Related Research Articles

Passive management is an investing strategy that tracks a market-weighted index or portfolio. Passive management is most common on the equity market, where index funds track a stock market index, but it is becoming more common in other investment types, including bonds, commodities and hedge funds.

Peter Lewyn Bernstein was an American financial historian, economist and educator whose evangelizing of the efficient-market hypothesis to the public made him one of the country's best known popularizers of academic finance.

James Joseph Cramer is an American television personality, author, entertainer, and former hedge fund manager. He is the host of Mad Money on CNBC, and an anchor on Squawk on the Street. After graduating from Harvard College and Harvard Law School, he worked for Goldman Sachs and then became a hedge fund manager, founder, and senior partner of Cramer Berkowitz. He co-founded TheStreet, which he wrote for from 1996 to 2021. Cramer hosted Kudlow & Cramer from 2002 to 2005. Mad Money with Jim Cramer first aired on CNBC in 2005. Cramer has written several books, including Confessions of a Street Addict (2002), Jim Cramer's Real Money: Sane Investing in an Insane World (2005), Jim Cramer's Mad Money: Watch TV, Get Rich (2006), and Jim Cramer's Get Rich Carefully (2013).

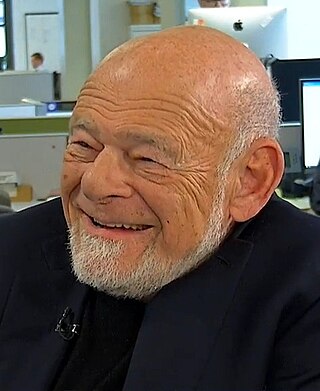

Samuel Zell was an American billionaire businessman and philanthropist primarily engaged in real estate investment. Companies founded by or controlled by Zell include Equity Residential, Equity International, EQ Office, Covanta, Tribune Media, and Anixter.

The Harvard University endowment, valued at $50.7 billion as of June 30, 2023, is the largest academic endowment in the world. Its value increased by over 10 billion dollars in fiscal year 2021, ending the year with its largest sum in history. Along with Harvard's pension assets, working capital, and non-cash gifts, the endowment is managed by Harvard Management Company, Inc. (HMC), a Harvard-owned investment management company.

Squawk Box is an American business news television program that airs from 6 to 9 a.m. Eastern time on CNBC. The program is co-hosted by Joe Kernen, Becky Quick, and Andrew Ross Sorkin. Since debuting in 1995, the show has spawned a number of versions across CNBC's international channels, many of which employ a similar format. The program title originates from a term used in investment banks and stock brokerages for a permanent voice circuit or intercom used to communicate stock deals or sales priorities. It also may refer to the squawk of a bird, like a peacock, which is the logo of CNBC.

Rebecca "Becky" Quick is an American television journalist/newscaster and co-anchorwoman of CNBC's financial news shows Squawk Box and On the Money.

Citadel LLC is an American multinational hedge fund and financial services company. Founded in 1990 by Ken Griffin, it has more than $63 billion in assets under management as of June 2024. The company has over 2,800 employees, with corporate headquarters in Miami, Florida, and offices throughout North America, Asia, and Europe. Founder, CEO and Co-CIO Griffin owns approximately 85% of the firm. As of December 2022, Citadel is one of the most profitable hedge funds in the world, posting $74 billion in net gains since its inception in 1990, making it the most successful hedge fund in history, according to CNBC.

Squawk on the Street, which debuted on December 19, 2005, is a business show on CNBC that follows the first 90 minutes of trading on Wall Street in the United States.

Anne Dias-Griffin is a French-American investor. She is the founder and chief executive officer of Aragon, an investment firm active in global equities, with a focus on the internet, technology, and consumer sectors, as well as alternative assets.

Kenneth Lawrence Fisher is an American billionaire investment analyst, author, and the founder and executive chairman of Fisher Investments, a fee-only financial adviser. Fisher's Forbes "Portfolio Strategy" column ran from 1984 to 2017, making him the longest continuously-running columnist in the magazine's history. Fisher is now known for writing monthly, native language columns in international outlets. Fisher has authored eleven books on investing, and research papers in the field of behavioral finance. In 2010, he was included in Investment Advisor magazine's "30 for 30" list of the 30 most influential people in the investment advisory business over the last 30 years. As of August 2024, his net worth was estimated at $11.2 billion.

Karen Lisa Finerman is an American businesswoman and television personality.

Denise Kay Shull is a performance coach who uses neuroeconomics and modern psychoanalysis in her work with hedge funds and professional athletes. She is also the founder of The ReThink Group. Shull focuses on the positive contribution of feelings and emotion in high-pressure decisions. She is the author of Market Mind Games which explains how Wall Street traders act out Freudian transferences in reaction to market moves. Shull postulates that human perception contains fractal elements in the same manner as the fractal geometry of nature.

