In financial accounting, a balance sheet is a summary of the financial balances of an individual or organization, whether it be a sole proprietorship, a business partnership, a corporation, private limited company or other organization such as government or not-for-profit entity. Assets, liabilities and ownership equity are listed as of a specific date, such as the end of its financial year. A balance sheet is often described as a "snapshot of a company's financial condition". It is the summary of each and every financial statement of an organization

Wealth is the abundance of valuable financial assets or physical possessions which can be converted into a form that can be used for transactions. This includes the core meaning as held in the originating Old English word weal, which is from an Indo-European word stem. The modern concept of wealth is of significance in all areas of economics, and clearly so for growth economics and development economics, yet the meaning of wealth is context-dependent. An individual possessing a substantial net worth is known as wealthy. Net worth is defined as the current value of one's assets less liabilities.

The Bureau of Economic Analysis (BEA) of the United States Department of Commerce is a U.S. government agency that provides official macroeconomic and industry statistics, most notably reports about the gross domestic product (GDP) of the United States and its various units—states, cities/towns/townships/villages/counties, and metropolitan areas. They also provide information about personal income, corporate profits, and government spending in their National Income and Product Accounts (NIPAs).

The government budget balance, also referred to as the general government balance, public budget balance, or public fiscal balance, is the difference between government revenues and spending. For a government that uses accrual accounting the budget balance is calculated using only spending on current operations, with expenditure on new capital assets excluded. A positive balance is called a government budget surplus, and a negative balance is a government budget deficit. A government budget presents the government's proposed revenues and spending for a financial year.

A millionaire is an individual whose net worth or wealth is equal to or exceeds one million units of currency. Depending on the currency, a certain level of prestige is associated with being a millionaire. Many national currencies have, or have had at various times, a low unit value, in many cases due to past inflation. It is obviously much easier and less significant to be a millionaire in those currencies, thus a millionaire in Hong Kong or Taiwan, for example, may be merely averagely wealthy, or perhaps less wealthy than average. A millionaire in Zimbabwe in 2007 could have been extremely poor. Because of this, the term 'millionaire' generally refers to those whose assets total at least one million units of a high-value currency, such as the United States dollar, euro, or pound sterling.

Net worth is the value of all the non-financial and financial assets owned by an individual or institution minus the value of all its outstanding liabilities. Financial assets minus outstanding liabilities equal net financial assets, so net worth can be expressed as the sum of non-financial assets and net financial assets. This concept can apply to companies, individuals, governments, or economic sectors such as the financial corporations sector, or even entire countries.

The distribution of wealth is a comparison of the wealth of various members or groups in a society. It shows one aspect of economic inequality or economic heterogeneity.

A wealth tax is a tax on an entity's holdings of assets or an entity's net worth. This includes the total value of personal assets, including cash, bank deposits, real estate, assets in insurance and pension plans, ownership of unincorporated businesses, financial securities, and personal trusts. Typically, wealth taxation often involves the exclusion of an individual's liabilities, such as mortgages and other debts, from their total assets. Accordingly, this type of taxation is frequently denoted as a netwealth tax.

National accounts or national account systems (NAS) are the implementation of complete and consistent accounting techniques for measuring the economic activity of a nation. These include detailed underlying measures that rely on double-entry accounting. By design, such accounting makes the totals on both sides of an account equal even though they each measure different characteristics, for example production and the income from it. As a method, the subject is termed national accounting or, more generally, social accounting. Stated otherwise, national accounts as systems may be distinguished from the economic data associated with those systems. While sharing many common principles with business accounting, national accounts are based on economic concepts. One conceptual construct for representing flows of all economic transactions that take place in an economy is a social accounting matrix with accounts in each respective row-column entry.

