Related Research Articles

Econometrica is a peer-reviewed academic journal of economics, publishing articles in many areas of economics, especially econometrics. It is published by Wiley-Blackwell on behalf of the Econometric Society. The current editor-in-chief is Guido Imbens.

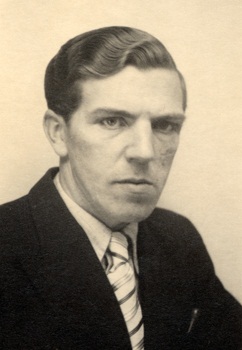

Sir Clive William John Granger was a British econometrician known for his contributions to nonlinear time series analysis. He taught in Britain, at the University of Nottingham and in the United States, at the University of California, San Diego. Granger was awarded the Nobel Memorial Prize in Economic Sciences in 2003 in recognition of the contributions that he and his co-winner, Robert F. Engle, had made to the analysis of time series data. This work fundamentally changed the way in which economists analyse financial and macroeconomic data.

In econometrics, the autoregressive conditional heteroskedasticity (ARCH) model is a statistical model for time series data that describes the variance of the current error term or innovation as a function of the actual sizes of the previous time periods' error terms; often the variance is related to the squares of the previous innovations. The ARCH model is appropriate when the error variance in a time series follows an autoregressive (AR) model; if an autoregressive moving average (ARMA) model is assumed for the error variance, the model is a generalized autoregressive conditional heteroskedasticity (GARCH) model.

In economics, a model is a theoretical construct representing economic processes by a set of variables and a set of logical and/or quantitative relationships between them. The economic model is a simplified, often mathematical, framework designed to illustrate complex processes. Frequently, economic models posit structural parameters. A model may have various exogenous variables, and those variables may change to create various responses by economic variables. Methodological uses of models include investigation, theorizing, and fitting theories to the world.

Trygve Magnus Haavelmo, born in Skedsmo, Norway, was an economist whose research interests centered on econometrics. He received the Nobel Memorial Prize in Economic Sciences in 1989.

Robert Fry Engle III is an American economist and statistician. He won the 2003 Nobel Memorial Prize in Economic Sciences, sharing the award with Clive Granger, "for methods of analyzing economic time series with time-varying volatility (ARCH)".

Financial econometrics is the application of statistical methods to financial market data. Financial econometrics is a branch of financial economics, in the field of economics. Areas of study include capital markets, financial institutions, corporate finance and corporate governance. Topics often revolve around asset valuation of individual stocks, bonds, derivatives, currencies and other financial instruments.

The Granger causality test is a statistical hypothesis test for determining whether one time series is useful in forecasting another, first proposed in 1969. Ordinarily, regressions reflect "mere" correlations, but Clive Granger argued that causality in economics could be tested for by measuring the ability to predict the future values of a time series using prior values of another time series. Since the question of "true causality" is deeply philosophical, and because of the post hoc ergo propter hoc fallacy of assuming that one thing preceding another can be used as a proof of causation, econometricians assert that the Granger test finds only "predictive causality". Using the term "causality" alone is a misnomer, as Granger-causality is better described as "precedence", or, as Granger himself later claimed in 1977, "temporally related". Rather than testing whether Xcauses Y, the Granger causality tests whether X forecastsY.

Cointegration is a statistical property of a collection (X1, X2, ..., Xk) of time series variables. First, all of the series must be integrated of order d (see Order of integration). Next, if a linear combination of this collection is integrated of order less than d, then the collection is said to be co-integrated. Formally, if (X,Y,Z) are each integrated of order d, and there exist coefficients a,b,c such that aX + bY + cZ is integrated of order less than d, then X, Y, and Z are cointegrated. Cointegration has become an important property in contemporary time series analysis. Time series often have trends—either deterministic or stochastic. In an influential paper , Charles Nelson and Charles Plosser (1982) provided statistical evidence that many US macroeconomic time series (like GNP, wages, employment, etc.) have stochastic trends.

Vector autoregression (VAR) is a statistical model used to capture the relationship between multiple quantities as they change over time. VAR is a type of stochastic process model. VAR models generalize the single-variable (univariate) autoregressive model by allowing for multivariate time series. VAR models are often used in economics and the natural sciences.

Tim Peter Bollerslev is a Danish economist, currently the Juanita and Clifton Kreps Professor of Economics at Duke University. A fellow of the Econometric Society, Bollerslev is known for his ideas for measuring and forecasting financial market volatility and for the GARCH model.

Sir David Forbes Hendry, FBA CStat is a British econometrician, currently a professor of economics and from 2001 to 2007 was head of the Economics Department at the University of Oxford. He is also a professorial fellow at Nuffield College, Oxford.

An error correction model (ECM) belongs to a category of multiple time series models most commonly used for data where the underlying variables have a long-run common stochastic trend, also known as cointegration. ECMs are a theoretically-driven approach useful for estimating both short-term and long-term effects of one time series on another. The term error-correction relates to the fact that last-period's deviation from a long-run equilibrium, the error, influences its short-run dynamics. Thus ECMs directly estimate the speed at which a dependent variable returns to equilibrium after a change in other variables.

In statistics, the Johansen test, named after Søren Johansen, is a procedure for testing cointegration of several, say k, I(1) time series. This test permits more than one cointegrating relationship so is more generally applicable than the Engle–Granger test which is based on the Dickey–Fuller test for unit roots in the residuals from a single (estimated) cointegrating relationship.

The methodology of econometrics is the study of the range of differing approaches to undertaking econometric analysis.

John Denis Sargan, FBA was a British econometrician who specialized in the analysis of economic time-series.

Søren Johansen is a Danish statistician and econometrician who is known for his contributions to the theory of cointegration. He is currently a professor at the Department of Economics, University of Copenhagen and in the Center for Research in Econometric Analysis of Time Series (CREATES) of the Aarhus University. He has previously held positions at the Department of Statistics, University of Copenhagen, and the European University Institute in Florence.

Helmut Lütkepohl is a German econometrician specializing in time series analysis. Since January 2012, he has been Bundesbank Professor in the field of "Methods of Empirical Economics" at the Free University of Berlin and Dean of the Graduate Center at the German Institute for Economic Research.

Katarina Juselius is professor Emeritus of econometrics and empirical economics at the University of Copenhagen. Her work has been on empirical macro models and associated issues.

Jean-François Richard is a Belgian-American economist, who is currently the distinguished university professor of Economics at the University of Pittsburgh. He has taught and done research at five major universities, primarily in the field of econometrics. His interests are auctions, computational methods, collusions, Bayesian methods and econometric modeling. He has been extensively involved as author, editor, and advisor with scholarly publications in econometrics and related fields.

References

- Favero, Carlo A. (2001). Applied Macroeconometrics. New York: Oxford University Press. pp. 132–161. ISBN 978-0-19-829685-0.

- Davis, G. C. (2005). "Clarifying the 'puzzle' between the Textbook and LSE approaches to econometrics: A comment on Cook's Kuhnian perspective on econometric modelling". Journal of Economic Methodology . 12 (1): 93–115. doi:10.1080/1350178042000330913.

- Gilbert, Christopher L. (1989). "LSE and the British approach to time series econometrics". Oxford Economic Papers. 41 (1): 108–128. doi:10.1093/oxfordjournals.oep.a041887. JSTOR 2663185.

- Juselius, Katarina (1999). "Models and Relations in Economics and Econometrics" (PDF). Journal of Economic Methodology . 6 (2): 259–290. doi:10.1080/13501789900000017.