The Canada Health Act, adopted in 1984, is the federal legislation in Canada for publicly-funded health insurance, commonly called "medicare", and sets out the primary objective of Canadian healthcare policy.

In Canada, a First Ministers' conference is a meeting of the provincial and territorial premiers and the Prime Minister. These events are held at the call of the prime minister. They are usually held in Ottawa.

Equalization payments are cash payments made in some federal systems of government from the federal government to subnational governments with the objective of offsetting differences in available revenue or in the cost of providing services. Many federations use fiscal equalisation to reduce the inequalities in the fiscal capacities of sub-national governments arising from the differences in their geography, demography, natural endowments and economies. The level of equalisation sought can vary, however.

In macroeconomics and finance, a transfer payment is a redistribution of income and wealth by means of the government making a payment, without goods or services being received in return. These payments are considered to be non-exhaustive because they do not directly absorb resources or create output. Examples of transfer payments include welfare, financial aid, social security, and government subsidies for certain businesses.

As a subfield of public economics, fiscal federalism is concerned with "understanding which functions and instruments are best centralized and which are best placed in the sphere of decentralized levels of government". In other words, it is the study of how competencies and fiscal instruments are allocated across different (vertical) layers of the administration. An important part of its subject matter is the system of transfer payments or grants by which a central government shares its revenues with lower levels of government.

The Institute for Research on Public Policy is an independent, national, bilingual, not-for-profit organization based in Montreal, Quebec. Its mission is to "improve public policy in Canada by generating research, providing insight and informing debate on current and emerging policy issues facing Canadians and their governments." It publishes peer-reviewed research and acts as a convenor of policy debates by organizing conferences, round tables and panel discussions among stakeholders, academics, policy-makers and the general public. It is also the publisher of Policy Options magazine and the home of the Centre of Excellence on the Canadian Federation.

Fiscal imbalance is the term used in Canada to describe a monetary imbalance between the Canadian federal government and the provincial governments.

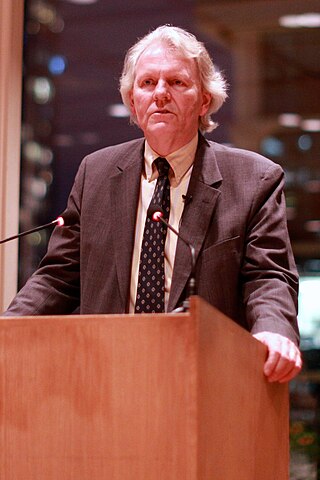

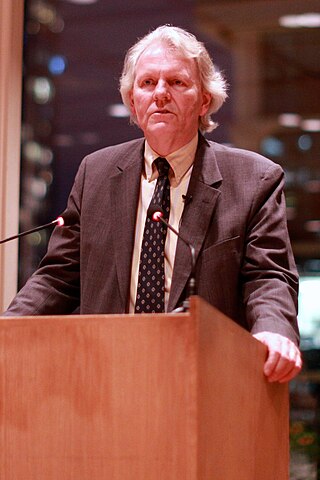

Thomas Joseph Courchene, known as Tom Courchene, is a Canadian economist and professor.

The National Finance Commission Award or NFC is a series of planned economic programs in Pakistan enacted since 1951. Constituted under the Article 160 of the Constitution, the program was emerged to take control of financial imbalances and equally managed the financial resources to four provinces to meet their expenditure liabilities while alleviating the horizontal fiscal imbalances. As per Constitution, the program awards the designs of financial formulas of economic distribution to provincial and federal government for five consecutive years. All together, a total of seven awards has been reimbursed since its emergence in 1951, by Prime Minister Liaquat Ali Khan. Stipulations and directions mentioned by the Constitution, the provisional governments and federal government competes to get higher share of the program's revenues in order to stabilize their own financial status.

