In management accounting or managerial accounting, managers use accounting information in decision-making and to assist in the management and performance of their control functions.

Business intelligence (BI) consists of strategies, methodologies, and technologies used by enterprises for data analysis and management of business information. Common functions of BI technologies include reporting, online analytical processing, analytics, dashboard development, data mining, process mining, complex event processing, business performance management, benchmarking, text mining, predictive analytics, and prescriptive analytics.

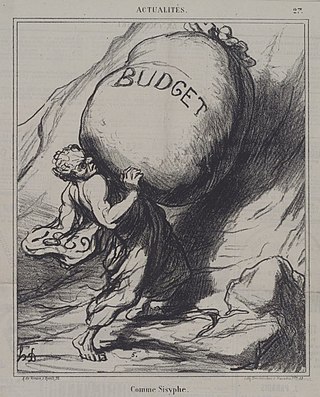

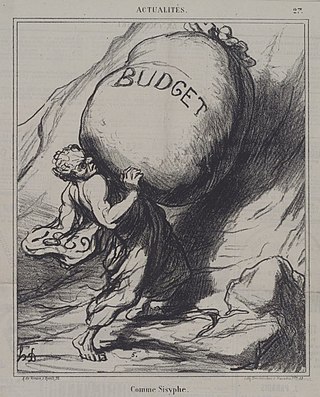

A budget is a calculation plan, usually but not always financial, for a defined period, often one year or a month. A budget may include anticipated sales volumes and revenues, resource quantities including time, costs and expenses, environmental impacts such as greenhouse gas emissions, other impacts, assets, liabilities and cash flows. Companies, governments, families, and other organizations use budgets to express strategic plans of activities in measurable terms.

Managerial finance is the branch of finance that concerns itself with the financial aspects of managerial decisions. Finance addresses the ways in which organizations raise and allocate monetary resources over time, taking into account the risks entailed in their projects; Managerial finance, then, emphasizes the managerial application of these finance techniques and theories.

Data management comprises all disciplines related to handling data as a valuable resource, it is the practice of managing an organization's data so it can be analyzed for decision making.

A financial analyst is a professional undertaking financial analysis for external or internal clients as a core feature of the job. The role may specifically be titled securities analyst, research analyst, equity analyst, investment analyst, or ratings analyst. The job title is a broad one: In banking, and industry more generally, various other analyst-roles cover financial management and (credit) risk management, as opposed to focusing on investments and valuation.

An executive information system (EIS), also known as an executive support system (ESS), is a type of management support system that facilitates and supports senior executive information and decision-making needs. It provides easy access to internal and external information relevant to organizational goals. It is commonly considered a specialized form of decision support system (DSS).

An accounting information system (AIS) is a system of collecting, storing and processing financial and accounting data that are used by decision makers. An accounting information system is generally a computer-based method for tracking accounting activity in conjunction with information technology resources. The resulting financial reports can be used internally by management or externally by other interested parties including investors, creditors and tax authorities. Accounting information systems are designed to support all accounting functions and activities including auditing, financial accounting porting, -managerial/ management accounting and tax. The most widely adopted accounting information systems are auditing and financial reporting modules.

Financial risk management is the practice of protecting economic value in a firm by managing exposure to financial risk - principally credit risk and market risk, with more specific variants as listed aside - as well as some aspects of operational risk. As for risk management more generally, financial risk management requires identifying the sources of risk, measuring these, and crafting plans to mitigate them. See Finance § Risk management for an overview.

A business analyst (BA) is a person who processes, interprets and documents business processes, products, services and software through analysis of data. The role of a business analyst is to ensure business efficiency increases through their knowledge of both IT and business function.

Financial modeling is the task of building an abstract representation of a real world financial situation. This is a mathematical model designed to represent the performance of a financial asset or portfolio of a business, project, or any other investment.

In general usage, a financial plan is a comprehensive evaluation of an individual's current pay and future financial state by using current known variables to predict future income, asset values and withdrawal plans. This often includes a budget which organizes an individual's finances and sometimes includes a series of steps or specific goals for spending and saving in the future. This plan allocates future income to various types of expenses, such as rent or utilities, and also reserves some income for short-term and long-term savings. A financial plan is sometimes referred to as an investment plan, but in personal finance, a financial plan can focus on other specific areas such as risk management, estates, college, or retirement.

Valuation using discounted cash flows is a method of estimating the current value of a company based on projected future cash flows adjusted for the time value of money. The cash flows are made up of those within the “explicit” forecast period, together with a continuing or terminal value that represents the cash flow stream after the forecast period. In several contexts, DCF valuation is referred to as the "income approach".

The following outline is provided as an overview of and topical guide to finance:

Cash flow forecasting is the process of obtaining an estimate of a company's future cash levels, and its financial position more generally. A cash flow forecast is a key financial management tool, both for large corporates, and for smaller entrepreneurial businesses. The forecast is typically based on anticipated payments and receivables. Several forecasting methodologies are available.

Business analytics (BA) refers to the skills, technologies, and practices for iterative exploration and investigation of past business performance to gain insight and drive business planning. Business analytics focuses on developing new insights and understanding of business performance based on data and statistical methods. In contrast, business intelligence traditionally focuses on using a consistent set of metrics to both measure past performance and guide business planning. In other words, business intelligence focusses on description, while business analytics focusses on prediction and prescription.

Financial management is the business function concerned with profitability, expenses, cash and credit. These are often grouped together under the rubric of maximizing the value of the firm for stockholders. The discipline is then tasked with the "efficient acquisition and deployment" of both short- and long-term financial resources, to ensure the objectives of the enterprise are achieved.

Moody's, previously known as Moody's Analytics, is a subsidiary of Moody's Corporation established in 2007 to focus on non-rating activities, separate from Moody's Investors Service. It provides economic research regarding risk, performance and financial modeling, as well as consulting, training and software services. Moody's is composed of divisions such as Moody's KMV, Moody's Economy.com, Moody's Wall Street Analytics, the Institute of Risk Standards and Qualifications, and Canadian Securities Institute Global Education Inc.

Corporate finance is the area of finance that deals with the sources of funding, and the capital structure of businesses, the actions that managers take to increase the value of the firm to the shareholders, and the tools and analysis used to allocate financial resources. The primary goal of corporate finance is to maximize or increase shareholder value.

Datarails is a New York-based multinational software development company. It is an AI-powered financial planning and analysis (FP&A) platform for Microsoft Excel users.