Oil sands, tar sands, crude bitumen, or bituminous sands, are a type of unconventional petroleum deposit. Oil sands are either loose sands or partially consolidated sandstone containing a naturally occurring mixture of sand, clay, and water, soaked with bitumen, a dense and extremely viscous form of petroleum.

The Athabasca oil sands, also known as the Athabasca tar sands, are large deposits of bitumen, a heavy and viscous form of petroleum, located in northeastern Alberta, Canada. These reserves are one of the largest sources of unconventional oil in the world, making Canada a significant player in the global energy market.

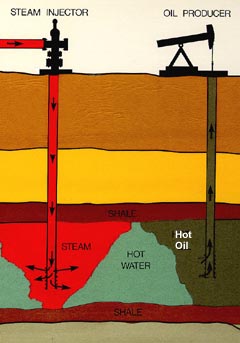

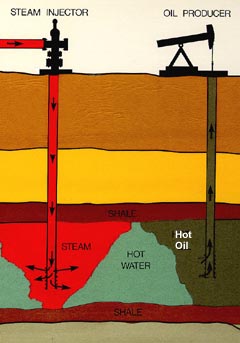

Steam-assisted gravity drainage is an enhanced oil recovery technology for producing heavy crude oil and bitumen. It is an advanced form of steam stimulation in which a pair of horizontal wells are drilled into the oil reservoir, one a few metres above the other. High pressure steam is continuously injected into the upper wellbore to heat the oil and reduce its viscosity, causing the heated oil to drain into the lower wellbore, where it is pumped out. Dr. Roger Butler, engineer at Imperial Oil from 1955 to 1982, invented the steam assisted gravity drainage (SAGD) process in the 1970s. Butler "developed the concept of using horizontal pairs of wells and injected steam to develop certain deposits of bitumen considered too deep for mining". In 1983 Butler became director of technical programs for the Alberta Oil Sands Technology and Research Authority (AOSTRA), a crown corporation created by Alberta Premier Lougheed to promote new technologies for oil sands and heavy crude oil production. AOSTRA quickly supported SAGD as a promising innovation in oil sands extraction technology.

Connacher Oil and Gas Limited is a Calgary-based exploration, development and production company active in the production and sale of bitumen in the Athabasca oil sands region. Connacher's shares used to trade on the Toronto Stock Exchange, but it was de-listed in 2016, after filing for insolvency.

Dilbit is a bitumen diluted with one or more lighter petroleum products, typically natural-gas condensates such as naphtha. Diluting bitumen makes it much easier to transport, for example in pipelines. Per the Alberta Oil Sands Bitumen Valuation Methodology, "Dilbit Blends" means "Blends made from heavy crudes and/or bitumens and a diluent, usually natural-gas condensate, for the purpose of meeting pipeline viscosity and density specifications, where the density of the diluent included in the blend is less than 800 kg/m3." If the diluent density is greater than or equal to 800 kg/m3, the diluent is typically synthetic crude and accordingly the blend is called synbit.

The Wood River Refinery is an oil refinery located in Roxana, Illinois, approximately 15 miles (24 km) north of St. Louis, Missouri, on the east side of the Mississippi River. The refinery is currently owned by Phillips 66 and Cenovus Energy and operated by the joint-venture company WRB Refining, LLC (WRB). WRB was formed on 1 July 2007, with Encana taking a 49% interest in Wood River and also Phillips 66's Borger refinery. Encana subsequently spun off oil sands producer Cenovus and ConocoPhillips spun off Phillips 66. In return for a 49% stake in the refinery, ConocoPhillips gained a joint interest in two Alberta oil sands (bitumen) heavy oil projects: Christina Lake (Alberta) and Foster Creek. ConocoPhillips’ interest was sold to Cenovus in May 2017, leaving Cenovus as the sole owner of the assets.

Canada's oil sands and heavy oil resources are among the world's great petroleum deposits. They include the vast oil sands of northern Alberta, and the heavy oil reservoirs that surround the small city of Lloydminster, which sits on the border between Alberta and Saskatchewan. The extent of these resources is well known, but better technologies to produce oil from them are still being developed.

The Kearl Oil Sands Project is an oil sands mine in the Athabasca Oil Sands region at the Kearl Lake area, about 70 kilometres (43 mi) north of Fort McMurray in Alberta, Canada that is operated by the 143-year old Calgary, Alberta-headquartered Imperial Oil Limited—one of the largest integrated oil companies in Canada. Kearl is owned by Imperial Oil and is controlled by Imperial's parent company, ExxonMobil—an American multinational that is one of the largest in the world.

