Related Research Articles

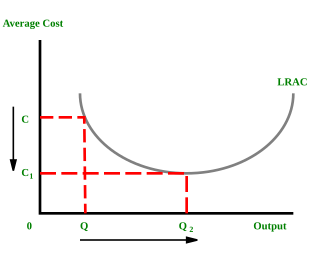

In microeconomics, economies of scale are the cost advantages that enterprises obtain due to their scale of operation, and are typically measured by the amount of output produced per unit of time. A decrease in cost per unit of output enables an increase in scale. At the basis of economies of scale, there may be technical, statistical, organizational or related factors to the degree of market control.

Physical capital represents in economics one of the three primary factors of production. Physical capital is the apparatus used to produce a good and services. Physical capital represents the tangible man-made goods that help and support the production. Inventory, cash, equipment or real estate are all examples of physical capital.

In machine learning, the perceptron is an algorithm for supervised learning of binary classifiers. A binary classifier is a function which can decide whether or not an input, represented by a vector of numbers, belongs to some specific class. It is a type of linear classifier, i.e. a classification algorithm that makes its predictions based on a linear predictor function combining a set of weights with the feature vector.

In economics, the marginal cost is the change in the total cost that arises when the quantity produced is increased, i.e. the cost of producing additional quantity. In some contexts, it refers to an increment of one unit of output, and in others it refers to the rate of change of total cost as output is increased by an infinitesimal amount. As Figure 1 shows, the marginal cost is measured in dollars per unit, whereas total cost is in dollars, and the marginal cost is the slope of the total cost, the rate at which it increases with output. Marginal cost is different from average cost, which is the total cost divided by the number of units produced.

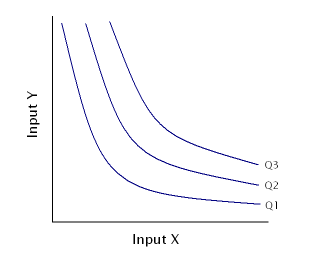

In economics and econometrics, the Cobb–Douglas production function is a particular functional form of the production function, widely used to represent the technological relationship between the amounts of two or more inputs and the amount of output that can be produced by those inputs. The Cobb–Douglas form was developed and tested against statistical evidence by Charles Cobb and Paul Douglas between 1927 and 1947; according to Douglas, the functional form itself was developed earlier by Philip Wicksteed.

In mathematics, the Hessian matrix, Hessian or Hesse matrix is a square matrix of second-order partial derivatives of a scalar-valued function, or scalar field. It describes the local curvature of a function of many variables. The Hessian matrix was developed in the 19th century by the German mathematician Ludwig Otto Hesse and later named after him. Hesse originally used the term "functional determinants". The Hessian is sometimes denoted by H or, ambiguously, by ∇2.

In economics, a production function gives the technological relation between quantities of physical inputs and quantities of output of goods. The production function is one of the key concepts of mainstream neoclassical theories, used to define marginal product and to distinguish allocative efficiency, a key focus of economics. One important purpose of the production function is to address allocative efficiency in the use of factor inputs in production and the resulting distribution of income to those factors, while abstracting away from the technological problems of achieving technical efficiency, as an engineer or professional manager might understand it.

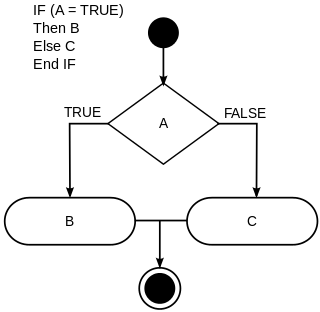

In computer science, conditionals are programming language commands for handling decisions. Specifically, conditionals perform different computations or actions depending on whether a programmer-defined Boolean condition evaluates to true or false. In terms of control flow, the decision is always achieved by selectively altering the control flow based on some condition . Although dynamic dispatch is not usually classified as a conditional construct, it is another way to select between alternatives at runtime. Conditional statements are the checkpoints in the programme that determines behaviour according to situation.

