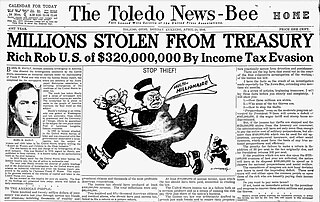

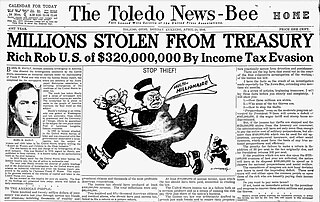

Tax avoidance is the legal usage of the tax regime in a single territory to one's own advantage to reduce the amount of tax that is payable by means that are within the law. A tax shelter is one type of tax avoidance, and tax havens are jurisdictions that facilitate reduced taxes. Tax avoidance should not be confused with tax evasion, which is illegal. Both tax evasion and tax avoidance can be viewed as forms of tax noncompliance, as they describe a range of activities that intend to subvert a state's tax system.

A law firm is a business entity formed by one or more lawyers to engage in the practice of law. The primary service rendered by a law firm is to advise clients about their legal rights and responsibilities, and to represent clients in civil or criminal cases, business transactions, and other matters in which legal advice and other assistance are sought.

Baker McKenzie is one of the largest international law firms, headquartered in Chicago. Founded in 1949 under the name Baker & McKenzie, it has 77 offices in 46 countries and employs 4,809 attorneys and approximately 13,000 employees.

Greenberg Traurig is a multinational law and lobbying firm founded in Miami in 1967 by Mel Greenberg, Larry J. Hoffman, and Robert H. Traurig.

Bryan Cave Leighton Paisner LLP (BCLP) is an international law firm with 31 offices worldwide. BCLP is headquartered in St Louis, Missouri. BCLP claims specialisms in Real Estate, Tax, Finance, Corporate, Litigation & Corporate Risk and Transactions.

Quinn Emanuel Urquhart & Sullivan, LLP is an American white shoe law firm headquartered in Los Angeles, California. The firm employs approximately 1,000 attorneys throughout 35 offices around the world.

Dykema Gossett PLLC, is an American full-service law firm. Founded and headquartered in Detroit, it has offices in various locations around the United States including California, Illinois, Michigan, Minnesota, Texas, Washington, D.C., and Wisconsin. Dykema's largest office is in Chicago but its combined Southeast Michigan offices are collectively larger. As of 2020, it was the 118th largest law firm in the nation.

Sidley Austin LLP is an American multinational law firm with approximately 2,300 lawyers in 21 offices worldwide. It was established in 1866 and its headquarters is at One South Dearborn in Chicago's Loop. It is one of the largest law firms in the world in terms of revenue. Among its alumni are former President Barack Obama and former First Lady Michelle Obama.

The KPMG tax shelter fraud scandal involved illegal U.S. tax shelters by KPMG that were exposed beginning in 2003. In early 2005, the United States member firm of KPMG International, KPMG LLP, was accused by the United States Department of Justice of fraud in marketing abusive tax shelters.

Howrey LLP was a global law firm that practiced antitrust, global litigation and intellectual property law. At its peak Howrey had more than 700 attorneys in 17 locations worldwide.

Winston & Strawn LLP is an international law firm headquartered in Chicago. It has more than 900 attorneys spread across ten offices in the United States and six offices in Europe, Asia and South America. Founded in 1853, it is one of the largest and oldest law firms in Chicago.

The United States Department of Justice Tax Division is responsible for the prosecution of both civil and criminal cases arising under the Internal Revenue Code and other tax laws of the United States. The Division began operation in 1934, under United States Attorney General Homer Stille Cummings, who charged it with primary responsibility for supervising all federal litigation involving internal revenue.

Snell & Wilmer is an American law firm based in Phoenix, Arizona. Founded in 1938, Snell & Wilmer is a full-service business law firm with more than 500 attorneys practicing in 16 locations throughout the United States and in Mexico, including Los Angeles, Orange County and San Diego, California; Phoenix and Tucson, Arizona; Denver, Colorado; Washington, D.C.; Boise, Idaho; Las Vegas and Reno, Nevada; Albuquerque, New Mexico; Portland, Oregon; Dallas, Texas; Salt Lake City, Utah; Seattle, Washington; and Los Cabos, Mexico. The firm represents clients ranging from large, publicly traded corporations to small businesses, individuals, and entrepreneurs. Barbara J. Dawson is the chair.

Parker Chapin Flattau & Klimpl was a New York City-based law firm that practiced from 1934 to 2001, when it merged with Dallas-based Jenkens & Gilchrist. It was a prominent mid-sized New York firm, often called a corporate and securities boutique because of its highly regarded middle market securities practice which also embraced securities litigation and arbitration. Its securities clients, according to electronic filings with the Securities and Exchange Commission, included Sbarro, Sotheby's and Logitech.

Son of BOSS is a type of tax shelter used in the United States, one that was designed and promoted by tax advisors in the 1990s to reduce federal income tax obligations on capital gains from the sale of a business or other appreciated asset. Its informal name comes from the name of an earlier tax shelter, BOSS, which it somewhat resembles. There were at least 7 legal cases still under way at the end of 2016.

Under the federal law of the United States of America, tax evasion or tax fraud is the purposeful illegal attempt of a taxpayer to evade assessment or payment of a tax imposed by Federal law. Conviction of tax evasion may result in fines and imprisonment. Compared to other countries, Americans are more likely to pay their taxes on time and law-abidingly.

Irma Carrillo Ramirez is an American lawyer and jurist serving as a United States circuit judge of the United States Court of Appeals for the Fifth Circuit. She previously served as a United States magistrate judge of the United States District Court for the Northern District of Texas from 2002 to 2023. She is a former nominee to be a United States district judge of the United States District Court for the Northern District of Texas.

Reid Collins & Tsai LLP is a national trial law firm with offices in New York, Austin, Dallas, Wilmington, and Washington, D.C. The firm represents plaintiffs in complex commercial litigation on a mixed-fee or contingency-fee basis.

Troutman Pepper Hamilton Sanders LLP, known as Troutman Pepper, is an American law firm with more than 1,200 attorneys located in 23 U.S. cities. In terms of revenue, Troutman Pepper placed 47th on The American Lawyer's 2022 AmLaw 100 rankings of U.S. law firms, with $1,029,503,000 in gross revenue in 2021.