The Economy of Chile is a market economy and high-income economy as ranked by the World Bank. The country is considered one of South America's most prosperous nations, leading the region in competitiveness, income per capita, globalization, economic freedom, and low perception of corruption. Although Chile has high economic inequality, as measured by the Gini index, it is close to the regional mean.

A cartel is a group of independent market participants who collude with each other in order to improve their profits and dominate the market. Cartels are usually associations in the same sphere of business, and thus an alliance of rivals. Most jurisdictions consider it anti-competitive behavior and have outlawed such practices. Cartel behavior includes price fixing, bid rigging, and reductions in output. The doctrine in economics that analyzes cartels is cartel theory. Cartels are distinguished from other forms of collusion or anti-competitive organization such as corporate mergers.

The Organization of the Petroleum Exporting Countries is an intergovernmental organization of 13 countries. Founded on 14 September 1960 in Baghdad by the first five members, it has, since 1965, been headquartered in Vienna, Austria, although Austria is not an OPEC member state. As of September 2018, the 13 member countries accounted for an estimated 44 percent of global oil production and 81.5 percent of the world's proven oil reserves, giving OPEC a major influence on global oil prices that were previously determined by the so-called "Seven Sisters" grouping of multinational oil companies.

The 1973 oil crisis or first oil crisis began in October 1973 when the members of the Organization of Arab Petroleum Exporting Countries (OAPEC), led by Saudi Arabia, proclaimed an oil embargo. The embargo was targeted at nations that had supported Israel during the Yom Kippur War. The initial nations targeted were Canada, Japan, the Netherlands, the United Kingdom and the United States, though the embargo also later extended to Portugal, Rhodesia and South Africa. By the end of the embargo in March 1974, the price of oil had risen nearly 300%, from US$3 per barrel ($19/m3) to nearly $12 per barrel ($75/m3) globally; US prices were significantly higher. The embargo caused an oil crisis, or "shock", with many short- and long-term effects on global politics and the global economy. It was later called the "first oil shock", followed by the 1979 oil crisis, termed the "second oil shock".

The National Energy Program was an energy policy of the Canadian federal government from 1980 to 1985. Created under the Liberal government of Prime Minister Pierre Trudeau by Energy Minister Marc Lalonde in 1980, the program was administered by the Department of Energy, Mines and Resources. Introduced following the oil crises and stagflation of the 1970s, the NEP proved to be a highly controversial policy initiative that pitted centralized economic nationalism and federal aspirations of energy self-sufficiency against provincial jurisdiction with hundreds of billions of dollars in oil revenue at stake. The result was a dispute that sparked intense opposition and anger in Canada's West, particularly in Alberta, and the rise of the Reform Party, a development that would shape Canadian politics for years to come.

Trade can be a key factor in economic development. The prudent use of trade can boost a country's development and create absolute gains for the trading partners involved. Trade has been touted as an important tool in the path to development by prominent economists. However trade may not be a panacea for development as important questions surrounding how free trade really is and the harm trade can cause domestic infant industries to come into play.

Ahmed Zaki Yamani was a Saudi Arabian politician who served as Minister of Petroleum and Mineral Resources from 1962 to 1986, and a minister in the Organization of the Petroleum Exporting Countries (OPEC) for 25 years. With degrees from institutions including New York University School of Law, Harvard Law School, and a doctorate from the University of Exeter, Yamani became a close adviser to the Saudi government in 1958 and then became oil minister in 1962. He is known for his role during the 1973 oil embargo, when he spurred OPEC to quadruple the price of crude oil.

Since 1870, there have been several formal attempts to restrict the copper output and raise, in this form, its price.

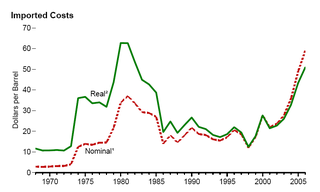

The price of oil, or the oil price, generally refers to the spot price of a barrel of benchmark crude oil—a reference price for buyers and sellers of crude oil such as West Texas Intermediate (WTI), Brent Crude, Dubai Crude, OPEC Reference Basket, Tapis crude, Bonny Light, Urals oil, Isthmus and Western Canadian Select (WCS). Oil prices are determined by global supply and demand, rather than any country's domestic production level.

The Gas Exporting Countries Forum (GECF) is an intergovernmental organization currently comprising 19 Member Countries of the world's leading natural gas producers: Algeria, Bolivia, Egypt, Equatorial Guinea, Iran, Libya, Nigeria, Qatar, Russia, Trinidad and Tobago, Venezuela are members and Angola, Azerbaijan, Iraq, Mozambique, Malaysia, Norway, Peru and the United Arab Emirates are observers. GECF members together control over 71% of the world's natural proven gas reserves, 44% of its marketed production, 53% of the pipeline, and 57% of the liquefied natural gas (LNG) exports across the globe. It is headquartered in Doha, Qatar.

