HM Customs and Excise was a department of the British Government formed in 1909 by the merger of HM Customs and HM Excise; its primary responsibility was the collection of customs duties, excise duties, and other indirect taxes.

Excise tax in the United States is an indirect tax on listed items. Excise taxes can be and are made by federal, state and local governments and are not uniform throughout the United States. Certain goods, such as gasoline, diesel fuel, alcohol, and tobacco products, are taxed by multiple governments simultaneously. Some excise taxes are collected from the producer or retailer and not paid directly by the consumer, and as such often remain "hidden" in the price of a product or service, rather than being listed separately.

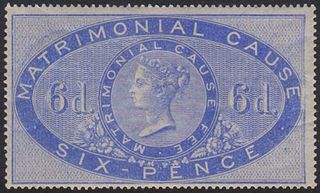

A revenue stamp, tax stamp, duty stamp or fiscal stamp is a (usually) adhesive label used to designate collected taxes or fees on documents, tobacco, alcoholic drinks, drugs and medicines, playing cards, hunting licenses, firearm registration, and many other things. Typically, businesses purchase the stamps from the government, and attach them to taxed items as part of putting the items on sale, or in the case of documents, as part of filling out the form.

A bonded warehouse, or bond, is a building or other secured area in which dutiable goods may be stored, manipulated, or undergo manufacturing operations without payment of duty. It may be managed by the state or by private enterprise. In the latter case a customs bond must be posted with the government. This system is widely used in developed countries throughout the world.

In British slang, a booze cruise is a brief trip from Britain to France or Belgium with the intent of taking advantage of lower prices, and buying personal supplies of (especially) alcohol or tobacco in bulk quantities. This is a legally allowed process not to be confused with smuggling.

His or Her Majesty's Excise refers to 'inland' duties levied on articles at the time of their manufacture. Excise duty was first raised in England in 1643. Like HM Customs, the Excise was administered by a Board of Commissioners who were accountable to the Lords Commissioners of the Treasury. While 'HM Revenue of Excise' was a phrase used in early legislation to refer to this form of duty, the body tasked with its collection and general administration was usually known as the Excise Office.

The Treasury of the Isle of Man is the finance department of the Isle of Man Government. It prepares the annual budget for the Government, and also handles taxation, customs and excise, economic affairs, information systems, internal audit, currency and the census in the Isle of Man.

An excise, or excise tax, is any duty on manufactured goods that is normally levied at the moment of manufacture for internal consumption rather than at sale. Excises are often associated with customs duties, which are levied on pre-existing goods when they cross a designated border in a specific direction; customs are levied on goods that become taxable items at the border, while excise is levied on goods that came into existence inland.

Special Occupational Taxpayers are a group of Federal Firearm Licensees in the United States who manufacture, import and/or transfer NFA weapons. The National Firearms Act Special Occupational Taxpayer class is part of the Internal Revenue Code of 1986.

The first revenue stamps in the United States were used briefly during colonial times, among the most notable usage involved the Stamp Act. Long after independence, the first revenue stamps printed by the United States government were issued in the midst of the American Civil War, prompted by the urgent need to raise revenue to pay for the great costs it incurred. After the war ended however, revenue stamps and the taxes they represented still continued. Revenue stamps served to pay tax duties on items that came under two main categories, Proprietary and Documentary. Proprietary stamps paid tax duties on goods like alcohol and tobacco, and were also used for various services, while Documentary stamps paid duties on legal documents, mortgage deeds, stocks and a fair number of other legal dealings. Proprietary and Documentary stamps often bore these respective designations, while in several of the issues they shared the same designs, sometimes with minor variations. Beginning in 1862 the first revenue stamps were issued, and would continue to be used for another hundred years and more. For the first twelve years George Washington was the only subject featured on U.S. revenue stamps, when in 1875 an allegorical figure of Liberty finally appeared. Revenue stamps were printed in many varieties and denominations and are widely sought after by collectors and historians. Revenue stamps were finally discontinued on December 31, 1967.

