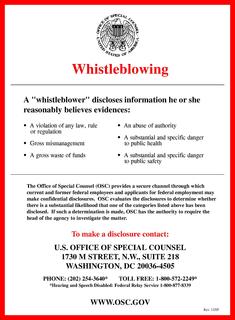

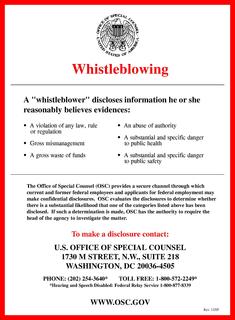

The Occupational Safety and Health Administration is a large regulatory agency of the United States Department of Labor that originally had federal visitorial powers to inspect and examine workplaces. Congress established the agency under the Occupational Safety and Health Act, which President Richard M. Nixon signed into law on December 29, 1970. OSHA's mission is to "assure safe and healthy working conditions for working men and women by setting and enforcing standards and by providing training, outreach, education and assistance". The agency is also charged with enforcing a variety of whistleblower statutes and regulations. OSHA is currently headed by Acting Assistant Secretary of Labor Loren Sweatt. OSHA's workplace safety inspections have been shown to reduce injury rates and injury costs without adverse effects to employment, sales, credit ratings, or firm survival.

A wage is the distribution from an employer of a security paid to an employee. Like interest is paid out to an investor on his investments, a wage is paid as earnings to the employee on his invested assets. Some examples of wage distributions include compensatory payments such as minimum wage, prevailing wage, and yearly bonuses, and remunerative payments such as prizes and tip payouts.

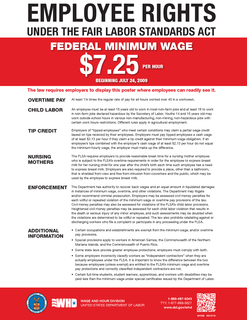

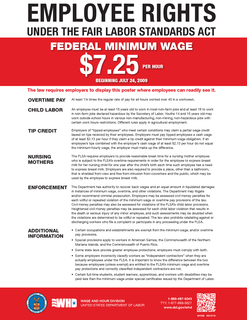

United States labor law sets the rights and duties for employees, labor unions, and employers in the United States. Labor law's basic aim is to remedy the "inequality of bargaining power" between employees and employers, especially employers "organized in the corporate or other forms of ownership association". Over the 20th century, federal law created minimum social and economic rights, and encouraged state laws to go beyond the minimum to favor employees. The Fair Labor Standards Act of 1938 requires a federal minimum wage, currently $7.25 but higher in 28 states, and discourages working weeks over 40 hours through time-and-a-half overtime pay. There are no federal or state laws requiring paid holidays or paid family leave: the Family and Medical Leave Act of 1993 creates a limited right to 12 weeks of unpaid leave in larger employers. There is no automatic right to an occupational pension beyond federally guaranteed social security, but the Employee Retirement Income Security Act of 1974 requires standards of prudent management and good governance if employers agree to provide pensions, health plans or other benefits. The Occupational Safety and Health Act of 1970 requires employees have a safe system of work.

The Senior Executive Service (SES) is a position classification in the civil service of the United States federal government, equivalent to general officer or flag officer ranks in the U.S. Armed Forces. It was created in 1979 when the Civil Service Reform Act of 1978 went into effect under President Jimmy Carter.

The General Schedule (GS) is the predominant pay scale within the United States civil service. The GS includes the majority of white collar personnel positions. As of September 2004, 71 percent of federal civilian employees were paid under the GS. The GG pay rates are identical to published GS pay rates.

PATCOB are occupational categories established by Equal Employment Opportunity Commission (EEOC). They are used for statistical reporting on data collected by the United States Census Bureau, employer reports or federal agencies.

The Michigan Occupational Safety and Health Administration (MIOSHA) is a state government agency that regulates workplace safety and health in the U.S. state of Michigan. Michigan OSHA is an agency within the Michigan Department of Licensing and Regulatory Affairs and operates under a formal state-plan agreement with the Occupational Safety and Health Administration (OSHA).

The United States federal civil service is the civilian workforce of the United States federal government's departments and agencies. The federal civil service was established in 1871. U.S. state and local government entities often have comparable civil service systems that are modeled on the national system, in varying degrees.

