Related Research Articles

In mathematics, a time series is a series of data points indexed in time order. Most commonly, a time series is a sequence taken at successive equally spaced points in time. Thus it is a sequence of discrete-time data. Examples of time series are heights of ocean tides, counts of sunspots, and the daily closing value of the Dow Jones Industrial Average.

gretl is an open-source statistical package, mainly for econometrics. The name is an acronym for GnuRegression, Econometrics and Time-seriesLibrary.

EViews is a statistical package for Windows, used mainly for time-series oriented econometric analysis. It is developed by Quantitative Micro Software (QMS), now a part of IHS. Version 1.0 was released in March 1994, and replaced MicroTSP. The TSP software and programming language had been originally developed by Robert Hall in 1965. The current version of EViews is 13, released in August 2022.

In statistics, the Durbin–Watson statistic is a test statistic used to detect the presence of autocorrelation at lag 1 in the residuals from a regression analysis. It is named after James Durbin and Geoffrey Watson. The small sample distribution of this ratio was derived by John von Neumann. Durbin and Watson applied this statistic to the residuals from least squares regressions, and developed bounds tests for the null hypothesis that the errors are serially uncorrelated against the alternative that they follow a first order autoregressive process. Note that the distribution of this test statistic does not depend on the estimated regression coefficients and the variance of the errors.

JMulTi is an open-source interactive software for econometric analysis, specialised in univariate and multivariate time series analysis. It has a Java graphical user interface.

RATS, an abbreviation of Regression Analysis of Time Series, is a statistical package for time series analysis and econometrics. RATS is developed and sold by Estima, Inc., located in Evanston, IL.

The following tables compare general and technical information for a number of statistical analysis packages.

Ox is an object-oriented matrix programming language with a mathematical and statistical function library, developed by Jurgen Doornik. It has been designed for econometric programming. It is available for Windows, Mac OS X and Linux platforms.

Sir David Forbes Hendry, FBA CStat is a British econometrician, currently a professor of economics and from 2001 to 2007 was head of the economics department at the University of Oxford. He is also a professorial fellow at Nuffield College, Oxford.

Neil Shephard, FBA, is an econometrician, currently Frank B. Baird Jr., Professor of Science in the Department of Economics and the Department of Statistics at Harvard University.

TSP is a programming language for the estimation and simulation of econometric models. TSP stands for "Time Series Processor", although it is also commonly used with cross section and panel data. The program was initially developed by Robert Hall during his graduate studies at Massachusetts Institute of Technology in the 1960s. The company behind the program is TSP International which was founded in 1978 by Bronwyn H. Hall, Robert Hall's wife. After their divorce in April 1983, the asset of TSP was split into two versions, and subsequently the two versions have diverged in terms of interface and types of subroutines included. One version is TSP, still developed by TSP International. The other version, initially named MicroTSP, is now named EViews, developed by Quantitative Micro Software.

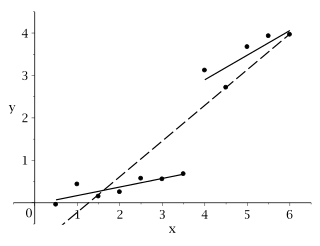

In econometrics and statistics, a structural break is an unexpected change over time in the parameters of regression models, which can lead to huge forecasting errors and unreliability of the model in general. This issue was popularised by David Hendry, who argued that lack of stability of coefficients frequently caused forecast failure, and therefore we must routinely test for structural stability. Structural stability − i.e., the time-invariance of regression coefficients − is a central issue in all applications of linear regression models.

James Durbin FBA was a British statistician and econometrician, known particularly for his work on time series analysis and serial correlation.

The methodology of econometrics is the study of the range of differing approaches to undertaking econometric analysis.

LIMDEP is an econometric and statistical software package with a variety of estimation tools. In addition to the core econometric tools for analysis of cross sections and time series, LIMDEP supports methods for panel data analysis, frontier and efficiency estimation and discrete choice modeling. The package also provides a programming language to allow the user to specify, estimate and analyze models that are not contained in the built in menus of model forms.

NLOGIT is an extension of the econometric and statistical software package LIMDEP. In addition to the estimation tools in LIMDEP, NLOGIT provides programs for estimation, model simulation and analysis of multinomial choice data, such as brand choice, transportation mode and for survey and market data in which consumers choose among a set of competing alternatives.

The LSE approach to econometrics, named for the London School of Economics, involves viewing econometric models as reductions from some unknown data generation process (DGP). A complex DGP is typically modelled as the starting point and this complexity allows information in the data from the real world but absent in the theory to be drawn upon. The complexity is then reduced by the econometrician by a series of restrictions which are tested.

Bent Nielsen is a professorial fellow in economics at Nuffield College, University of Oxford. Nielsen has research interests in econometrics and financial economics: time series, outlier detection, and cohort analysis. Nielsen completed his Ph.D. at the University of Copenhagen.

References

- Durbin, J.; Koopman, S. J. (2012). Time Series Analysis by State Space Methods (Second ed.). Oxford University Press.

- Hendry, D. F.; Nielsen, B. (2007). Econometric Modeling: A Likelihood Approach. Princeton University Press.

- Renfro, C. (2004). "Econometric software: The first fifty years in perspective" (PDF). Journal of Economic and Social Measurement. 29: 9–107.