Steam injection is an increasingly common method of extracting heavy crude oil. Used commercially since the 1960s, it is considered an enhanced oil recovery (EOR) method and is the main type of thermal stimulation of oil reservoirs. There are several different forms of the technology, with the two main ones being Cyclic Steam Stimulation and Steam Flooding. Both are most commonly applied to oil reservoirs, which are relatively shallow and which contain crude oils which are very viscous at the temperature of the native underground formation. Steam injection is widely used in the San Joaquin Valley of California (US), the Lake Maracaibo area of Venezuela, and the oil sands of northern Alberta, Canada.

Japan Canada Oil Sands Limited (JACOS) was an oil sands extraction company. It was the operator of the Hangingstone oil sands project. JACOS was acquired by Greenfire Resources Operating Corporation in 2021.

The Clearwater Formation is a stratigraphic unit of Early Cretaceous (Albian) age in the Western Canada Sedimentary Basin in northeastern Alberta, Canada. It was first defined by R.G. McConnell in 1893 and takes its name from the Clearwater River near Fort McMurray.

The McMurray Formation is a stratigraphic unit of Early Cretaceous age of the Western Canada Sedimentary Basin in northeastern Alberta. It takes the name from Fort McMurray and was first described from outcrops along the banks of the Athabasca River 5 kilometres (3.1 mi) north of Fort McMurray by F.H. McLearn in 1917. It is a well-studied example of fluvial to estuarine sedimentation, and it is economically important because it hosts most of the vast bitumen resources of the Athabasca Oil Sands region.

Although there are numerous oil companies operating in Canada, as of 2009, the majority of production, refining and marketing was done by fewer than 20 of them. According to the 2013 edition of Forbes Global 2000, canoils.com and any other list that emphasizes market capitalization and revenue when sizing up companies, as of March 31, 2014 these are the largest Canada-based oil and gas companies.

Petrobank was an oil exploration, development, and production company based in Calgary, Canada. It operates through 4 units/subsidiaries, PetroBakken Energy in Canada, Petrominerales Ltd in Peru and Colombia, HBU in the heavy crude oil business, and its technology unit Archon Technologies Ltd . In 1986 the company changed its name from Petrobank Energy Resources Ltd. to Petrobank Energy and Resources Ltd. Though it has a significant resource base its ten patents for heavy oil extracting technology are becoming increasingly valuable to the company. In December 2010 the company received permission from the government of Alberta to produce oil sands bitumen at a new location in Dawson using a technique known as fireflooding, the third Petrobank operation that will use it; the 50% interest in Dawson was acquired in October from Shell Canada.

The Long Lake oil sands upgrader project is an in situ oil extraction project near Anzac, Alberta, 40 km (25 mi) southeast of Fort McMurray in the Athabasca oil sands region of Alberta.

Athabasca Oil Corporation is a Canadian energy company with a focused strategy on the development of thermal and light oil assets. Situated in Alberta's Western Canadian Sedimentary Basin, the company has amassed a significant land base of extensive, high quality resources. Athabasca's common shares trade on the TSX under the symbol "ATH".

MEG Energy is a pure play Canadian oil sands producer engaged in exploration in Northern Alberta. All of its oil reserves are more than 1,000 feet (300 m) below the surface and so they depend on steam-assisted gravity drainage and associated technology to produce. The company's main thermal project is Christina Lake. 85-megawatt cogeneration plants are used to produce the steam used in SAGD which is required to bring bitumen to the surface. The excess heat and electricity produced at its plants is then sold to Alberta's power grid. Its proven reserves have been independently pegged at 1.7 billion barrels and probable reserves 3.7 billion barrels ; That's significant considering only 300 billion barrels of the 1.6 trillion barrels of bitumen in Alberta is considered recoverable under current technology. The value of those reserves is over $19.8 billion. CNOOC has a minority 16.69% interest in MEG Energy.

The Grosmont Formation is a stratigraphical unit of Frasnian age in the Western Canadian Sedimentary Basin.

Horizon Oil Sands is an oil sands mining and upgrading project in Bitumount, Alberta, Canada. The project includes a surface oil sands mining and bitumen extraction plant, complemented by on-site bitumen upgrading with associated infrastructure.

The Sturgeon Refinery also NWR Sturgeon Refinery is an 80,000 bbl/d (13,000 m3/d) crude oil upgrader—built and operated by North West Redwater Partnership (NWRP) in a public-private partnership with the Alberta provincial government. It is located in Sturgeon County northeast of Edmonton, Alberta, in Alberta's Industrial Heartland. Premier Jason Kenney announced on July 6, 2021, that the province of Alberta had acquired NWRP's equity stake, representing 50% of the $10-billion project, with the other 50% owned by Canadian Natural Resources.