Related Research Articles

The Department of the Treasury (USDT) is the national treasury and finance department of the federal government of the United States, where it serves as an executive department. The department oversees the Bureau of Engraving and Printing and the U.S. Mint. These two agencies are responsible for printing all paper currency and minting coins, while the treasury executes currency circulation in the domestic fiscal system. The USDT collects all federal taxes through the Internal Revenue Service; manages U.S. government debt instruments; licenses and supervises banks and thrift institutions; and advises the legislative and executive branches on matters of fiscal policy. The department is administered by the secretary of the treasury, who is a member of the Cabinet. The treasurer of the United States has limited statutory duties, but advises the Secretary on various matters such as coinage and currency production. Signatures of both officials appear on all Federal Reserve notes.

His Majesty's Treasury, occasionally referred to as the Exchequer, or more informally the Treasury, is a ministerial department of the Government of the United Kingdom. It is responsible for developing and executing the government's public finance policy and economic policy. The Treasury maintains the Online System for Central Accounting and Reporting, the replacement for the Combined Online Information System, which itemises departmental spending under thousands of category headings, and from which the Whole of Government Accounts annual financial statements are produced.

The Treasurerof Australia, also known as the FederalTreasurer or more simply the Treasurer, is the minister of state of the Commonwealth of Australia charged with overseeing government revenue collection, federal expenditure and economic policy as the head of the Department of the Treasury. The current treasurer is Jim Chalmers, who was selected by Prime Minister Anthony Albanese in May 2022 following the 2022 Australian federal election.

The Australian Securities and Investments Commission (ASIC) is an independent commission of the Australian Government tasked as the national corporate regulator. ASIC's role is to regulate company and financial services and enforce laws to protect Australian consumers, investors and creditors. ASIC was established on 1 July 1998 following recommendations from the Wallis Inquiry. ASIC's authority and scope are determined by the Australian Securities and Investments Commission Act 2001.

Manitoba Finance is the department of finance for the Canadian province of Manitoba.

Helen Lloyd Coonan is a former Australian politician who was a Senator for New South Wales from 1996 to 2011, representing the Liberal Party. She was a minister in the Howard government, serving as Minister for Revenue and Assistant Treasurer from 2001 to 2004 and then as Minister for Communications, Information Technology and the Arts from 2004 to 2007.

Banking in Australia is dominated by four major banks: Commonwealth Bank, Westpac, Australia & New Zealand Banking Group and National Australia Bank. There are several smaller banks with a presence throughout the country which includes Bendigo and Adelaide Bank, Suncorp Bank, and a large number of other financial institutions, such as credit unions, building societies and mutual banks, which provide limited banking-type services and are described as authorised deposit-taking institutions (ADIs). Many large foreign banks have a presence, but few have a retail banking presence. The central bank is the Reserve Bank of Australia (RBA). The Australian government’s Financial Claims Scheme guarantees deposits up to $250,000 per account-holder per ADI in the event of the ADI failing.

The Committee on Foreign Investment in the United States is an inter-agency committee in the United States government that reviews the national security implications of foreign investments in the U.S. economy.

Foreign Investment may refer to:

Superannuation in Australia, or "super", is a savings system for workplace pensions in retirement. It involves money earned by an employee being placed into an investment fund to be made legally available to members upon retirement. Employers make compulsory payments to these funds at a proportion of their employee's wages. From July 2024, the mandatory minimum "guarantee" contribution is 11.5%, rising to 12% from 2025. The superannuation guarantee was introduced by the Hawke government to promote self-funded retirement savings, reducing reliance on a publicly funded pension system. Legislation to support the introduction of the superannuation guarantee was passed by the Keating Government in 1992.

The Future Fund is an independently managed sovereign wealth fund established in 2006 to strengthen the Australian Government's long-term financial position by making provision for unfunded superannuation liabilities for politicians and other public servants that will become payable during a period when an ageing population is likely to place significant pressure on the Commonwealth's finances. As of 31 December 2023, the fund has $272.3 billion in assets under management.

Land banking is the practice of aggregating parcels of land for future sale or development.

A sovereign wealth fund (SWF), or sovereign investment fund is a state-owned investment fund that invests in real and financial assets such as stocks, bonds, real estate, precious metals, or in alternative investments such as private equity funds or hedge funds. Sovereign wealth funds invest globally. Most SWFs are funded by revenues from commodity exports or from foreign-exchange reserves held by the central bank.

Macquarie Group Limited, known more commonly as Macquarie Bank, is a global investment banking and financial services group providing banking, financial advisory and investment, and funds management services, to institutional, corporate, and retail clients and counterparties, around the world, headquartered in Sydney and listed in Australia. Macquarie Bank employs more than 20,000 staff across four operating groups in 34 markets and its Investment Banking division is Australia's top ranked mergers and acquisitions adviser with more than A$871 billion in assets under management and is the world's largest infrastructure asset manager.

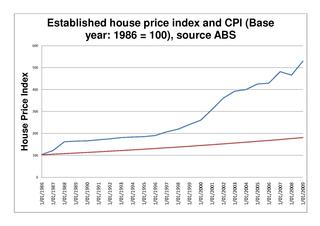

The Australian property bubble is the economic theory that the Australian property market has become or is becoming significantly overpriced and due for a significant downturn. Since the early 2010s, various commentators, including one Treasury official, have claimed the Australian property market is in a significant bubble.

The Australian government debt is the amount owed by the Australian federal government. The Australian Office of Financial Management, which is part of the Treasury Portfolio, is the agency which manages the government debt and does all the borrowing on behalf of the Australian government. Australian government borrowings are subject to limits and regulation by the Loan Council, unless the borrowing is for defence purposes or is a 'temporary' borrowing. Government debt and borrowings have national macroeconomic implications, and are also used as one of the tools available to the national government in the macroeconomic management of the national economy, enabling the government to create or dampen liquidity in financial markets, with flow on effects on the wider economy.

Financial regulation in Australia is extensive and detailed.

The Clean Energy Finance Corporation (CEFC) is an Australian Government-owned green bank that invests in clean energy, to help achieve Australia's national goal of net zero emissions by 2050. The CEFC invests billions of dollars on behalf of the Australian Government in economy-wide decarbonisation opportunities. It aims to help transform the Australian energy grid, as well as supporting sustainable housing initiatives, and climate tech innovators.

The National Security Committee (NSC), also known as the National Security Committee of Cabinet, is the peak decision-making body for national security and major foreign policy matters in the Australian Government. It is a committee of the Cabinet of Australia, though decisions of the NSC do not require the endorsement of the Cabinet itself.

Cromwell Property Group is a commercial real estate investment and management company with operations in Australia, New Zealand and Europe. The Group is in the ASX 200 list. At December 2020, Cromwell had a market capitalisation of $A2.3 billion, a direct property investment portfolio in Australia valued at $A3 billion and total assets under management of $A11.6 billion across Australia, New Zealand and Europe.

References

- ↑ "Foreign Investment Review Board". foreigninvestment.gov.au. Retrieved 30 May 2024.

- ↑ "Treasury | Foreign Investment Review Board". directory.gov.au. Retrieved 30 May 2024.

- ↑ Australia’s Foreign Investment Policy (PDF), The Treasury, 30 May 2024, pp. 5–13, retrieved 1 May 2024

- ↑ "Home | Foreign Investment Review Board". Firb.gov.au. Retrieved 1 May 2022.