Related Research Articles

School choice is a term for education options that allow students and families to select alternatives to public schools. It is the subject of fierce debate in various state legislatures across the United States.

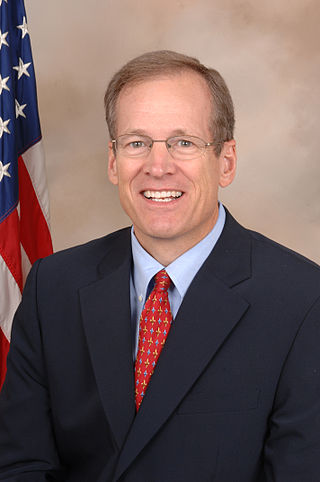

John Heddens Kingston is an American businessman, lobbyist, and politician who served as U.S. representative for Georgia's 1st congressional district in southeast Georgia, serving from 1993 to 2015. He is a member of the Republican Party and was part of the House leadership (2002–06) when he served as vice-chair of the Republican Conference. In 2014, he ran for the U.S. Senate seat occupied by retiring senator Saxby Chambliss and advanced beyond the May 20 primary to the July 22 runoff, where he was defeated by David Perdue.

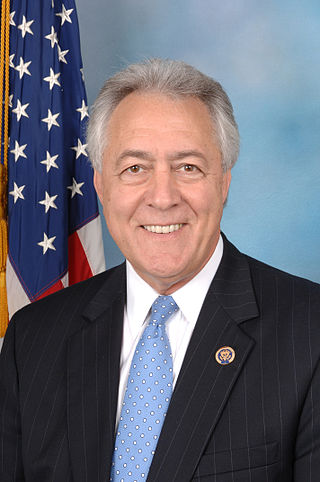

Rodney McKinnie Alexander is an American politician and member of the Republican Party who served as the Secretary of the Louisiana Department of Veterans Affairs from September 30, 2013, until June 3, 2014. Previously he was the U.S. representative for Louisiana's 5th congressional district from 2003 to 2013. First elected as a Democrat, he changed parties in 2004 to run as a Republican and was re-elected five times.

The Benjamin Franklin True Patriot Act is a bill introduced in the United States House of Representatives intended to review the previously passed USA PATRIOT Act. The bill was referred to subcommittees where it languished without action taken before the end of the 108th United States Congress. The bill will have to be reintroduced in order to be considered again.

FairTax is a single rate tax proposal which has been proposed as a bill in the United States Congress regularly since 2005 that includes complete dismantling of the Internal Revenue Service. The proposal would eliminate all federal income taxes, payroll taxes, gift taxes, and estate taxes, replacing them with a single consumption tax on retail sales.

The Employment Non-Discrimination Act (ENDA) is legislation proposed in the United States Congress that would prohibit discrimination in hiring and employment on the basis of sexual orientation or, depending on the version of the bill, gender identity, by employers with at least 15 employees.

A 529 plan, also called a Qualified Tuition Program, is a tax-advantaged investment vehicle in the United States designed to encourage saving for the future higher education expenses of a designated beneficiary. In 2017, K–12 public, private, and religious school tuition were included as qualified expenses for 529 plans along with post-secondary education costs after passage of the Tax Cuts and Jobs Act.

The Development, Relief, and Education for Alien Minors Act, known as the DREAM Act, is a United States legislative proposal to grant temporary conditional residency, with the right to work, to undocumented immigrants who entered the United States as minors—and, if they later satisfy further qualifications, they would attain permanent residency.

The Universal National Service Act is the name of at least four bills proposed in the United States Congress, sponsored by Congressman Charles Rangel of New York, proposing mandatory national service for young adults, male or female. Other advocates for mandatory national service include Senator Chris Dodd, along with author Larry J. Sabato.

Ron Paul is an American author, activist, and retired politician who served in the House of Representatives for twelve non-consecutive terms and ran for President of the United States on three occasions. His political views are generally described as libertarian, but have also been labeled conservative. Paul's nickname "Dr. No" reflects both his medical degree and his assertion that he will "never vote for legislation unless the proposed measure is expressly authorized by the Constitution". This position has frequently resulted in Paul casting the sole "no" vote against proposed legislation. In one 2007 speech, he said he believes that "the proper role for government in America is to provide national defense, a court system for civil disputes, a criminal justice system for acts of force and fraud, and little else."

Jared Schutz Polis is an American politician, businessman, and philanthropist serving as the 43rd governor of Colorado since 2019.

Under United States tax law, certain performing artists are eligible to deduct the expenses incurred in the course of their employment as performing artists. The deduction itself is provided by IRC § 62(a)(2)(B), while qualifications of a Qualified Performing Artist ("QPA") are provided by IRC § 62(b).

