A pension is a fund into which a sum of money is added during an employee's employment years and from which payments are drawn to support the person's retirement from work in the form of periodic payments. A pension may be a "defined benefit plan", where a fixed sum is paid regularly to a person, or a "defined contribution plan", under which a fixed sum is invested that then becomes available at retirement age. Pensions should not be confused with severance pay; the former is usually paid in regular installments for life after retirement, while the latter is typically paid as a fixed amount after involuntary termination of employment before retirement.

In the United States, Social Security is the commonly used term for the federal Old-Age, Survivors, and Disability Insurance (OASDI) program and is administered by the Social Security Administration. The original Social Security Act was signed into law by Franklin D. Roosevelt in 1935, and the current version of the Act, as amended, encompasses several social welfare and social insurance programs.

Welfare is a type of government support intended to ensure that members of a society can meet basic human needs such as food and shelter. Social security may either be synonymous with welfare, or refer specifically to social insurance programs which provide support only to those who have previously contributed, as opposed to social assistance programs which provide support on the basis of need alone. The International Labour Organization defines social security as covering support for those in old age, support for the maintenance of children, medical treatment, parental and sick leave, unemployment and disability benefits, and support for sufferers of occupational injury.

National Insurance (NI) is a fundamental component of the welfare state in the United Kingdom. It acts as a form of social security, since payment of NI contributions establishes entitlement to certain state benefits for workers and their families.

Kela, abbr. from Finnish: Kansaneläkelaitos, Swedish: Folkpensionsanstalten (Fpa), English: The Social Insurance Institution (SII), is a Finnish government agency in charge of settling benefits under national social security programs. Kela was founded in 1937 to handle retirement pay. In the 1980s and 1990s, its role was expanded to handle other fields like child benefits, unemployment benefits, sickness benefits, health insurance and student financial aid.

The U.S. Railroad Retirement Board (RRB) is an independent agency in the executive branch of the United States government created in 1935 to administer a social insurance program providing retirement benefits to the country's railroad workers.

Social insurance is a concept where the government intervenes in the insurance market to ensure that a group of individuals are insured or protected against the risk of any emergencies that lead to financial problems. This is done through a process where individuals' claims are partly dependent on their contributions, which can be considered as insurance premium to create a common fund out of which the individuals are then paid benefits in the future.

Taxation in France is determined by the yearly budget vote by the French Parliament, which determines which kinds of taxes can be levied and which rates can be applied.

In France employees of some government-owned corporations enjoy a special retirement plan, collectively known as régimes spéciaux de retraite. These professions include employees of the SNCF, the RATP, the electrical and gas companies which used to be government-owned; as well as some employees whose functions are directly related to the State such as the military, French National Police, sailors, Civil law notaries' assistants, employees of the Opéra de Paris, etc. The main differences between the special retirement plan and the usual private sector retirement plans are the retirement age and the number of years a worker must contribute to the fund before being allowed a full pension. In the private sector the minimum retirement age is 62 and the minimum number of quarters of contribution to the retirement fund in order to receive a full pension is between 166 and 172 quarters depending on date of birth. Employees who are enrolled in the special retirement plan can retire earlier.

Social security is divided by the French government into five branches: illness; old age/retirement; family; work accident; and occupational disease. From an institutional point of view, French social security is made up of diverse organismes. The system is divided into three main Regimes: the General Regime, the Farm Regime, and the Self-employed Regime. In addition there are numerous special regimes dating from prior to the creation of the state system in the mid-to-late 1940s.

The French URSSAF is a network of private organizations created in 1960 whose main task is to collect employee and employer social security contributions that finance the Régime general of France's social security system, including state health insurance.

Welfare in France includes all systems whose purpose is to protect people against the financial consequences of social risks.

The Allocation de solidarité aux personnes âgées (ASPA) is a French state pension for elderly people, whether former employees or not, on low incomes. It replaced the multiple components of the minimum pension from 1 January 2006. Existing recipients of the minimum pension are not automatically transferred to the ASPA, but may do so on request.

Pensions in France fall into five major divisions;

The Swiss pension system rests on three pillars:

The Sozialversicherungen in Switzerland includes several public and private insurance plans to assist the welfare of the population.

The French Pension Reserve Fund is a public entity created by law n°2001-624 dated 17 July 2001. Its mission is to invest monies entrusted to it by the public authorities on behalf of the community with the aim of financing the pension system. Its investment policy is to optimize returns on the investments it makes as prudently as possible. Its policy must be consistent with those collective values that are designed to promote balanced economic, social and environmental development.

As unemployed according to the art. 2 of the Ukrainian Law on Employment of Population are qualified citizens capable of work and of employable age, who due to lack of a job do not have any income or other earnings laid down by the law and are registered in the State Employment Center as looking for work, ready and able to start working. This definition also includes persons with disabilities who not attained retirement age and are registered as seeking employment.

Luxembourg has an extensive welfare system. It comprises a social security, health, and pension funds. The labour market is highly regulated, and Luxembourg is a corporatist welfare state. Enrollment is mandatory in one of the welfare schemes for any employed person. Luxembourg's social security system is the Centre Commun de la Securite Sociale (CCSS). Both employees and employers make contributions to the fund at a rate of 25% of total salary, which cannot eclipse more than five times the minimum wage. Social spending accounts for 21.8% of GDP.

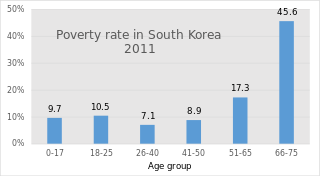

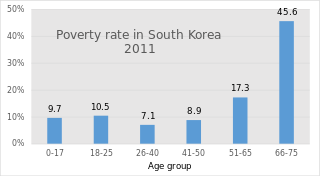

South Korea's pension scheme was introduced relatively recently, compared to other democratic nations. Half of the country's population aged 65 and over lives in relative poverty, or nearly four times the 13% average for member countries of the Organisation for Economic Co-operation and Development (OECD). This makes old age poverty an urgent social problem. Public social spending by general government is half the OECD average, and is the lowest as a percentage of GDP among OECD member countries.