Revenue stamps of Malta were first issued in 1899, when the islands were a British colony. From that year to 1912, all revenue issues were postage stamps overprinted accordingly, that was either done locally or by De La Rue in London. Postage stamps also became valid for fiscal use in 1913, so no new revenues were issued until 1926–1930, when a series of key type stamps depicting King George V were issued. These exist unappropriated for use as general-duty revenues, or with additional inscriptions indicating a specific use; Applications, Contracts, Registers or Stocks & Shares. The only other revenues after this series were £1 stamps depicting George VI and Elizabeth II. Postage stamps remained valid for fiscal use until at least the 1980s.

Revenue stamps of the United Kingdom refer to the various revenue or fiscal stamps, whether adhesive, directly embossed or otherwise, which were issued by and used in the Kingdom of England, the Kingdom of Great Britain, the United Kingdom of Great Britain and Ireland and the United Kingdom of Great Britain and Northern Ireland, from the late 17th century to the present day.

The illicit cigarette trade is defined as "the production, import, export, purchase, sale, or possession of tobacco goods which fail to comply with legislation". Illicit cigarette trade activities fall under 3 categories:

- Contraband: cigarettes smuggled from abroad without domestic duty paid;

- Counterfeit: cigarettes manufactured without authorization of the rightful owners, with intent to deceive consumers and to avoid paying duty;

- Illicit whites: brands manufactured legitimately in one country, but smuggled and sold in another without duties being paid.

Excise stamps of Russia are a kind of Russian revenue stamps. They were issued according to the governmental order of the Russian Federation. On 14 April 1994 they adopted resolution number 319 "Introduction of excise stamps in the Russian Federation". Certain goods produced in Russia or imported to the territory of Russia are subject to excise tax including:

A customs declaration is a form that lists the details of goods that are being imported or exported when a citizen or visitor enters a customs territory. Most countries require travellers to complete a customs declaration form when bringing notified goods across international borders. Posting items via international mail also requires the sending party to complete a customs declaration form.

SICPA is a Swiss company that provides security inks for currencies and sensitive documents, including identity documents, passports, transport and lottery tickets. According to the Counterfeiting Intelligence Bureau's International Anti-Counterfeiting Directory, SICPA provides more than 85% of the world's currency inks. The company is also involved in the market for secure traceability of products subject to excise duties, such as alcohol and tobacco stamps, and regulated products, such as halal products.

Very few revenue stamps of the Bahamas have been issued, as most of the time dual-purpose postage and revenue stamps were used for fiscal purposes. They were used as such from around the 1860s to at least the 1950s. A couple of revenue-only impressed duty stamps embossed in vermilion ink are known used in the 1950s. Similar stamps but with colourless embossing might also exist.

Revenue stamps of Guyana refer to the various revenue or fiscal stamps, whether adhesive, directly embossed or otherwise, which have been issued by Guyana since its independence in 1966. Prior to independence, the country was known as British Guiana, and it had issued its own revenue stamps since the 19th century. Guyana used dual-purpose postage and revenue stamps until 1977, and it issued revenue-only stamps between 1975 and the 2000s. The country has also issued National Insurance stamps, labels for airport departure tax and excise stamps for cigarettes and alcohol.

The 1985 United Kingdom budget was delivered by Nigel Lawson, the Chancellor of the Exchequer, to the House of Commons on 19 March 1985. The second budget to be presented by Lawson, it was held shortly after the end of the year-long 1984–85 miners' strike. The chancellor said the cost of the strike on public borrowing had impacted on his plans for tax reductions, although he did make some changes to income tax personal allowances and stamp duty. Changes to National Insurance were also announced, but threatened to place extra costs on employers.

The 1984 United Kingdom budget was delivered by Nigel Lawson, the Chancellor of the Exchequer, to the House of Commons on 13 March 1984. It was the first budget to be presented by Lawson, who had been appointed as chancellor after the 1983 general election, and saw him embark on "a radical programme of tax reform". These included a reduction in Corporation Tax and a cut in the higher rate of Transfer Tax and raised the Stamp Duty threshold.