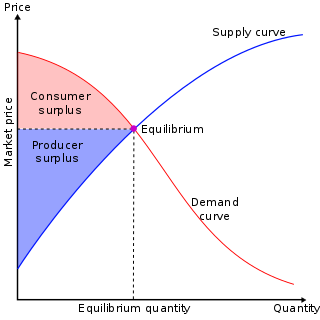

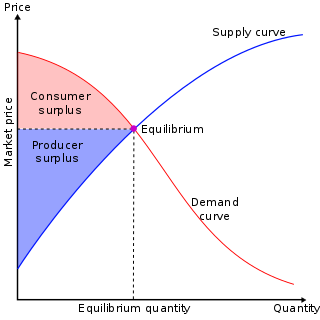

In economics, specifically general equilibrium theory, a perfect market, also known as an atomistic market, is defined by several idealizing conditions, collectively called perfect competition, or atomistic competition. In theoretical models where conditions of perfect competition hold, it has been demonstrated that a market will reach an equilibrium in which the quantity supplied for every product or service, including labor, equals the quantity demanded at the current price. This equilibrium would be a Pareto optimum.

In microeconomics, supply and demand is an economic model of price determination in a market. It postulates that, holding all else equal, in a competitive market, the unit price for a particular good, or other traded item such as labor or liquid financial assets, will vary until it settles at a point where the quantity demanded will equal the quantity supplied, resulting in an economic equilibrium for price and quantity transacted. The concept of supply and demand forms the theoretical basis of modern economics.

In economics, general equilibrium theory attempts to explain the behavior of supply, demand, and prices in a whole economy with several or many interacting markets, by seeking to prove that the interaction of demand and supply will result in an overall general equilibrium. General equilibrium theory contrasts with the theory of partial equilibrium, which analyzes a specific part of an economy while its other factors are held constant. In general equilibrium, constant influences are considered to be noneconomic, or in other words, considered to be beyond the scope of economic analysis. The noneconomic influences may change given changes in the economic factors however, and therefore the prediction accuracy of an equilibrium model may depend on the independence of the economic factors from noneconomic ones.

Marie-Esprit-Léon Walras was a French mathematical economist and Georgist. He formulated the marginal theory of value and pioneered the development of general equilibrium theory. Walras is best known for his book Éléments d'économie politique pure, a work that has contributed greatly to the mathematization of economics through the concept of general equilibrium. The definition of the role of the entrepreneur found in it was also taken up and amplified by Joseph Schumpeter.

In mainstream economics, economic surplus, also known as total welfare or total social welfare or Marshallian surplus, is either of two related quantities:

In economics, profit maximization is the short run or long run process by which a firm may determine the price, input and output levels that will lead to the highest possible total profit. In neoclassical economics, which is currently the mainstream approach to microeconomics, the firm is assumed to be a "rational agent" which wants to maximize its total profit, which is the difference between its total revenue and its total cost.

In economics, economic equilibrium is a situation in which economic forces such as supply and demand are balanced and in the absence of external influences the values of economic variables will not change. For example, in the standard text perfect competition, equilibrium occurs at the point at which quantity demanded and quantity supplied are equal.

In macroeconomics, aggregate demand (AD) or domestic final demand (DFD) is the total demand for final goods and services in an economy at a given time. It is often called effective demand, though at other times this term is distinguished. This is the demand for the gross domestic product of a country. It specifies the amount of goods and services that will be purchased at all possible price levels. Consumer spending, investment, corporate and government expenditure, and net exports make up the aggregate demand.

In economics, quantity adjustment is the process by which a market surplus leads to a cut-back in the quantity supplied or a market shortage causes an increase in supplied quantity. It is one possible result of supply and demand disequilibrium in a market. Quantity adjustment is complementary to pricing.

In mathematical economics, the Arrow–Debreu model is a theoretical general equilibrium model. It posits that under certain economic assumptions there must be a set of prices such that aggregate supplies will equal aggregate demands for every commodity in the economy.

Bertrand competition is a model of competition used in economics, named after Joseph Louis François Bertrand (1822–1900). It describes interactions among firms (sellers) that set prices and their customers (buyers) that choose quantities at the prices set. The model was formulated in 1883 by Bertrand in a review of Antoine Augustin Cournot's book Recherches sur les Principes Mathématiques de la Théorie des Richesses (1838) in which Cournot had put forward the Cournot model. Cournot's model argued that each firm should maximise its profit by selecting a quantity level and then adjusting price level to sell that quantity. The outcome of the model equilibrium involved firms pricing above marginal cost; hence, the competitive price. In his review, Bertrand argued that each firm should instead maximise its profits by selecting a price level that undercuts its competitors' prices, when their prices exceed marginal cost. The model was not formalized by Bertrand; however, the idea was developed into a mathematical model by Francis Ysidro Edgeworth in 1889.

Cournot competition is an economic model used to describe an industry structure in which companies compete on the amount of output they will produce, which they decide on independently of each other and at the same time. It is named after Antoine Augustin Cournot (1801–1877) who was inspired by observing competition in a spring water duopoly. It has the following features:

A Walrasian auction, introduced by Léon Walras, is a type of simultaneous auction where each agent calculates its demand for the good at every possible price and submits this to an auctioneer. The price is then set so that the total demand across all agents equals the total amount of the good. Thus, a Walrasian auction perfectly matches the supply and the demand.

Walras's law is a principle in general equilibrium theory asserting that budget constraints imply that the values of excess demand must sum to zero regardless of whether the prices are general equilibrium prices. That is:

Hugo Freund Sonnenschein was an American economist and educational administrator. He served as president of the University of Chicago from 1993 to 2000.

The Sonnenschein–Mantel–Debreu theorem is an important result in general equilibrium economics, proved by Gérard Debreu, Rolf Mantel, and Hugo F. Sonnenschein in the 1970s. It states that the excess demand curve for an exchange economy populated with utility-maximizing rational agents can take the shape of any function that is continuous, has homogeneity degree zero, and is in accordance with Walras's law. This implies that the excess demand function does not take a well-behaved form even if each agent has a well-behaved utility function. Market processes will not necessarily reach a unique and stable equilibrium point.

In economics, an aggregate is a summary measure. It replaces a vector that is composed of many real numbers by a single real number, or a scalar. Consequently, there occur various problems that are inherent in the formulations that use aggregated variables.

Competitive equilibrium is a concept of economic equilibrium, introduced by Kenneth Arrow and Gérard Debreu in 1951, appropriate for the analysis of commodity markets with flexible prices and many traders, and serving as the benchmark of efficiency in economic analysis. It relies crucially on the assumption of a competitive environment where each trader decides upon a quantity that is so small compared to the total quantity traded in the market that their individual transactions have no influence on the prices. Competitive markets are an ideal standard by which other market structures are evaluated.

In theoretical economics, an abstract economy is a model that generalizes both the standard model of an exchange economy in microeconomics, and the standard model of a game in game theory. An equilibrium in an abstract economy generalizes both a Walrasian equilibrium in microeconomics, and a Nash equilibrium in game-theory.

Market equilibrium computation is a computational problem in the intersection of economics and computer science. The input to this problem is a market, consisting of a set of resources and a set of agents. There are various kinds of markets, such as Fisher market and Arrow–Debreu market, with divisible or indivisible resources. The required output is a competitive equilibrium, consisting of a price-vector, and an allocation, such that each agent gets the best bundle possible given the budget, and the market clears.