The Financial Times Stock Exchange 100 Index, also called the FTSE 100 Index, FTSE 100, FTSE, or, informally, the "Footsie", is the United Kingdom's best-known stock market index of the 100 most highly capitalised blue chips listed on the London Stock Exchange.

The FTSE 250 Index, also called the FTSE 250, or, informally, the "Footsie 250", is a stock market index that measures the real strength of the economy of the United Kingdom and consists of the 101st to the 350th mid-cap blue chip companies listed on the London Stock Exchange.

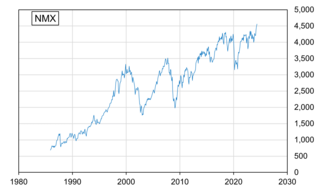

The NIFTY Next 50 is a stock market index provided and maintained by NSE Indices. It represents the next rung of liquid securities after the NIFTY 50. It consists of 50 companies representing approximately 10% of the traded value of all stocks on the National Stock Exchange of India. It is quoted using the symbol NIFTYJR.

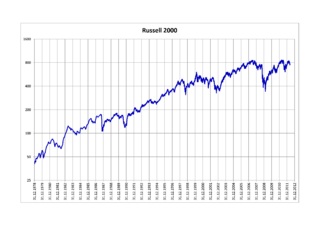

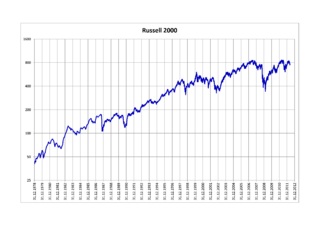

The Russell 2000 Index is a small-cap U.S. stock market index that makes up the smallest 2,000 stocks in the Russell Index. It was started by the Frank Russell Company in 1984. The index is maintained by FTSE Russell, a subsidiary of the London Stock Exchange Group (LSEG).

The Russell 1000 Index is a U.S. stock market index that tracks the highest-ranking 1,000 stocks in the Russell 3000 Index, which represent about 93% of the total market capitalization of that index.

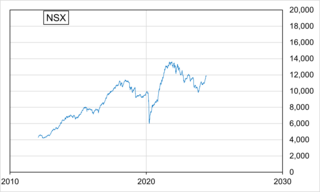

The Straits Times Index is a capitalisation-weighted measurement stock market index that is regarded as the benchmark index for the stock market in Singapore. It tracks the performance of the top 30 companies that are listed on the Singapore Exchange (SGX).

FTSE International Limited trading as FTSE Russell ( "Footsie") is a British provider of stock market indices and associated data services, wholly owned by the London Stock Exchange (LSE) and operating from premises in Canary Wharf. It operates the well known UK FTSE 100 Index as well as a number of other indices. FTSE stands for Financial Times Stock Exchange.

The FTSE 350 Index is a market capitalization weighted stock market index made up of the constituents of the FTSE 100 and FTSE 250 indices. The FTSE 100 Index comprises the largest 100 companies by capitalization which have their primary listing on the London Stock Exchange, while the FTSE 250 Index comprises mid-capitalized companies not covered by the FTSE 100, i.e. the 101st to 350th largest. See the articles about those indices for lists of the constituents of the FTSE 350.

The FTSE AIM UK 50 Index was introduced on 16 May 2005, and is a market-capitalisation-weighted stock market index. The index incorporates the largest 50 UK companies which have their primary listing on the Alternative Investment Market (AIM).

The FTSE AIM UK 100 Index was introduced on 16 May 2005, and is a market-capitalisation-weighted stock market index. The index incorporates the largest 100 companies which have their primary listing on the Alternative Investment Market (AIM). It includes UK and international domiciled companies. The index is reviewed quarterly, and the constituent companies may change based on market capitalisation data as at the end of February, May, August and November. The index is maintained by FTSE Russell, a subsidiary of the London Stock Exchange Group.

The FTSE AIM All-Share Index was revised from the previous FTSE AIM Index on 16 May 2005, and is a stock market index consisting of all companies quoted on the Alternative Investment Market which meet the requirements for liquidity and free float.

The FTSE SmallCap Index is an index of small market capitalisation companies consisting of the 351st to the 619th largest-listed companies on the London Stock Exchange main market. The index, which is maintained by FTSE Russell, a subsidiary of the London Stock Exchange Group, is a constituent of the FTSE All-Share Index which is an index of all 620 companies listed on the main market of the LSE.

The Russell Microcap Index measures the performance of the microcap segment of the U.S. equity market. It makes up less than 3% of the U.S. equity market. It includes 1,000 of the smallest securities in the Russell 2000 Index based on a combination of their market cap and current index membership and it also includes up to the next 1,000 stocks. As of 31 December 2016, the weighted average market capitalization for a company in the index was $535 million; the median market cap was $228 million. The market cap of the largest company in the index was $3.6 billion.

The FTSE Fledgling Index comprises companies listed on the main market of the London Stock Exchange (LSE) which qualify as eligible for inclusion in the FTSE UK series but are too small to be included in the FTSE All-Share Index. There is no liquidity requirement for constituents of the FTSE Fledgling Index.

Herald Investment Trust plc is a large United Kingdom-based investment trust focused predominantly on holdings of quoted small- and mid-cap technology, communications and media companies. Established in February 1994, the company is listed on the London Stock Exchange and is a constituent of the FTSE 250 Index. The fund is managed under the auspices of Herald Investment Management and its chairman is Ian Russell.

The PSI-20 is a benchmark stock market index of companies that trade on Euronext Lisbon, the main stock exchange of Portugal. The index tracks the prices of the twenty listings with the largest market capitalisation and share turnover in the PSI Geral, the general stock market of the Lisbon exchange. It is one of the main national indices of the pan-European stock exchange group Euronext alongside Brussels' BEL20, Paris's CAC 40 and Amsterdam's AEX. On August 12, 2021 index has been renamed from PSI-20 to PSI.

Baltic Classifieds Group is a Lithuanian company that specialises in classified portals. The company was established in 1999 and is headquartered in Vilnius, Lithuania. It is listed on the London Stock Exchange and is a constituent of the FTSE 250 Index.