In economics, a shortage or excess demand is a situation in which the demand for a product or service exceeds its supply in a market. It is the opposite of an excess supply (surplus).

In economics, a shortage or excess demand is a situation in which the demand for a product or service exceeds its supply in a market. It is the opposite of an excess supply (surplus).

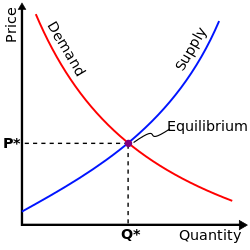

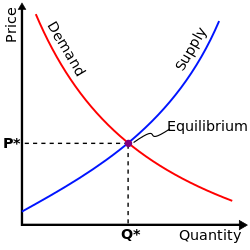

In a perfect market (one that matches a simple microeconomic model), an excess of demand will prompt sellers to increase prices until demand at that price matches the available supply, establishing market equilibrium. [1] [2] In economic terminology, a shortage occurs when for some reason (such as government intervention, or decisions by sellers not to raise prices) the price does not rise to reach equilibrium. In this circumstance, buyers want to purchase more at the market price than the quantity of the good or service that is available, and some non-price mechanism (such as "first come, first served" or a lottery) determines which buyers are served. So in a perfect market the only thing that can cause a shortage is price.

In common use, the term "shortage" may refer to a situation where most people are unable to find a desired good at an affordable price, especially where supply problems have increased the price. [3] "Market clearing" happens when all buyers and sellers willing to transact at the prevailing price are able to find partners. There are almost always willing buyers at a lower-than-market-clearing price; the narrower technical definition doesn't consider failure to serve this demand as a "shortage", even if it would be described that way in a social or political context (which the simple model of supply and demand does not attempt to encompass).

Shortages (in the technical sense) may be caused by the following causes:

Decisions which result in a below-market-clearing price help some people and hurt others. In this case, shortages may be accepted because they theoretically enable a certain portion of the population to purchase a product that they couldn't afford at the market-clearing price. The cost is to those who are willing to pay for a product and either can't, or experience greater difficulty in doing so.

In the case of government intervention in the market, there is always a trade-off with positive and negative effects. For example, a price ceiling may cause a shortage, but it will also enable a certain percentage of the population to purchase a product that they couldn't afford at market costs. [3] Economic shortages caused by higher transaction costs and opportunity costs (e.g., in the form of lost time) also mean that the distribution process is wasteful. Both of these factors contribute to a decrease in aggregate wealth.

Shortages may or will cause: [3]

Many regions around the world have experienced shortages in the past.

In its narrowest definition, a labour shortage is an economic condition in which employers believe there are insufficient qualified candidates (employees) to fill the marketplace demands for employment at a specific wage. Such a condition is sometimes referred to by economists as "an insufficiency in the labour force."[ citation needed ] According to the Frisch elasticity of labor supply lower wages reduce labour supply. [18]

In a wider definition, a widespread and persistent domestic labour shortage is caused by excessively low salaries (relative to the domestic cost of living) and adverse working conditions (excessive workload and working hours) in low-wage industries (hospitality and leisure, education, health care, rail transportation, aviation, retail, manufacturing, food, elderly care), which collectively lead to occupational burnout and attrition of existing workers, reduced incentives to attract domestic workers, short-staffing at workplaces and further exacerbation (positive feedback) of staff shortages. [19]

Labour shortages can occur even during economic periods of high unemployment or youth unemployment within specific industries due to low salaries offered. [20] In response to domestic labour shortages, some business associations such as chambers of commerce, trade associations or employers' organizations lobby for an increased immigration of foreign workers which accept lower salaries according to the global labor arbitrage. [21] In addition, business associations have campaigned for greater state provision of child care, which would enable more women to re-enter the labour workforce at a lower wage rate to achieve economic equilibrium. [22] However, lower salaries discourage local labour from entering the relevant industries and can cause labour shortages in developing countries. [23]

The Atlantic slave trade (which originated in the early 17th century but ended by the early 19th century) was said to have originated from perceived shortages of agricultural labour in the Americas (particularly in the Southern United States). It was thought that bringing African labor was the only means of malaria resistance available at the time. [24]

The Great Depression of the 1930s hit Mexican immigrants especially hard. Along with the job crisis and food shortages that affected all U.S. workers, Mexicans and Mexican Americans had to face an additional threat: deportation.