This article has multiple issues. Please help improve it or discuss these issues on the talk page . (Learn how and when to remove these messages)

|

This article has multiple issues. Please help improve it or discuss these issues on the talk page . (Learn how and when to remove these messages)

|

Free Economic Zone Grodnoinvest (sometimes shortened to Grodno FEZ) is a Special Economic Zone in Belarus. As a Free Economic Zone it is taxed lightly, with its regulations overseen by the Belarusian government.

| Year Founded | 2002 |

|---|---|

| Total Territory | 4156 ha |

| Cities in Grodno Region | Grodno, Lida, Schuchin, Smorgon, Mosty, Slonim, Novogrudok, Svisloch |

| Number of Resident Companies | >70 |

| Management | Administration of FEZ Grodnoinvest |

The resident companies of FEZ Grodnoinvest are involved in the fields of woodworking, furniture production, mechanical engineering, metalworking, food production, chemical and light industries and agriculture. The primary export markets for these resident companies include Russia, some European Union countries and Kazakhstan.

Within the territory of Grodno FEZ, investors are exempt from the following:

The economy of Honduras is based mostly on agriculture, which accounts for 14% of its gross domestic product (GDP) in 2013. The country's leading export is coffee (US$340 million), which accounted for 22% of the total Honduran export revenues. Bananas, formerly the country's second-largest export until being virtually wiped out by 1998's Hurricane Mitch, recovered in 2000 to 57% of pre-Mitch levels. Cultivated shrimp is another important export sector. Since the late 1970s, towns in the north began industrial production through maquiladoras, especially in San Pedro Sula and Puerto Cortés.

A special economic zone (SEZ) is an area in which the business and trade laws are different from the rest of the country. SEZs are located within a country's national borders, and their aims include increasing trade balance, employment, increased investment, job creation and effective administration. To encourage businesses to set up in the zone, financial policies are introduced. These policies typically encompass investing, taxation, trading, quotas, customs and labour regulations. Additionally, companies may be offered tax holidays, where upon establishing themselves in a zone, they are granted a period of lower taxation.

The Common Agricultural Policy (CAP) is the agricultural policy of the European Commission. It implements a system of agricultural subsidies and other programmes. It was introduced in 1962 and has since then undergone several changes to reduce the EEC budget cost and consider rural development in its aims. It has however, been criticised on the grounds of its cost, its environmental, and humanitarian effects.

Free economic zones (FEZ), free economic territories (FETs) or free zones (FZ) are a class of special economic zone (SEZ) designated by the trade and commerce administrations of various countries. The term is used to designate areas in which companies are taxed very lightly or not at all to encourage economic activity. The taxation rules and duties are determined by each country. The World Trade Organization (WTO) Agreement on Subsidies and Countervailing Measures (SCM) has content on the conditions and benefits of free zones.

A tax incentive is an aspect of a government's taxation policy designed to incentivize or encourage a particular economic activity by reducing tax payments.

The tax system of the Russian Federation is a complex of relationships between fiscal authorities and taxpayers in the field of all existing taxes and fees. It implies continuous communication of all its members and related objects: payers; legislative framework; oversight authorities; types of mandatory payments. The Russian Tax Code is the primary tax law for the Russian Federation. The Code was created, adopted and implemented in three stages.

Taxation in Iran is levied and collected by the Iranian National Tax Administration under the Ministry of Finance and Economic Affairs of the Government of Iran. In 2008, about 55% of the government's budget came from oil and natural gas revenues, the rest from taxes and fees. An estimated 50% of Iran's GDP was exempt from taxes in FY 2004. There are virtually millions of people who do not pay taxes in Iran and hence operate outside the formal economy. The fiscal year begins on March 21 and ends on March 20 of the next year.

Taxation represents the biggest source of revenues for the Peruvian government. For 2016, the projected amount of taxation revenues was S/.94.6 billion. There are four taxes that make up approximately 90 percent of the taxation revenues:

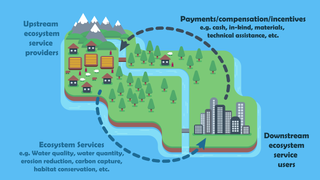

Payments for ecosystem services (PES), also known as payments for environmental services, are incentives offered to farmers or landowners in exchange for managing their land to provide some sort of ecological service. They have been defined as "a transparent system for the additional provision of environmental services through conditional payments to voluntary providers". These programmes promote the conservation of natural resources in the marketplace.

The economy of Belarus is an upper-middle income mixed economy. As a post-Soviet transition economy, Belarus rejected most privatisation efforts in favour of retaining centralised political and economic controls by the state. The highly centralized Belarusian economy emphasizes full employment and a dominant public sector. It has been described as a welfare state practicing market socialism. Belarus is the world's 74th-largest economy by GDP.

The economy of Belize is a small, essentially private enterprise economy that is based primarily on agriculture, tourism, and services. The cultivation of newly discovered oil in the town of Spanish Lookout has presented new prospects and problems for this developing nation. Belize's primary exports are citrus, sugar, and bananas. Belize's trade deficit has been growing, mostly as a result of low export prices for sugar and bananas.

The economy of Lithuania is the largest economy among the three Baltic states. Lithuania is a member of the European Union and belongs to the group of very high human development countries and is a member of the WTO and OECD.

Klaipėda Free Economic Zone or Klaipėda FEZ is the first free economic zone in the Baltic region. It was established in 1996 and officially launched in 2002.

Tangier's economy is the third biggest of all Moroccan cities, after the economic capital Casablanca and the city of Fez. Tangier is Morocco's second most important industrial center after Casablanca. The industrial sectors are diversified: textile, chemical, mechanical, metallurgical and naval. Currently, the city has four industrial parks of which two have the status of free economic zone.

Alabuga is a special economic zone of an industrial and production type located in a 20 km2 area in the Yelabuzhsky District of the Republic of Tatarstan in the Kama Innovative Territorial Production Cluster 10 km from Yelabuga, 25 km from Naberezhnye Chelny, 40 km from Nizhnekamsk and 210 km from the regional center — Kazan. The shareholders of the management company of the SEZ "Alabuga" are the Russian Federation through the JSC "Special Economic Zones" with 100% state participation.

Sughd free economic zone is an industrial-innovative type, which was established in 2009 according to the Decree of the Government of the Republic of Tajikistan dated May 2, 2008.

The Kaunas Free Economic Zone (FEZ) or Kaunas FEZ (Lithuanian: Kauno laisvoji ekonominė zona) is a free economic zone near Kaunas, Lithuania. It is a 534 hectare industrial development area which offers favorable and smaller taxes for production or logistics companies which invest at least 1 million euros or service companies which invest more than 100 thousand euros and employ over 20 people. The investors are mostly foreign companies, as more than 70% of total investments in Kaunas FEZ are foreign direct investments (FDI).

The China–Belarus Industrial Park "Great Stone" is a special economic zone in Belarus, established under the intergovernmental agreement between the People's Republic of China and the Republic of Belarus. The park offers easy access to International Highways M1/E30 and M4, International Airport, International Railways and the capital of Belarus (Minsk) with its labour and scientific potential. Great Stone Industrial Park is designated for high-tech industrial and business activities, including research and development, manufacturing and assembly, warehousing and logistic facilities. Park tax benefits, free customs regime within the countries of the Eurasian Economic Union (EAEU), including Russia and Kazakhstan, open market opportunities for 183 million customers.

Vladimir Vladimirovich Efimov is a Russian statesman and manager, Deputy Mayor of Moscow for Economic Policy and Property and Land Relations.