Customs is an authority or agency in a country responsible for collecting tariffs and for controlling the flow of goods, including animals, transports, personal effects, and hazardous items, into and out of a country. Traditionally, customs has been considered as the fiscal subject that charges customs duties and other taxes on import and export. In recent decades, the views on the functions of customs have considerably expanded and now covers three basic issues: taxation, security, and trade facilitation.

Protectionism, sometimes referred to as trade protectionism, is the economic policy of restricting imports from other countries through methods such as tariffs on imported goods, import quotas, and a variety of other government regulations. Proponents argue that protectionist policies shield the producers, businesses, and workers of the import-competing sector in the country from foreign competitors and raise government revenue. Opponents argue that protectionist policies reduce trade, and adversely affect consumers in general as well as the producers and workers in export sectors, both in the country implementing protectionist policies and in the countries against which the protections are implemented.

A grey market or dark market is the trade of a commodity through distribution channels that are not authorised by the original manufacturer or trade mark proprietor. Grey market products are products traded outside the authorised manufacturer's channel.

The first-sale doctrine is an American legal concept that limits the rights of an intellectual property owner to control resale of products embodying its intellectual property. The doctrine enables the distribution chain of copyrighted products, library lending, giving, video rentals and secondary markets for copyrighted works. In trademark law, this same doctrine enables reselling of trademarked products after the trademark holder puts the products on the market. In the case of patented products, the doctrine allows resale of patented products without any control from the patent holder. The first sale doctrine does not apply to patented processes, which are instead governed by the patent exhaustion doctrine.

Trade barriers are government-induced restrictions on international trade. According to the theory of comparative advantage, trade barriers are detrimental to the world economy and decrease overall economic efficiency.

Non-tariff barriers to trade are trade barriers that restrict imports or exports of goods or services through mechanisms other than the simple imposition of tariffs. Such barriers are subject to controversy and debate, as they may comply with international rules on trade yet serve protectionist purposes.

A parallel import is a non-counterfeit product imported from another country without the permission of the intellectual property owner. Parallel imports are often referred to as a grey product and are implicated in issues of international trade, and intellectual property.

A voluntary export restraint (VER) or voluntary export restriction is a measure by which the government or an industry in the importing country arranges with the government or the competing industry in the exporting country for a restriction on the volume of the latter's exports of one or more products.

The TARIC code is designed to show the various rules applying to specific products when imported into the EU. This includes the provisions of the harmonised system and the combined nomenclature but also additional provisions specified in Community legislation such as tariff suspensions, tariff quotas and tariff preferences, which exist for the majority of the Community’s trading partners. In trade with third countries, the 10-digit Taric code must be used in customs and statistical declarations.

A used car, a pre-owned vehicle, or a secondhand car, is a vehicle that has previously had one or more retail owners. Used cars are sold through a variety of outlets, including franchise and independent car dealers, rental car companies, buy here pay here dealerships, leasing offices, auctions, and private party sales. Some car retailers offer "no-haggle prices," "certified" used cars, and extended service plans or warranties.

Custom brokers or Customs House Brokerages are working positions that may be employed by or affiliated with freight forwarders, independent businesses, or shipping lines, importers, exporters, trade authorities, and customs brokerage firms.

An importer is the receiving country in an export from the sending country. Importation and exportation are the defining financial transactions of international trade. Import is part of the International Trade which involves buying and receiving of goods or services produced in another country. The seller of such goods and services is called an exporter, while the foreign buyer is known as an importer.

The ATA Carnet, often referred to as the "Passport for goods", is an international customs document that permits the tax-free and duty-free temporary export and import of nonperishable goods for up to one year. It consists of unified customs declaration forms which are prepared ready to use at every border crossing point. It is a globally accepted guarantee for customs duties and taxes which can replace the security deposit required by each customs authority. It can be used in multiple countries in multiple trips up to its one-year validity. The acronym ATA is a combination of French and English terms "Admission Temporaire/Temporary Admission". The ATA carnet is now the document most widely used by the business community for international operations involving temporary admission of goods.

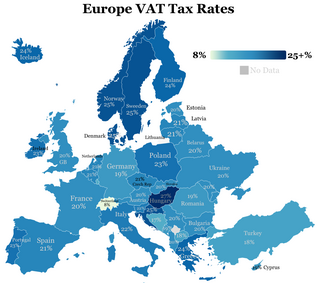

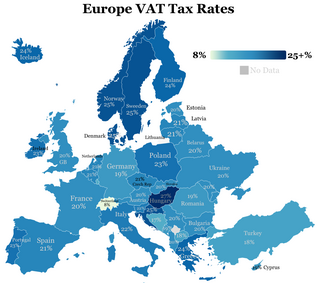

The European Union value-added tax is a value added tax on goods and services within the European Union (EU). The EU's institutions do not collect the tax, but EU member states are each required to adopt in national legislation a value added tax that complies with the EU VAT code. Different rates of VAT apply in different EU member states, ranging from 17% in Luxembourg to 27% in Hungary. The total VAT collected by member states is used as part of the calculation to determine what each state contributes to the EU's budget.

Rewe-Zentral v Bundesmonopolverwaltung für Branntwein (1979) Case C-120/78, popularly known as Cassis de Dijon after its subject matter, is an EU law decision of the European Court of Justice. The Court held that a regulation applying to both imported and to domestic goods that produces an effect equivalent to a quantitative import restriction is an unlawful restriction on the free movement of goods. The case is a seminal judicial interpretation of article 34 of the Treaty on the Functioning of the European Union. In the same ruling, the Court established the so-called rule of reason, allowing non-discriminatory restrictive measures to be justified on grounds other than those listed in article 36 TFEU.

In economics, a tariff-rate quota (TRQ) is a two-tiered tariff system that combines import quotas and tariffs to regulate import products.

Penguin Books Ltd. v. India Book Distributors and Others, was a 1984 Delhi High Court court case. Penguin Books Ltd. of England brought a suit for perpetual injunction against the respondents, India Book Distributors of New Delhi, to restrain them from infringing Penguin's territorial license in 23 books, the subject matter of the suit.

Brown v. Maryland, 25 U.S. 419 (1827), was a significant United States Supreme Court case which interpreted the Import-Export and Commerce Clauses of the U.S. Constitution to prohibit discriminatory taxation by states against imported items after importation, rather than only at the time of importation. The state of Maryland passed a law requiring importers of foreign goods to obtain a license for selling their products. Brown was charged under this law and appealed. It was the first case in which the U.S. Supreme Court construed the Import-Export Clause. Chief Justice John Marshall delivered the opinion of the court, ruling that Maryland's statute violated the Import-Export and Commerce Clauses and the federal law was supreme. He alleged that the power of a state to tax goods did not apply if they remained in their "original package". A license tax on the importer was essentially the same as a tax on an import itself. Despite arguing the case for Maryland, future chief justice Roger Taney admitted that the case was correctly decided.

SIGL or Sigl may refer to:

The United Kingdom–Crown Dependencies Customs Union or customs arrangements with the Crown Dependencies is a customs union that covers the British Islands.