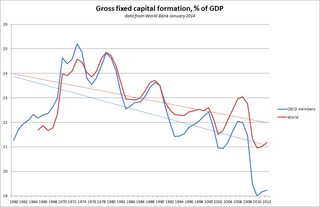

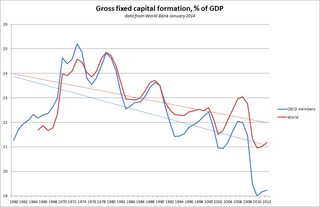

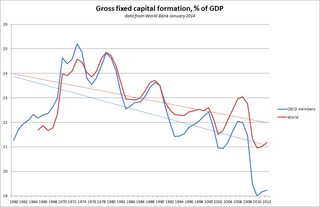

(GFCF) is a macroeconomic concept used in official national accounts such as the United Nations System of National Accounts (UNSNA), National Income and Product Accounts (NIPA) and the European System of Accounts (ESA). The concept dates back to the National Bureau of Economic Research (NBER) studies of Simon Kuznets of capital formation in the 1930s, and standard measures for it were adopted in the 1950s. Statistically it measures the value of acquisitions of new or existing fixed assets by the business sector, governments and "pure" households less disposals of fixed assets.

is a component of the expenditure on gross domestic product (GDP), and thus shows something about how much of the new value added in the economy is invested rather than consumed.

High-net-worth individual (HNWI) is a term used by some segments of the financial services industry to designate persons whose investible wealth exceeds a given amount. Typically, these individuals are defined as holding financial assets with a value greater than US$1 million. "Very-HNWI" (VHNWI) can refer to someone with a net worth of at least US$5 million. As of December 2022, there were estimated to be just over 15 million HNWIs in the world according to the World's Wealthiest Cities Report 2023 by Henley & Partners. The United States had the highest number of HNWIs of any country, whilst New York is the wealthiest city with 340,000 HNWIs.

The Millionaire Next Door: The Surprising Secrets of America's Wealthy (ISBN 0-671-01520-6) is a 1996 book by Thomas J. Stanley and William D. Danko. The book is a compilation of research done by the two authors in the profiles of American millionaires.

Operating surplus is an accounting concept used in national accounts statistics and in corporate and government accounts. It is the balancing item of the Generation of Income Account in the UNSNA. It may be used in macro-economics as a proxy for total pre-tax profit income, although entrepreneurial income may provide a better measure of business profits. According to the 2008 SNA, it is the measure of the surplus accruing from production before deducting property income, e.g., land rent and interest.

Capital formation is a concept used in macroeconomics, national accounts and financial economics. Occasionally it is also used in corporate accounts. It can be defined in three ways:

Household income is a measure of the combined incomes of all people sharing a particular household or place of residence. It includes every form of income, e.g., salaries and wages, retirement income, near cash government transfers like food stamps, and investment gains.

Affluence refers to an individual's or household's economical and financial advantage in comparison to others. It may be assessed through either income or wealth.

The inequality of wealth has substantially increased in the United States in recent decades. Wealth commonly includes the values of any homes, automobiles, personal valuables, businesses, savings, and investments, as well as any associated debts.

Asset poverty is an economic and social condition that is more persistent and prevalent than income poverty. It is a household’s inability to access wealth resources that are sufficient to provide for basic needs for a period of three months. Basic needs refer to the minimum standards for consumption and acceptable needs. Wealth resources consist of home ownership, other real estate, net value of farm and business assets, stocks, checking and savings accounts, and other savings. Wealth is measured in three forms: net worth, net worth minus home equity, and liquid assets. Net worth consists of all the aspects mentioned above. Net worth minus home equity is the same except it does not include home ownership in asset calculations. Liquid assets are resources that are readily available such as cash, checking and savings accounts, stocks, and other sources of savings. There are two types of assets: tangible and intangible. Tangible assets most closely resemble liquid assets in that they include stocks, bonds, property, natural resources, and hard assets not in the form of real estate. Intangible assets are simply the access to credit, social capital, cultural capital, political capital, and human capital.

The financial position of the United States includes assets of at least $269.6 trillion and debts of $145.8 trillion to produce a net worth of at least $123.8 trillion. GDP in Q1 decline was due to foreclosures and increased rates of household saving. There were significant declines in debt to GDP in each sector except the government, which ran large deficits to offset deleveraging or debt reduction in other sectors.

Racial inequality in the United Statesof America identifies the social inequality and advantages and disparities that affect different races within the country. These can also be seen as a result of historic oppression, inequality of inheritance, or racism and prejudice, especially against minority groups.