In economics, average cost (AC) or unit cost is equal to total cost (TC) divided by the number of units of a good produced :

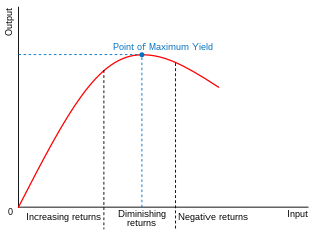

In economics, diminishing returns are the decrease in marginal (incremental) output of a production process as the amount of a single factor of production is incrementally increased, holding all other factors of production equal. The law of diminishing returns states that in productive processes, increasing a factor of production by one unit, while holding all other production factors constant, will at some point return a lower unit of output per incremental unit of input. The law of diminishing returns does not cause a decrease in overall production capabilities, rather it defines a point on a production curve whereby producing an additional unit of output will result in a loss and is known as negative returns. Under diminishing returns, output remains positive, but productivity and efficiency decrease.

An isoquant, in microeconomics, is a contour line drawn through the set of points at which the same quantity of output is produced while changing the quantities of two or more inputs. The x and y axis on an isoquant represent two relevant inputs, which are usually a factor of production such as labour, capital, land, or organisation. An isoquant may also be known as an “Iso-Product Curve”, or an “Equal Product Curve”.

In economics, an input–output model is a quantitative economic model that represents the interdependencies between different sectors of a national economy or different regional economies. Wassily Leontief (1906–1999) is credited with developing this type of analysis and earned the Nobel Prize in Economics for his development of this model.

In matrix theory, the Perron–Frobenius theorem, proved by Oskar Perron and Georg Frobenius, asserts that a real square matrix with positive entries has a unique eigenvalue of largest magnitude and that eigenvalue is real. The corresponding eigenvector can be chosen to have strictly positive components, and also asserts a similar statement for certain classes of nonnegative matrices. This theorem has important applications to probability theory ; to the theory of dynamical systems ; to economics ; to demography ; to social networks ; to Internet search engines (PageRank); and even to ranking of American football teams. The first to discuss the ordering of players within tournaments using Perron–Frobenius eigenvectors is Edmund Landau.

In economics, a cost curve is a graph of the costs of production as a function of total quantity produced. In a free market economy, productively efficient firms optimize their production process by minimizing cost consistent with each possible level of production, and the result is a cost curve. Profit-maximizing firms use cost curves to decide output quantities. There are various types of cost curves, all related to each other, including total and average cost curves; marginal cost curves, which are equal to the differential of the total cost curves; and variable cost curves. Some are applicable to the short run, others to the long run.

In mathematics, an operation is a function which takes zero or more input values to a well-defined output value. The number of operands is the arity of the operation.

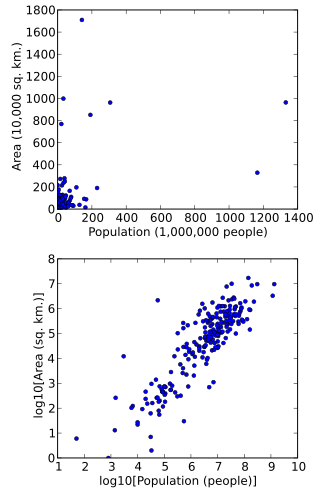

In statistics, data transformation is the application of a deterministic mathematical function to each point in a data set—that is, each data point zi is replaced with the transformed value yi = f(zi), where f is a function. Transforms are usually applied so that the data appear to more closely meet the assumptions of a statistical inference procedure that is to be applied, or to improve the interpretability or appearance of graphs.

Production is the process of combining various inputs, both material and immaterial in order to create output. Ideally this output will be a good or service which has value and contributes to the utility of individuals. The area of economics that focuses on production is called production theory, and it is closely related to the consumption theory of economics.

In economics, the marginal product of labor (MPL) is the change in output that results from employing an added unit of labor. It is a feature of the production function and depends on the amounts of physical capital and labor already in use.

Kernel methods are a well-established tool to analyze the relationship between input data and the corresponding output of a function. Kernels encapsulate the properties of functions in a computationally efficient way and allow algorithms to easily swap functions of varying complexity.

Environmentally extended input–output analysis (EEIOA) is used in environmental accounting as a tool which reflects production and consumption structures within one or several economies. As such, it is becoming an important addition to material flow accounting.

References

- ↑ Intermediate Microeconomics, Hal R. Varian 1999, W. W. Norton & Company; 5th edition

- ↑ Mas-Colell, Andreu; Whinston, Michael D.; Jerry R. Green (1995). Microeconomic Theory. New York: Oxford University Press. ISBN 0-19-507340-1.