Related Research Articles

The Goldman Sachs Group, Inc. is an American multinational investment bank and financial services company. Founded in 1869, Goldman Sachs is headquartered in Lower Manhattan in New York City, with regional headquarters in many international financial centers. Goldman Sachs is the second largest investment bank in the world by revenue and is ranked 55th on the Fortune 500 list of the largest United States corporations by total revenue. In Forbes Global 2000 2023, Goldman Sachs ranked 34th. It is considered a systemically important financial institution by the Financial Stability Board.

Joshua Brewster Bolten is an American lawyer and politician. Bolten served as the White House chief of staff to U.S. president George W. Bush, replacing Andrew Card on April 14, 2006. Previously, he served as the director of the Office of Management and Budget from 2003 to 2006.

A collateralized debt obligation (CDO) is a type of structured asset-backed security (ABS). Originally developed as instruments for the corporate debt markets, after 2002 CDOs became vehicles for refinancing mortgage-backed securities (MBS). Like other private label securities backed by assets, a CDO can be thought of as a promise to pay investors in a prescribed sequence, based on the cash flow the CDO collects from the pool of bonds or other assets it owns. Distinctively, CDO credit risk is typically assessed based on a probability of default (PD) derived from ratings on those bonds or assets.

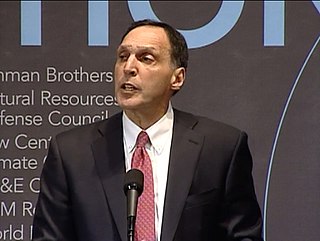

Richard Severin Fuld Jr. is an American banker best known as the final chairman and chief executive officer of investment bank Lehman Brothers. Fuld held this position from 1 April 1994 after the firm's spinoff from American Express until 15 September 2008. Lehman Brothers filed for bankruptcy protection under Chapter 11 on September 15, 2008, and subsequently announced the sale of major operations to parties including Barclays Bank and Nomura Securities.

John Howard Dalton is an American politician and investor. Dalton was Secretary of the Navy from July 22, 1993, to November 16, 1998.

Lloyd Craig Blankfein is an American investment banker who has served as senior chairman of Goldman Sachs since 2019, and chairman and chief executive from 2006 until the end of 2018. Before leading Goldman Sachs, he was the company's president and chief operating officer (COO) from 2004 to 2006, serving under then-CEO Henry Paulson.

The American subprime mortgage crisis was a multinational financial crisis that occurred between 2007 and 2010 that contributed to the 2007–2008 global financial crisis. The crisis led to a severe economic recession, with millions losing their jobs and many businesses going bankrupt. The U.S. government intervened with a series of measures to stabilize the financial system, including the Troubled Asset Relief Program (TARP) and the American Recovery and Reinvestment Act (ARRA).

An asset-backed securities index is a curated list of asset-backed security exposures that is used for performance bench-marking or trading.

John Alfred Paulson is an American billionaire hedge fund manager. He leads Paulson & Co., a New York–based investment management firm he founded in 1994. He has been called "one of the most prominent names in high finance", and "a man who made one of the biggest fortunes in Wall Street history."

A synthetic CDO is a variation of a CDO that generally uses credit default swaps and other derivatives to obtain its investment goals. As such, it is a complex derivative financial security sometimes described as a bet on the performance of other mortgage products, rather than a real mortgage security. The value and payment stream of a synthetic CDO is derived not from cash assets, like mortgages or credit card payments – as in the case of a regular or "cash" CDO—but from premiums paying for credit default swap "insurance" on the possibility of default of some defined set of "reference" securities—based on cash assets. The insurance-buying "counterparties" may own the "reference" securities and be managing the risk of their default, or may be speculators who've calculated that the securities will default.

Michael James Burry is an American investor and hedge fund manager. He founded the hedge fund Scion Capital, which he ran from 2000 until 2008 before closing it to focus on his personal investments. He is best known for being among the first investors to predict and profit from the subprime mortgage crisis that occurred between 2007 and 2010.

Magnetar Capital is a hedge fund based in Evanston, Illinois. The firm was founded in 2005 and invests in fixed-income, energy, quantitative, and event-driven strategies. The firm was actively involved in the collateralized debt obligation (CDO) market during the 2006–2007 period. In some articles critical of Magnetar Capital, the firm's arbitrage strategy for CDOs is described as the "Magnetar trade".

Paulson & Co., Inc. is a family office based in New York City. Previously, it was a hedge fund established by John Paulson in 1994. Specializing in "global mergers, event arbitrage, and credit strategies", the firm had a relatively low profile on Wall Street until its hugely successful bet against the subprime mortgage market in 2007. At one time the company had offices in London and Dublin.

Richard Cayne Perry is an American hedge fund manager whose firm, Perry Capital LLC invested in several companies and, starting in 2012, owned a controlling interest in Barneys New York. Perry sold his controlling interest in Barneys New York in August 2019.

Pine River Capital Management is an American asset management firm based in Minnetonka, MN. The firm traded its investors funds using stocks, fixed income, derivatives and warrants.

Anthony Noto is an American businessman, the CEO of SoFi, and the former COO of Twitter.

Stefano Alberto Bonfiglio is an Italian businessman, the co-founder and managing partner of Stirling Square Capital Partners, a London-based private equity firm that invests in companies valued between €50 million and €500 million.

Goldman Sachs, an investment bank, has been the subject of controversies. The company has been criticized for lack of ethical standards, working with dictatorial regimes, close relationships with the U.S. federal government via a "revolving door" of former employees, and driving up prices of commodities through futures speculation. It has also been criticized by its employees for 100-hour work weeks, high levels of employee dissatisfaction among first-year analysts, abusive treatment by superiors, a lack of mental health resources, and extremely high levels of stress in the workplace leading to physical discomfort.

Pretium Partners, LLC (Pretium) is an American alternative investment firm headquartered in New York City. The firm focuses on investments in residential real estate as well as Corporate and Structured Credit.

References

- ↑ "Joshua Birnbaum | C-SPAN.org". www.c-span.org. Retrieved 2024-02-09.

- 1 2 Cohan, William (2011). Money and Power: How Goldman Sachs Came to Rule the World. USA: Knopf Doubleday Publishing Group. pp. 466–468. ISBN 978-0-7679-2826-7.

- 1 2 3 Peltz, Michael (10 July 2014). "Josh Birnbaum's Talent: Identifying Cheap Options". Institutional Investor. Retrieved 21 December 2018.

- ↑ Sorkin, Andrew Ross (6 June 2011). "The Fine Print of Goldman's Subprime Bet". New York Times . Retrieved 21 December 2018.

- ↑ Gapper, John (8 April 2011). "The squid and the Whale". Financial Times . Retrieved 21 December 2018.

- ↑ Comstock, Courtney (15 April 2011). "Josh Birnbaum Made $10 Million At Goldman And Left Because It Wasn't Enough". Business Insider . Retrieved 21 December 2018.