Mark Spitznagel is an American investor and hedge fund manager. He is the founder, owner, and chief investment officer of Universa Investments, a hedge fund management firm based in Miami, Florida.

Co-founder of The Applied Finance Group, managing director at Applied Finance Advisors, and Co-founder Applied Finance Capital Management. Resendes was raised in Atwater, California and moved to Chicago, Illinois in 1989 after receiving his bachelor's degree.

Todd Anthony Combs is a former hedge fund manager and current investment manager at Berkshire Hathaway, who has been the chief executive officer (CEO) of GEICO since January 2020. Alongside Ted Weschler, he is frequently cited as a potential successor of Warren Buffett as the chief investment officer of Berkshire. In 2016, he was appointed board member of JPMorgan Chase.

Mary Callahan Erdoes is an American investment manager and businesswoman. She is the chief executive officer (CEO) of the asset and wealth management division of J.P. Morgan, serving since 2009. With the firm since 1996, she began her career as a portfolio manager, specializing in fixed income trading. From 2005 to 2009, she served as the CEO of the firm's private bank, advising wealthy families and institutions. Her career has led to her being described as the most powerful woman in American finance. She has been noted as a potential successor to Jamie Dimon, as CEO of JPMorgan Chase.

Maneet Ahuja is an American author, journalist, television news producer, and hedge fund specialist. She is a producer of CNBC's morning business news program, Squawk Box. Her 2012 book, The Alpha Masters: Unlocking the Genius of the World's Top Hedge Funds, was published by John Wiley & Sons and nominated for an FT / Goldman Sachs Book of the Year Award. Forbes named her to their "30 Under 30" list of media figures for 2012. Ahuja has also produced a number of business events including CNBC's Delivering Alpha conference, a hedge fund summit that she created and co-developed. Ahuja serves on the Council of Advocates for Mt. Sinai Hospital and is on the United Nations Commission on the Status of Women. Her next book is The Techtonics.

Byron Richard Wien was an American investor. After a long career as an executive at Morgan Stanley, he became vice chairman of Blackstone Advisory Partners, a subsidiary of The Blackstone Group. He was regarded as one of Wall Street's most prominent market strategists.

References

- ↑ John H. Christy (October 30, 2000). "Queen of Small Caps". Forbes Magazine.

- ↑ Meredith A. Jones (April 28, 2015). Women of The Street: Why Female Money Managers Generate Higher Returns (and How You Can Too). Palgrave Macmillan. pp. 29–. ISBN 978-1-137-46291-6.

- ↑ Raphael, Marc (2008). The Columbia history of Jews and Judaism in America. Colombia. p. 237.

- 1 2 Stewart, Janet Kidd (December 10, 2000). "Family History Helps Drive Leah Zell's Zeal For Success". Chicago Tribune. Archived from the original on July 1, 2018. Retrieved March 23, 2018.

- ↑ John F. Wasik (May 13, 2014). The Bear-Proof Investor: Prospering Safely in Any Market. Henry Holt and Company. pp. 137–. ISBN 978-1-4668-7102-1.

- ↑ "Harvard Board of Overseers Announces Election Results". Harvard University Gazette.

- 1 2 3 M. Jocelyn Armstrong; R. Warwick Armstrong; Kent Mulliner (October 12, 2012). Chinese Populations in Contemporary Southeast Asian Societies: Identities, Interdependence and International Influence. Routledge. pp. 245–. ISBN 978-1-136-12354-2.

- ↑ "Kiplinger's Personal Finance". Kiplinger's Personal Finance Magazine: 33–. July 2003. ISSN 1528-9729.

- ↑ "Two Wanger Stock-Pickers Join Crowd Leaving Industry". By Ian McDonald The Wall Street Journal Online, May 1, 2003

- ↑ "Zell sis takes ex-CEO digs in Trib Tower". Craine's, By: Eddie Baeb June 12, 2008

- ↑ "Bottom in Emerging Markets Near; Fund Manager". CNBC Squawk Box. August 28, 2013. Retrieved February 28, 2014.

- ↑ "Searching For Overseas Investment Bargins". CNBC What's Working. Retrieved March 2, 2014.

- ↑ "A Woman's Guide to Savvy Investing". Publishers Weekly

- ↑ "Leah Zell says private equity exits can be profitable". Financial Review, April 28, 2015

- ↑ "The Long and Short of Sohn London". Barron's By Jonathan Buck November 22, 2014

- ↑ "The Overlooked Small Cap Sector Merits Attention From Investors". By Jo Wrighton Staff Reporter of The Wall Street Journal, November 17, 2000