A pension is a fund into which amounts are paid regularly during an individual's working career, and from which periodic payments are made to support the person's retirement from work. A pension may be:

A pension fund, also known as a superannuation fund in some countries, is any program, fund, or scheme which provides retirement income. The U.S. Government's Social Security Trust Fund, which oversees $2.57 trillion in assets, is the world's largest public pension fund. Pension funds typically have large amounts of money to invest and are the major investors in listed and private companies. They are especially important to the stock market where large institutional investors dominate. The largest 300 pension funds collectively hold about USD$6 trillion in assets. In 2012, PricewaterhouseCoopers estimated that pension funds worldwide hold over $33.9 trillion in assets, the largest for any category of institutional investor ahead of mutual funds, insurance companies, currency reserves, sovereign wealth funds, hedge funds, or private equity.

In the United States, Social Security is the commonly used term for the federal Old-Age, Survivors, and Disability Insurance (OASDI) program and is administered by the Social Security Administration (SSA). The Social Security Act was passed in 1935, and the existing version of the Act, as amended, encompasses several social welfare and social insurance programs.

The Social Security Act of 1935 is a law enacted by the 74th United States Congress and signed into law by U.S. President Franklin D. Roosevelt on August 14, 1935. The law created the Social Security program as well as insurance against unemployment. The law was part of Roosevelt's New Deal domestic program.

Unemployment benefits, also called unemployment insurance, unemployment payment, unemployment compensation, or simply unemployment, are payments made by governmental bodies to unemployed people. Depending on the country and the status of the person, those sums may be small, covering only basic needs, or may compensate the lost time proportionally to the previous earned salary.

A disability pension is a form of pension given to those people who are permanently or temporarily unable to work due to a disability.

India has a robust social security legislative framework governing social security, encompassing multiple labour laws and regulations. These laws govern various aspects of social security, particularly focusing on the welfare of the workforce. The primary objective of these measures is to foster sound industrial relations, cultivate a high-quality work environment, ensure legislative compliance, and mitigate risks such as accidents and health concerns. Moreover, social security initiatives aim to safeguard against social risks such as retirement, maternity, healthcare and unemployment while tax-funded social assistance aims to reduce inequalities and poverty. The Directive Principles of State Policy, enshrined in Part IV of the Indian Constitution reflects that India is a welfare state. Food security to all Indians are guaranteed under the National Food Security Act, 2013 where the government provides highly subsidised food grains or a food security allowance to economically vulnerable people. The system has since been universalised with the passing of The Code on Social Security, 2020. These cover most of the Indian population with social protection in various situations in their lives.

Social security is divided by the French government into five branches: illness; old age/retirement; family; work accident; and occupational disease. From an institutional point of view, French social security is made up of diverse organismes. The system is divided into three main Regimes: the General Regime, the Farm Regime, and the Self-employed Regime. In addition there are numerous special regimes dating from prior to the creation of the state system in the mid-to-late 1940s.

German Statutory Accident Insurance or workers' compensation is among the oldest branches of German social insurance. Occupational accident insurance was established in Germany by statute in 1884. It is now a national, compulsory program that insures workers for injuries or illness incurred through their employment, or the commute to or from their employment. Wage earners, apprentices, family helpers and students including children in kindergarten are covered by this program. Almost all self-employed persons can voluntarily become insured. The German workers' compensation laws were the first of their kind.

Welfare in France includes all systems whose purpose is to protect people against the financial consequences of social risks.

According to the International Labour Organization, social security is a human right that aims at reducing and preventing poverty and vulnerability throughout the life cycle of individuals. Social security includes different kinds of benefits A social pension is a stream of payments from the state to an individual that starts when someone retires and continues to be paid until death. This type of pension represents the non-contributory part of the pension system, the other being the contributory pension, as per the most common form of composition of these systems in most developed countries.

The Social Security Institution is the governing authority of the Turkish social security system. It was established by the Social Security Institution Law No:5502, which was published in the Official Gazette No: 26173 on June 20, 2006. This brought five different retirement systems that affected civil servants, contractual paid workers, agricultural paid workers, and self-employed workers into a single retirement system offering equal actuarial rights and obligations.

Luxembourg has an extensive welfare system. It comprises social security, health, and pension funds. The labour market is highly regulated, and Luxembourg is a corporatist welfare state. Enrollment is mandatory in one of the welfare schemes for any employed person. Luxembourg's social security system is the Centre Commun de la Securite Sociale (CCSS). Both employees and employers make contributions to the fund at a rate of 25% of total salary, which cannot eclipse more than five times the minimum wage. Social spending accounts for 21.9% of GDP.

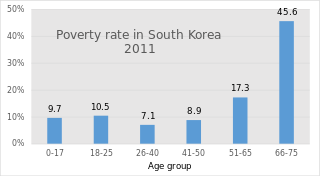

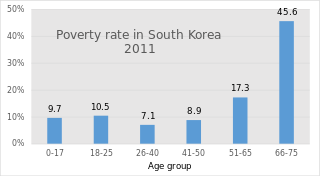

South Korea's pension scheme was introduced relatively recently, compared to other democratic nations. Half of the country's population aged 65 and over lives in relative poverty, or nearly four times the 13% average for member countries of the Organisation for Economic Co-operation and Development (OECD). This makes old age poverty an urgent social problem. Public social spending by general government is half the OECD average, and is the lowest as a percentage of GDP among OECD member countries.

The Caixa Andorrana de Seguretat Social (CASS) is the public institution in charge of the Social Security system in Andorra. It was established in April 1968. Since the Constitution of Andorra was approved in 1993, the objective of the Andorran system is to implement Article 30: «The right to health protection and to receive benefits to meet other personal needs is recognized. To these ends, the State will guarantee a Social Security system ». That is to say, guarantee protection, in its contributory and non-contributory modality, of insured persons, direct or indirect, through the appropriate benefits. It is compulsory for salaried workers and also for those who develop an economic activity.

The Pension reform in Brazil was a proposal by the Brazilian government to amend the Constitution for the reform of the social security system of the country. By changing the country's constitution, it had to be approved in both houses of the National Congress by an absolute majority. The reform was created to combat the giant deficit in the pension system, of more than R$194 billion in 2018, and the rapid aging of the Brazilian population.

Social security in Brazil has its origins in the 1824 Constitution, specifically through a system of "public aid" provided by private initiatives such as the Santa Casa de Misericórdia. Social security, along with public health and social assistance, forms part of the broader social welfare system. The Instituto Nacional do Seguro Social, responsible for managing social security benefits, was established by Decree No. 99,350 on June 27, 1990. This establishment resulted from the merger of the Instituto de Administração Financeira da Previdência e Assistência Social (IAPAS), founded in 1977, and the Instituto Nacional de Previdência Social (INPS), created in 1966.

The Empresa de Tecnologia e Informações da Previdência, also known as Dataprev, is a Brazilian public company linked to the Ministry of Management and Innovation in Public Services (MGI). It is responsible for managing the Brazilian social database, particularly that of the National Social Security Institute (INSS). It was created in 1974 under Law 6.125.

Old-age and survivors insurance constitutes one of the main social security schemes in Switzerland.