Russia's energy policy which is set out in the government's Energy Strategy document, first approved in 2000, which sets out the government's policy to 2020. The Energy Strategy outlines several key priorities: an increase in energy efficiency, reducing the impact on the environment, sustainable development, energy development and technological development, as well as improved effectiveness and competitiveness. Greenhouse gas emissions by Russia are large because of its energy policy. Russia, one of the world's energy superpowers, is rich in natural energy resources, the world's leading net energy exporter, and a major supplier to the European Union. While Russia has also signed and ratified the Kyoto Protocol numerous scholars note that Russia uses its energy exports as a foreign policy instrument towards other countries.

The Vuskovic Plan was the basis for the economic policy of the Popular Unity (UP) government of Chilean President Salvador Allende. It was drafted by and named after his first Economics Minister Pedro Vuskovic, who had worked before with the CEPAL. Although good results were obtained in 1970, hyperinflation made a comeback in 1972. By 1973, Chile was in shambles – inflation was hundreds of percents, the country had no foreign reserves, and GDP was falling.

Megacorpstate is a form of market structure that designs new strategies to systematize the cartel power in the world. This particular market framework consists of oligopolistic interdependent nations-states and multinational corporations, which have established alliance to own majority of the market power. The most prominent organizations within the structure are OPEC and the Seven Sisters that include Exxon, Mobil, Socal, Royal Dutch-Shell, BP, Texaco and Gulf. Regardless of its great influence, Megacorpstate does not have a major recognition in the world. The main reason for its unfamiliarity is its disinclination to characterize itself as a separate market structure.

Venezuela has the world's largest proven oil reserves at an estimated 304 billion barrels as of 2020. The country used to be one of the world's largest exporters of oil, but the oil industry saw a significant decline since its peak in 2012.

The Organisation of Rice Exporting Countries (OREC) describes a project of a small group of South-East Asian countries to create a homonymous organisation. The group is made up, in alphabetical order, of Cambodia, Laos, Myanmar, Thailand and Vietnam. The project came to the attention of international media after remarks made publicly by Thailand's Prime Minister Samak Sundaravej on the 30th April 2008.

The OPEC Fund for International Development is an intergovernmental development finance institution established in 1976 by the member states of the Organization of the Petroleum Exporting Countries (OPEC). The OPEC Fund was conceived at the Conference of the Sovereigns and Heads of State of OPEC Member Countries, which was held in Algiers, Algeria, in March 1975. A Solemn Declaration of the Conference "reaffirmed the natural solidarity which unites OPEC countries with other developing countries in their struggle to overcome underdevelopment", and called for measures to strengthen cooperation between these countries.

An international commodity agreement is an undertaking by a group of countries to stabilize trade, supplies, and prices of a commodity for the benefit of participating countries. An agreement usually involves a consensus on quantities traded, prices, and stock management. A number of international commodity agreements serve solely as forums for information exchange, analysis, and policy discussion.

The 1970s energy crisis occurred when the Western world, particularly the United States, Canada, Western Europe, Australia, and New Zealand, faced substantial petroleum shortages as well as elevated prices. The two worst crises of this period were the 1973 oil crisis and the 1979 energy crisis, when, respectively, the Yom Kippur War and the Iranian Revolution triggered interruptions in Middle Eastern oil exports.

Nadim al-Pachachi was the Secretary-General of OPEC from January 1971 until December 1972. Born in Baghdad during the Ottoman Empire, he received a doctorate in petroleum engineering and worked in the Rumalia oil fields as a young man. He served as the Minister of Economy in the Iraqi government from 1952 until 1957. He was arrested during the 14 July Revolution in 1958.

The No Oil Producing and Exporting Cartels Act (NOPEC) was a U.S. Congressional bill, never enacted, known as H.R. 2264 and then as part of H.R. 6074. NOPEC was designed to remove the state immunity shield and to allow the international oil cartel, OPEC, and its national oil companies to be sued under U.S. antitrust law for anti-competitive attempts to limit the world's supply of petroleum and the consequent impact on oil prices. Despite popular sentiment against OPEC, legislative proposals to limit the organization's sovereign immunity have so far been unsuccessful. "Varied forms of a NOPEC bill have been introduced some 16 times since 2000, only to be vehemently resisted by the oil industry and its allied oil interests like the American Petroleum Institute and their legion of “K” Street Lobbyists."