Environmental economics is a sub-field of economics concerned with environmental issues. It has become a widely studied subject due to growing environmental concerns in the twenty-first century. Environmental economics "undertakes theoretical or empirical studies of the economic effects of national or local environmental policies around the world. ... Particular issues include the costs and benefits of alternative environmental policies to deal with air pollution, water quality, toxic substances, solid waste, and global warming."

In neoclassical economics, market failure is a situation in which the allocation of goods and services by a free market is not Pareto efficient, often leading to a net loss of economic value. Market failures can be viewed as scenarios where individuals' pursuit of pure self-interest leads to results that are not efficient – that can be improved upon from the societal point of view. The first known use of the term by economists was in 1958, but the concept has been traced back to the Victorian philosopher Henry Sidgwick. Market failures are often associated with public goods, time-inconsistent preferences, information asymmetries, non-competitive markets, principal–agent problems, or externalities.

In economics, profit maximization is the short run or long run process by which a firm may determine the price, input and output levels that will lead to the highest possible total profit. In neoclassical economics, which is currently the mainstream approach to microeconomics, the firm is assumed to be a "rational agent" which wants to maximize its total profit, which is the difference between its total revenue and its total cost.

Energy economics is a broad scientific subject area which includes topics related to supply and use of energy in societies. Considering the cost of energy services and associated value gives economic meaning to the efficiency at which energy can be produced. Energy services can be defined as functions that generate and provide energy to the “desired end services or states”. The efficiency of energy services is dependent on the engineered technology used to produce and supply energy. The goal is to minimise energy input required to produce the energy service, such as lighting (lumens), heating (temperature) and fuel. The main sectors considered in energy economics are transportation and building, although it is relevant to a broad scale of human activities, including households and businesses at a microeconomic level and resource management and environmental impacts at a macroeconomic level.

A non-renewable resource is a natural resource that cannot be readily replaced by natural means at a pace quick enough to keep up with consumption. An example is carbon-based fossil fuels. The original organic matter, with the aid of heat and pressure, becomes a fuel such as oil or gas. Earth minerals and metal ores, fossil fuels and groundwater in certain aquifers are all considered non-renewable resources, though individual elements are always conserved.

In neoclassical economics, economic rent is any payment to the owner of a factor of production in excess of the cost needed to bring that factor into production. In classical economics, economic rent is any payment made or benefit received for non-produced inputs such as location (land) and for assets formed by creating official privilege over natural opportunities. In the moral economy of neoclassical economics, economic rent includes income gained by labor or state beneficiaries of other "contrived" exclusivity, such as labor guilds and unofficial corruption.

Free-market environmentalism argues that the free market, property rights, and tort law provide the best means of preserving the environment, internalizing pollution costs, and conserving resources.

In economics, rent is a surplus value after all costs and normal returns have been accounted for, i.e. the difference between the price at which an output from a resource can be sold and its respective extraction and production costs, including normal return. This concept is usually termed economic rent but when referring to rent in natural resources such as coastal space or minerals, it is commonly called resource rent. It can also be conceptualised as abnormal or supernormal profit.

Economic Order Quantity (EOQ), also known as Financial Purchase Quantity or Economic Buying Quantity (EPQ), is the order quantity that minimizes the total holding costs and ordering costs in inventory management. It is one of the oldest classical production scheduling models. The model was developed by Ford W. Harris in 1913, but R. H. Wilson, a consultant who applied it extensively, and K. Andler are given credit for their in-depth analysis.

Harold Hotelling was an American mathematical statistician and an influential economic theorist, known for Hotelling's law, Hotelling's lemma, and Hotelling's rule in economics, as well as Hotelling's T-squared distribution in statistics. He also developed and named the principal component analysis method widely used in finance, statistics and computer science.

The Ministry of Energy is a Cabinet-level agency of the government of the Canadian province of Alberta responsible for coordinating policy relating to the development of mineral and energy resources. It is also responsible for assessing and collecting non-renewable resource (NRR) royalties, freehold mineral taxes, rentals, and bonuses. The Alberta Petroleum Marketing Commission, which is fully integrated with the Department of Energy within the ministry, and fully funded by the Crown, accepts delivery of the Crown's royalty share of conventional crude oil and sells it at the current market value. The current ministry was formed in 1986, but ministries with other names dealing with energy resources go back to the Ministry of Lands and Mines in 1930.

