The adhesive embossed postage stamps of the United Kingdom, issued during the reign of Queen Victoria between 1847 and 1854 exhibit four features which are unique to this issue:

A stamp act is any legislation that requires a tax to be paid on the transfer of certain documents. Those who pay the tax receive an official stamp on their documents, making them legal documents. A variety of products have been covered by stamp acts including playing cards, dice, patent medicines, cheques, mortgages, contracts, marriage licenses and newspapers. The items may have to be physically stamped at approved government offices following payment of the duty, although methods involving annual payment of a fixed sum or purchase of adhesive stamps are more practical and common.

A revenue stamp, tax stamp, duty stamp or fiscal stamp is a (usually) adhesive label used to designate collected taxes or fees on documents, tobacco, alcoholic drinks, drugs and medicines, playing cards, hunting licenses, firearm registration, and many other things. Typically, businesses purchase the stamps from the government, and attach them to taxed items as part of putting the items on sale, or in the case of documents, as part of filling out the form.

Stamped paper is an often-foolscap piece of paper which bears an imprinted revenue stamp. Stamped papers are not a form of postal stationery as although they may contain writing, they are not designed to be used to convey a message.

Revenue stamps of Malta were first issued in 1899, when the islands were a British colony. From that year to 1912, all revenue issues were postage stamps overprinted accordingly, that was either done locally or by De La Rue in London. Postage stamps also became valid for fiscal use in 1913, so no new revenues were issued until 1926–1930, when a series of key type stamps depicting King George V were issued. These exist unappropriated for use as general-duty revenues, or with additional inscriptions indicating a specific use; Applications, Contracts, Registers or Stocks & Shares. The only other revenues after this series were £1 stamps depicting George VI and Elizabeth II. Postage stamps remained valid for fiscal use until at least the 1980s.

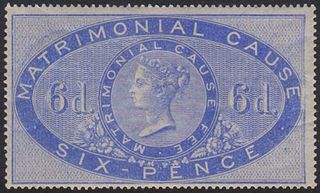

Revenue stamps of the United Kingdom refer to the various revenue or fiscal stamps, whether adhesive, directly embossed or otherwise, which were issued by and used in the Kingdom of England, the Kingdom of Great Britain, the United Kingdom of Great Britain and Ireland and the United Kingdom of Great Britain and Northern Ireland, from the late 17th century to the present day.

Australia issued revenue stamps from 1907 to 1994. There were various types for different taxes. In addition to Commonwealth issues, the states of New South Wales, Queensland, South Australia, Tasmania, Victoria and Western Australia as well as the territories Australian Capital Territory, North Australia and Northern Territory also had their own stamps.

The Australian state of Western Australia issued revenue stamps from 1881 to 1973. There were various types for different taxes.

The Australian state of Tasmania issued adhesive revenue stamps from 1863 to 1998, although impressed stamps had appeared briefly in the 1820s. There were general revenue and stamp duty issues, as well as a number of specific issues for various taxes.

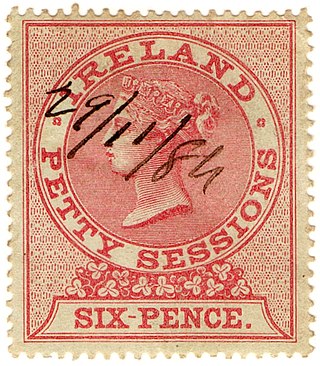

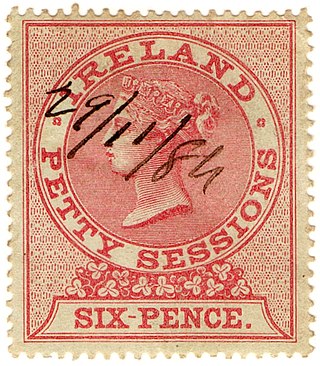

Revenue stamps of Ireland refer to the various revenue or fiscal stamps, whether adhesive, directly embossed or otherwise, which have been used on the island of Ireland since 1774. These include issues by the Kingdom of Ireland, issues by the United Kingdom specifically for use in Ireland or briefly Southern Ireland, and issues of an independent southern Ireland since 1922. Revenue stamps of Northern Ireland were also issued from 1921 to the 1980s, but they are not covered in this article.

The island of Cyprus first issued revenue stamps in 1878 and continues to do so to this day. The Turkish Republic of Northern Cyprus also issues its own revenue stamps.

Revenue stamps of British Guiana refer to the various revenue or fiscal stamps, whether adhesive or directly embossed, which were issued by British Guiana prior to the colony's independence as Guyana in 1966. Between the 1860s and 1890s, the colony issued Inland Revenue and Summary Jurisdiction stamps, while revenue stamps and dual-purpose postage and revenue stamps were issued during the late 19th and 20th centuries. In around the 1890s or 1900s, British Guiana possibly issued stamps for taxes on medicine and matches, but it is unclear if these were actually issued. Guyana continued to issue its own revenue stamps after independence.

The South African Republic (ZAR), later known as Transvaal issued revenue stamps from 1875 to around 1950. There were a number of different stamps for several taxes.

Revenue stamps of Jamaica were first issued in 1855. There were various types of fiscal stamps for different taxes.

Uganda issued revenue stamps from around 1896 to the 1990s. There were numerous types of revenue stamps for a variety of taxes and fees.

Revenue stamps of Seychelles were first issued in 1893, when the islands were a dependency of the British Crown Colony of Mauritius. The first stamps were Mauritius Internal Revenue stamps depicting Queen Victoria overprinted for use in Seychelles, and Bill stamps were also similarly overprinted. Postage stamps depicting Victoria or Edward VII were overprinted for fiscal use at various points between 1894 and 1904, while surcharges on Bill stamps were made in around 1897–98.

Revenue stamps of Hawaii were first issued in late 1876 by the Kingdom of Hawaii to pay taxes according to the Stamp Duty Act of 1876, although embossed revenue stamps had been introduced decades earlier in around 1845. The stamps issued in 1876–79 were used for over three decades, remaining in use during the Provisional Government, the Republic and after Hawaii became a U.S. Territory. Some changes were made along the years: from rouletted to perforated, and some new values, colours, designs and overprints were added. Some postage stamps were briefly valid for fiscal use in 1886–88 to pay for a tax on opium imports, and a stamp in a new design was issued for customs duties in 1897. A liquor stamp was issued in 1905.

Revenue stamps of Northern Ireland refer to the various revenue or fiscal stamps, whether adhesive, directly embossed or otherwise, which were issued by and used in Northern Ireland, a constituent country of the United Kingdom. From 1774, various revenue stamps of Ireland were used throughout both Northern and Southern Ireland, while revenue stamps of the United Kingdom were also used to pay for some taxes and fees.

Revenue stamps of the Leeward Islands were issued by the British Leeward Islands between 1882 and the 1930s. They were used on Antigua, the British Virgin Islands, Dominica, Montserrat and Saint Kitts and Nevis, all of which also issued their own revenue stamps before, during or after they used common issues for the Leeward Islands.

Revenue stamps of Guyana refer to the various revenue or fiscal stamps, whether adhesive, directly embossed or otherwise, which have been issued by Guyana since its independence in 1966. Prior to independence, the country was known as British Guiana, and it had issued its own revenue stamps since the 19th century. Guyana used dual-purpose postage and revenue stamps until 1977, and it issued revenue-only stamps between 1975 and the 2000s. The country has also issued National Insurance stamps, labels for airport departure tax and excise stamps for cigarettes and alcohol.