessing the true cost of conflict on a variety of parameters was commissioned by Saferworld and compiled by Michael Cranna. Strategic Foresight Group has taken this science to a new level by developing a multi-disciplinary methodology, that has been applied to most parts of the world. A key benefit of using this tool is to encourage people to look at conflict in new ways and to widen public discussion of the subject, and to bring new insights to the debate on global security.

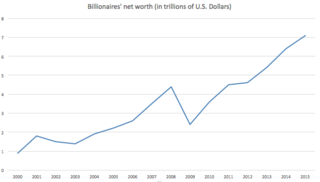

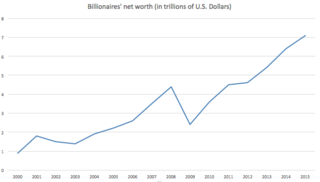

The World's Billionaires is an annual ranking of people who are billionaires, i.e., they are considered to have a net worth of US$1 billion or more, by the American business magazine Forbes. The list was first published in March 1987. The total net worth of each individual on the list is estimated and is cited in United States dollars, based on their documented assets and accounting for debt and other factors. Royalty and dictators whose wealth comes from their positions are excluded from these lists. This ranking is an index of the wealthiest documented individuals, excluding any ranking of those with wealth that is not able to be completely ascertained.

The 2013 United States federal budget is the budget to fund government operations for the fiscal year 2013, which began on October 1, 2012, and ended on September 30, 2013. The original spending request was issued by President Barack Obama in February 2012.

The trillion-dollar coin is a concept that emerged during the United States debt-ceiling crisis of 2011 as a proposed way to bypass any necessity for the United States Congress to raise the country's borrowing limit, through the minting of very high-value platinum coins. The concept gained more mainstream attention by late 2012 during the debates over the United States fiscal cliff negotiations and renewed debt-ceiling discussions. After reaching the headlines during the week of January 7, 2013, use of the trillion-dollar coin concept was ultimately rejected by the Federal Reserve and the Treasury.

The World's Billionaires 2013 edition was 27th annual ranking of The World's Billionaires by Forbes magazine. The list estimated the net worth of the world's richest people, excluding royalty and dictators, as of February 14, 2013. It was released online on March 3, 2013 and published in the March 25 print edition of Forbes.

The economic policy of the Donald Trump administration was characterized by the individual and corporate tax cuts, attempts to repeal the Affordable Care Act ("Obamacare"), trade protectionism, immigration restriction, deregulation focused on the energy and financial sectors, and responses to the COVID-19 pandemic.

The net worth of Donald Trump is not publicly known. Forbes has estimated his wealth for decades and estimates it at $7.2 billion as of June 2024, with Trump making much higher claims. Trump received gifts, loans, and inheritance from his father. His primary business has been real estate ventures, including hotels, casinos, and golf courses. He also made money from Trump-branded products including neckties, steaks, and urine tests. Money received through political fundraisers is used to pay for guest stays at properties owned by the Trump Organization and to pay his and his allies' lawyers.