The Canada Health Transfer (CHT) is the Canadian government's transfer payment program in support of the health systems of the provinces and territories of Canada. The program was originally combined with the Canada Social Transfer in a program known as the Canada Health and Social Transfer. It was made independent from the Canada Health and Social Transfer program on April 1, 2004 to allow for greater accountability and transparency for federal health funding led by then prime minister Paul Martin.

Canada has access to all main sources of energy including oil and gas, coal, hydropower, biomass, solar, geothermal, wind, marine and nuclear. It is the world's second largest producer of uranium, third largest producer of hydro-electricity, fourth largest natural gas producer, and the fifth largest producer of crude oil. In 2006, only Russia, the People's Republic of China, the United States and Saudi Arabia produce more total energy than Canada.

Monique Jérôme-Forget is a psychologist and a former Quebec politician. She was the Member of National Assembly (MNA) for the riding of Marguerite-Bourgeois in the Montreal region as a member of the Quebec Liberal Party between 1998 and 2009. With the government in power she was the Finance Minister from 2007 to 2009, the President of the Treasury Board and the Minister of government services and the Minister responsible of the government administration from 2003 to 2008.

Civil service reform is a deliberate action to improve the efficiency, effectiveness, professionalism, representativity and democratic character of a civil service, with a view to promoting better delivery of public goods and services, with increased accountability. Such actions can include data gathering and analysis, organizational restructuring, improving human resource management and training, enhancing pay and benefits while assuring sustainability under overall fiscal constraints, and strengthening measures for performance management, public participation, transparency, and combating corruption.

Transfer payments are a collection of payments made by the Government of Canada to Canadian provinces and territories under the Federal–Provincial Arrangements Act. Chief among these are the Canada Social Transfer, the Canada Health Transfer and equalization payments. The last of these can be spent however the receiving provinces see fit, while the first two are intended to support social and health services respectively.

David Hibbard Romer is an American economist, the Herman Royer Professor of Political Economy at the University of California, Berkeley, and the author of a standard textbook in graduate macroeconomics as well as many influential economic papers, particularly in the area of New Keynesian economics. He is also the husband and close collaborator of Council of Economic Advisers former Chairwoman Christina Romer.

In Canada, the federal government makes equalization payments to provincial governments of lesser fiscal capacity so that "reasonably comparable" levels of public services can be provided at similar levels of taxation. Equalization payments are entrenched in the Constitution Act of 1982, subsection 36(2).

Hourglass Federalism is a theory about Canadian economic geography and political economy that has been promoted by Thomas J. Courchene of Queen's University. The thesis he proposes is that federal cutbacks of provincial transfers to social services since 1995 has caused significant fiscal imbalances. These funding cuts forced the provinces to make cutbacks in nearly every provincial jurisdiction, except healthcare because cutting healthcare funding would be political suicide, but this left almost every other provincial jurisdiction, including cities which are creations of the provinces, with reduced and often insufficient funding. However, in the meantime, the federal government has been providing greater funds to social programs but they have been bypassing the provinces and giving the money directly to cities or citizens. This allows the federal government to fund provincial jurisdictions directly causing the provinces to become "the squeezed middle of the division-of-powers hourglass".

Emmanuel Farhi was a French economist who served as the Robert C. Waggoner Professor of Economics at Harvard University from 2018 till his death in 2020. A specialist in macroeconomics, taxation and finance, he also served on the Conseil d’Analyse Économique from 2010 to 2010. On July 23, 2020, aged 41, Farhi committed suicide.

Ramon Tremosa i Balcells is a Catalan economist and politician, professor at the Department of Economic Theory at the University of Barcelona, where he obtained his Doctorate about the influence of macroeconomic policy in the Catalan manufacturing industry. From 2009 onwards he has been independent MEP for Convergència i Unió and has been re-elected in 2014. He is author of various books and academic articles about monetary politics, fiscal federalism and regional economics.

Michael J. Prince is a Canadian political scientist and public policy and administration scholar. Prince is the Lansdowne Professor of Social Policy at the University of Victoria in Canada.