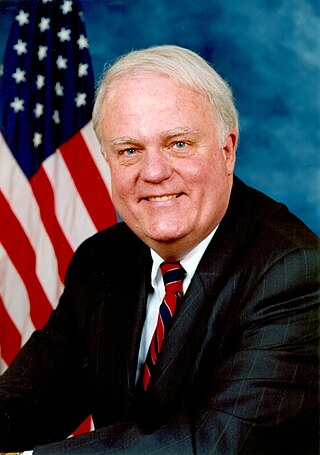

Frank James Sensenbrenner Jr. is an American politician who represented Wisconsin's 5th congressional district in the United States House of Representatives from 1979 to 2021. He is a member of the Republican Party.

The American Opportunity Tax Credit is a partially refundable tax credit first detailed in Section 1004 of the American Recovery and Reinvestment Act of 2009.

The Federal Reserve Transparency Act of 2015 was a bill introduced in the U.S. House of Representatives of the 114th United States Congress by Congressman Thomas Massie (KY-4). It included proposals for a reformed audit of the Federal Reserve System. The Senate version was introduced by Senator Rand Paul (R-KY)..

Jeffrey Darren Duncan is a United States representative for South Carolina's 3rd congressional district since 2011. His district comprises nine counties, two of these counties being manufacturing centers for the state. On January 17, 2024, Duncan announced that he would not run for re-election. Duncan previously served in the South Carolina House of Representatives from 2002 to 2010 when he retired to run for the U.S. House of Representatives.

The USA Freedom Act is a U.S. law enacted on June 2, 2015, that restored and modified several provisions of the Patriot Act, which had expired the day before. The act imposes some new limits on the bulk collection of telecommunication metadata on U.S. citizens by American intelligence agencies, including the National Security Agency. It also restores authorization for roving wiretaps and tracking lone wolf terrorists. The title of the act is a ten-letter backronym that stands for Uniting and Strengthening America by Fulfilling Rights and Ensuring Effective Discipline Over Monitoring Act of 2015.

The NSA Inspector General Act was a proposed bill introduced by Mark Sanford on October 30, 2013. It would "require the Director of the National Security Agency and the Inspector General of the National Security Agency to be appointed by the President, by and with the advice and consent of the Senate".

The American Research and Competitiveness Act of 2014 is a bill that would amend the Internal Revenue Code to modify the calculation method and the rate for the tax credit for qualified research expenses that expired at the end of 2013 and would make that modified credit permanent.

The Student and Family Tax Simplification Act is a bill that would amend the Internal Revenue Code to consolidate several different education tax incentives into an expanded American Opportunity Tax Credit. The American Opportunity Tax Credit, under this legislation, would provide a maximum credit of $2,500.

References

- 1 2 3 "H.R. 1056: Family Education Freedom Act of 2007". GovTrack. 2007-02-15. Retrieved 2007-09-13.

- ↑ "Tax Relief for Tax Time" (PDF). Sensenbrenner Congressional office. 2007. Archived from the original (PDF) on July 25, 2007. Retrieved 2007-09-14.

- ↑ "Local Control Key to Education Reform". Oklahoma Council on Public Affairs. 2000. Archived from the original on 2007-08-06. Retrieved 2007-09-14.

- ↑ "Federal Tax Benefits for Families' K-12 Education Expenses in the Context of School Choice" (PDF). First Amendment Center. 2003. Archived from the original (PDF) on 2008-07-25. Retrieved 2007-09-14.

- 1 2 "Federal Tax Credits Would Boost Educational Choice". School Reform News. Heartland Institute. 2000-12-01. Retrieved 2007-09-13.

- ↑ "Rep. Paul Introduces Education Package". Education Exchange newsletter. March 1999. Archived from the original on 2007-09-17. Retrieved 2007-09-14.

- ↑ "Congressman goes to school". The Hickory Daily Record. 2006-08-12. Archived from the original on 2007-11-01. Retrieved 2007-09-14.

- ↑ "Education : McHenry's Hosts Outdoor Town Hall Picnic for Homeschool Families". The Lincoln Tribune. 2006-08-03. Archived from the original on 2012-02-07. Retrieved 2007-09-14.

- ↑ "Responding to Current Legislative Challenges Promoted by National Organizations". Home Education Magazine. July 1998. Archived from the original on 2007-07-02. Retrieved 2007-09-14.

- 1 2 "H.R. 612 - Family Education Freedom Act of 2003". Home School Legal Defense Association. 2003-06-16. Retrieved 2007-09-13.

- ↑ "Minnesota Libertarians announce "evolutionary" legislative agenda". Libertarian Party. March 1999. Archived from the original on 2007-07-13. Retrieved 2007-09-14.

- ↑ "Home Schooling". Ron Paul presidential campaign. 2007. Retrieved 2007-09-14.

- ↑ "107th CONGRESS". Orator.com. Archived from the original on 2007-11-01. Retrieved 2007-09-14.

- ↑ Family Education Freedom Act of 2005 Archived 2007-11-01 at the Wayback Machine

- 1 2 "Education Tax Credits". Home School Legal Defense Association (HSLDA). Retrieved 2007-09-14.