Paid time off, planned time off, or personal time off (PTO) is a policy in some employee handbooks that provides a bank of hours in which the employer pools sick days, vacation days, and personal days that allows employees to use as the need or desire arises. This policy pertains mainly to the United States, where there are no federal legal requirements for a minimum number of paid vacation days. Instead, U.S. companies determine the amount of paid time off that will be allotted to employees, while keeping in mind the payoff in recruiting and retaining employees.

Produced by the Bureau of Labor Statistics (BLS) in the US Department of Labor, the National Compensation Survey (NCS) provides comprehensive measures of occupational earnings; compensation cost trends, benefit incidence, and detailed plan provisions. It is used to adjust the federal wage schedule for all federal employees. Detailed occupational earnings are available for metropolitan and non-metropolitan areas, broad geographic regions, and on a national basis. The index component of the NCS measures changes in labor costs. Average hourly employer cost for employee compensation is presented in the Employer Costs for Employee Compensation.

"Right to know", in the context of United States workplace and community environmental law, is the legal principle that the individual has the right to know the chemicals to which they may be exposed in their daily living. It is embodied in federal law in the United States as well as in local laws in several states. "Right to Know" laws take two forms: Community Right to Know and Workplace Right to Know. Each grants certain rights to those groups. The "right to know" concept is included in Rachel Carson's book Silent Spring.

Executive Schedule is the system of salaries given to the highest-ranked appointed officials in the executive branch of the U.S. government. The president of the United States appoints individuals to these positions, most with the advice and consent of the United States Senate. They include members of the president's Cabinet, several top-ranking officials of each executive department, the directors of some of the more prominent departmental and independent agencies, and several members of the Executive Office of the President.

Overtime rate is a calculation of hours worked by a worker that exceed those hours defined for a standard workweek. This rate can have different meanings in different countries and jurisdictions, depending on how that jurisdiction's labor law defines overtime. In many jurisdictions, additional pay is mandated for certain classes of workers when this set number of hours is exceeded. In others, there is no concept of a standard workweek or analogous time period, and no additional pay for exceeding a set number of hours within that week.

In government contracting, a prevailing wage is defined as the hourly wage, usual benefits and overtime, paid to the majority of workers, laborers, and mechanics within a particular area. This is usually the union wage.

The Federal Salary Council (FSC) is an advisory body of the executive branch of the United States government. Established under the provisions of Title 5, section 5304(e) of the United States Code, the FSC provides recommendations on the locality pay program, created by the Federal Employees Pay Comparability Act of 1990 (FEPCA). The locality pay program provides for localized pay differentials, also known as "comparability payments," for federal employees paid under the pay scale of the United States federal civil service who work in the United States and its territories and possessions. Section 1911 of Public Law 111-84, the Non-Foreign Area Retirement Equity Assurance Act of 2009, phased in locality pay for employees in the non-foreign areas as identified in Title 5 of the Code of Federal Regulations. Alaska and Hawaii are separate locality-pay areas with separate pay tables. Other non-foreign areas are included as part of the "Rest of U.S." locality pay area.

The Fair Labor Standards Act of 1938 29 U.S.C. § 203 (FLSA) is a United States labor law that creates the right to a minimum wage, and "time-and-a-half" overtime pay when people work over forty hours a week. It also prohibits employment of minors in "oppressive child labor". It applies to employees engaged in interstate commerce or employed by an enterprise engaged in commerce or in the production of goods for commerce, unless the employer can claim an exemption from coverage.

The Davis–Bacon Act of 1931 is a United States federal law that establishes the requirement for paying the local prevailing wages on public works projects for laborers and mechanics. It applies to "contractors and subcontractors performing on federally funded or assisted contracts in excess of $2,000 for the construction, alteration, or repair of public buildings or public works".

Human resource management in public administration concerns human resource management as it applies specifically to the field of public administration. It is considered to be an in-house structure that ensures unbiased treatment, ethical standards, and promotes a value-based system.

A whistleblower is a person who exposes any kind of information or activity that is deemed illegal, unethical, or not correct within an organization that is either private or public. The Whistleblower Protection Act was made into federal law in the United States in 1989.

Wage theft is the denial of wages or employee benefits rightfully owed to an employee. It can be conducted by employers in various ways, among them failing to pay overtime; violating minimum-wage laws; the misclassification of employees as independent contractors, illegal deductions in pay; forcing employees to work "off the clock", not paying annual leave or holiday entitlements, or simply not paying an employee at all.