In resource economics, Hartwick's rule defines the amount of investment in produced capital that is needed to exactly offset declining stocks of non-renewable resources. This investment is undertaken so that the standard of living does not fall as society moves into the indefinite future. Solow (1974) shows that, given a degree of substitutability between produced capital and natural resources, one way to design a sustainable consumption program for an economy is to accumulate produced capital sufficiently rapidly so that the pinch from the shrinking exhaustible resource stock is precisely countered by the services from the enlarged produced capital stock. Hartwick's rule – often abbreviated as "invest resource rents" – requires that a nation invest all rent earned from exhaustible resources currently extracted, where "rent" is defined along paths that maximize returns to owners of the resource stock. The rule extends to the case of many types of capital goods, including a vector of stocks of natural capital.

Stephen W. Salant is an economist who has done extensive research in applied microeconomics. His 1975 model of speculative attacks in the gold market was adapted by Paul Krugman and others to explain speculative attacks in foreign exchange markets. Hundreds of journal articles and books on financial speculative attacks followed.

Property rights are constructs in economics for determining how a resource or economic good is used and owned, which have developed over ancient and modern history, from Abrahamic law to Article 17 of the Universal Declaration of Human Rights. Resources can be owned by individuals, associations, collectives, or governments.

The Journal of Political Economy is a monthly peer-reviewed academic journal published by the University of Chicago Press. Established by James Laurence Laughlin in 1892, it covers both theoretical and empirical economics. In the past, the journal published quarterly from its introduction through 1905, ten issues per volume from 1906 through 1921, and bimonthly from 1922 through 2019. The editor-in-chief is Magne Mogstad.

In forestry, the optimal rotation age is the growth period required to derive maximum value from a stand of timber. The calculation of this period is specific to each stand and to the economic and sustainability goals of the harvester.

Green accounting is a type of accounting that attempts to factor environmental costs into the financial results of operations. It has been argued that gross domestic product ignores the environment and therefore policymakers need a revised model that incorporates green accounting. The major purpose of green accounting is to help businesses understand and manage the potential quid pro quo between traditional economics goals and environmental goals. It also increases the important information available for analyzing policy issues, especially when those vital pieces of information are often overlooked. Green accounting is said to only ensure weak sustainability, which should be considered as a step toward ultimately a strong sustainability.

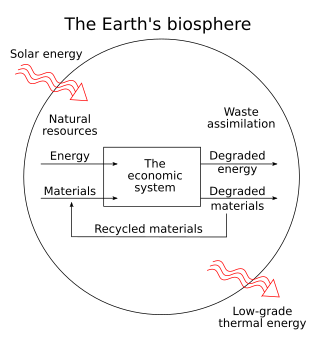

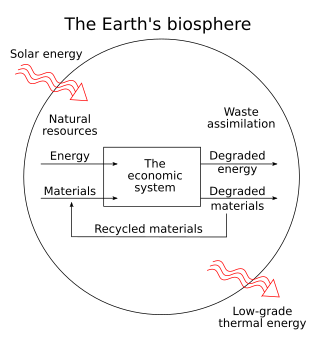

Natural resource economics deals with the supply, demand, and allocation of the Earth's natural resources. One main objective of natural resource economics is to better understand the role of natural resources in the economy in order to develop more sustainable methods of managing those resources to ensure their availability for future generations. Resource economists study interactions between economic and natural systems, with the goal of developing a sustainable and efficient economy.

The economics of climate change mitigation is part of the economics of climate change related to climate change mitigation, that is actions that are designed to limit the amount of long-term climate change.

Although related, sustainable development and sustainability are two different concepts. Weak sustainability is an idea within environmental economics which states that 'human capital' can substitute 'natural capital'. It is based upon the work of Nobel laureate Robert Solow, and John Hartwick. Contrary to weak sustainability, strong sustainability assumes that 'human capital' and 'natural capital' are complementary, but not interchangeable.