Related Research Articles

The Financial Times Stock Exchange 100 Index, also called the FTSE 100 Index, FTSE 100, FTSE, or, informally, the "Footsie", is a stock market index of 100 of the most highly capitalised blue chip companies listed on the London Stock Exchange.

The FTSE 250 Index ( "Footsie") is a capitalisation-weighted index consisting of the 101st to the 350th largest companies listed on the London Stock Exchange, mostly covering the mid cap sector between large and small companies. The index contains a higher proportion of companies whose primary business is conducted in the UK, compared to the FTSE 100. Due to this, the FTSE 250 tends to be more representative of the strength of the UK economy than the FTSE 100. Promotions and demotions to and from the index occur quarterly in March, June, September, and December.

AIM is a sub-market of the London Stock Exchange that was launched on 19 June 1995 as a replacement to the previous Unlisted Securities Market (USM) that had been in operation since 1980. It allows companies that are smaller, less-developed, or want/need a more flexible approach to governance to float shares with a more flexible regulatory system than is applicable on the main market.

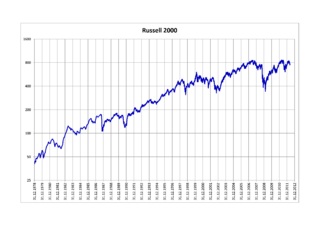

The Russell 2000 Index is a small-cap U.S. stock market index that makes up the smallest 2,000 stocks in the Russell 3000 Index. It was started by the Frank Russell Company in 1984. The index is maintained by FTSE Russell, a subsidiary of the London Stock Exchange Group (LSEG).

The Russell 1000 Index is a stock market index that tracks the highest-ranking 1,000 stocks in the Russell 3000 Index, which represent about 93% of the total market capitalization of that index. As of 31 December 2023, the stocks of the Russell 1000 Index had a weighted average market capitalization of $666.0 billion and a median market capitalization of $13.9 billion. As of 8 May 2020, components ranged in market capitalization from $1.8 billion to $1.4 trillion. The index, which was launched on January 1, 1984, is maintained by FTSE Russell, a subsidiary of the London Stock Exchange Group.

The Straits Times Index is a capitalisation-weighted measurement stock market index that is regarded as the benchmark index for the stock market in Singapore. It tracks the performance of the top 30 companies that are listed on the Singapore Exchange (SGX).

FTSE International Limited trading as FTSE Russell ( "Footsie") is a British provider of stock market indices and associated data services, wholly owned by the London Stock Exchange (LSE) and operating from premises in Canary Wharf. It operates the well known UK FTSE 100 Index as well as a number of other indices. FTSE stands for Financial Times Stock Exchange.

Borsa Italiana, based in Milan at Mezzanotte Palace, is the Italian stock exchange. It manages and organises domestic market, regulating procedures for admission and listing of companies and intermediaries and supervising disclosures for listed companies.

The FTSE 350 Index is a market capitalization weighted stock market index made up of the constituents of the FTSE 100 and FTSE 250 indices. The FTSE 100 Index comprises the largest 100 companies by capitalization which have their primary listing on the London Stock Exchange, while the FTSE 250 Index comprises mid-capitalized companies not covered by the FTSE 100, i.e. the 101st to 350th largest. See the articles about those indices for lists of the constituents of the FTSE 350.

The FTSE All-Share Index, originally known as the FTSE Actuaries All Share Index, is a capitalisation-weighted index, comprising around 600 of more than 2,000 companies traded on the London Stock Exchange (LSE). By weighting companies based on their market capitalisation, the index ensures that companies with larger market capitalisations have a greater influence on the index's performance. Since 29 December 2017 the constituents of this index totaled 641 companies. The FTSE All-Share is the aggregation of the FTSE 100 Index and the FTSE 250 Index, which are together known as the FTSE 350 Index, and the FTSE SmallCap Index. The index is maintained by FTSE Russell, a subsidiary of the London Stock Exchange Group. It aims to represent at least 98% of the full capital value of all UK companies that qualify as eligible for inclusion.

The FTSE AIM UK 50 Index was introduced on 16 May 2005, and is a market-capitalisation-weighted stock market index. The index incorporates the largest 50 UK companies which have their primary listing on the Alternative Investment Market (AIM).

The FTSE AIM UK 100 Index was introduced on 16 May 2005, and is a market-capitalisation-weighted stock market index. The index incorporates the largest 100 companies which have their primary listing on the Alternative Investment Market (AIM). It includes UK and international domiciled companies. The index is reviewed quarterly, and the constituent companies may change based on market capitalisation data as at the end of February, May, August and November. The index is maintained by FTSE Russell, a subsidiary of the London Stock Exchange Group.

The FTSE SmallCap Index is an index of small market capitalisation companies consisting of the 351st to the 619th largest-listed companies on the London Stock Exchange main market. The index, which is maintained by FTSE Russell, a subsidiary of the London Stock Exchange Group, is a constituent of the FTSE All-Share Index which is an index of all 620 companies listed on the main market of the LSE.

London Stock Exchange Group plc is a United Kingdom-based stock exchange and financial information company headquartered in the City of London, England. It owns the London Stock Exchange, Refinitiv, LSEG Technology, FTSE Russell, and majority stakes in LCH and Tradeweb.

The FTSE Fledgling Index comprises companies listed on the main market of the London Stock Exchange (LSE) which qualify as eligible for inclusion in the FTSE UK series but are too small to be included in the FTSE All-Share Index. There is no liquidity requirement for constituents of the FTSE Fledgling Index.

The FTSE4Good Index Series is a series of ethical investment stock market indices launched in 2001 by the FTSE Group which reports on the performance of companies which demonstrate "strong Environmental, Social and Governance practices". A number of stock market indices are available, for example covering UK shares, US shares, European markets and Japan, with inclusion based on a range of corporate social responsibility criteria. Research for the indices is supported by the Ethical Investment Research Services (EIRIS). The index excludes companies due to their involvement in tobacco production, nuclear weapons, conventional weapon systems, or coal power industry and rates companies for inclusion based environmental sustainability, relationships with stakeholders, attitudes to human rights, supply chain labour standards and the countering of bribery.

FTSE China A50 Index is a stock market index by FTSE Group, the components were chosen from Shanghai Stock Exchange and Shenzhen Stock Exchange, which issue A-share; B-share were not included.

FTSE Russell is a subsidiary of London Stock Exchange Group (LSEG) that produces, maintains, licenses, and markets stock market indices. The division is notable for the FTSE 100 Index and Russell 2000 Index, among others.

Baltic Classifieds Group is a Lithuanian company that specialises in classified portals. The company was established in 1999 and is headquartered in Vilnius, Lithuania. It is listed on the London Stock Exchange and is a constituent of the FTSE 250 Index.

References

- ↑ "FTSE AIM All-Share Index". ADVFN. Retrieved 15 March 2024.

- ↑ "FTSE AIM Index Series". FTSE Russell. Retrieved 15 March 2024.