Microeconomics is a branch of mainstream economics that studies the behavior of individuals and firms in making decisions regarding the allocation of scarce resources and the interactions among these individuals and firms. Microeconomics focuses on the study of individual markets, sectors, or industries as opposed to the national economy as whole, which is studied in macroeconomics.

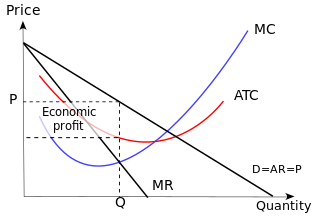

Monopolistic competition is a type of imperfect competition such that there are many producers competing against each other, but selling products that are differentiated from one another and hence are not perfect substitutes. In monopolistic competition, a company takes the prices charged by its rivals as given and ignores the impact of its own prices on the prices of other companies. If this happens in the presence of a coercive government, monopolistic competition will fall into government-granted monopoly. Unlike perfect competition, the company maintains spare capacity. Models of monopolistic competition are often used to model industries. Textbook examples of industries with market structures similar to monopolistic competition include restaurants, cereals, clothing, shoes, and service industries in large cities. The "founding father" of the theory of monopolistic competition is Edward Hastings Chamberlin, who wrote a pioneering book on the subject, Theory of Monopolistic Competition (1933). Joan Robinson published a book The Economics of Imperfect Competition with a comparable theme of distinguishing perfect from imperfect competition. Further work on monopolistic competition was undertaken by Dixit and Stiglitz who created the Dixit-Stiglitz model which has proved applicable used in the sub fields of international trade theory, macroeconomics and economic geography.

An oligopoly is a market in which control over an industry lies in the hands of a few large sellers who own a dominant share of the market. Oligopolistic markets have homogenous products, few market participants, and inelastic demand for the products in those industries. As a result of their significant market power, firms in oligopolistic markets can influence prices through manipulating the supply function. Firms in an oligopoly are also mutually interdependent, as any action by one firm is expected to affect other firms in the market and evoke a reaction or consequential action. As a result, firms in oligopolistic markets often resort to collusion as means of maximising profits.

In economics, industrial organization is a field that builds on the theory of the firm by examining the structure of firms and markets. Industrial organization adds real-world complications to the perfectly competitive model, complications such as transaction costs, limited information, and barriers to entry of new firms that may be associated with imperfect competition. It analyzes determinants of firm and market organization and behavior on a continuum between competition and monopoly, including from government actions.

Marketing is the process of identifying customers and "creating, communicating, delivering, and exchanging" goods and services for the satisfaction and retention of those customers. It is one of the primary components of business management and commerce.

Price discrimination is a microeconomic pricing strategy where identical or largely similar goods or services are sold at different prices by the same provider in different market segments. Price discrimination is distinguished from product differentiation by the more substantial difference in production cost for the differently priced products involved in the latter strategy. Price differentiation essentially relies on the variation in the customers' willingness to pay and in the elasticity of their demand. For price discrimination to succeed, a firm must have market power, such as a dominant market share, product uniqueness, sole pricing power, etc. All prices under price discrimination are higher than the equilibrium price in a perfectly competitive market. However, some prices under price discrimination may be lower than the price charged by a single-price monopolist. Price discrimination is utilised by the monopolist to recapture some deadweight loss. This Pricing strategy enables firms to capture additional consumer surplus and maximize their profits while benefiting some consumers at lower prices. Price discrimination can take many forms and is prevalent in many industries, from education and telecommunications to healthcare.

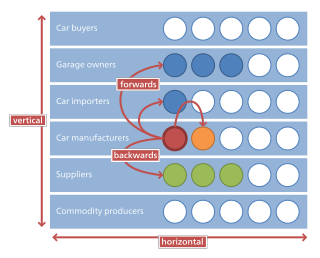

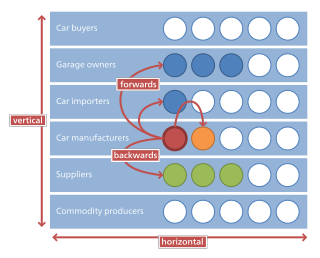

In microeconomics, management and international political economy, vertical integration is an arrangement in which the supply chain of a company is integrated and owned by that company. Usually each member of the supply chain produces a different product or (market-specific) service, and the products combine to satisfy a common need. It contrasts with horizontal integration, wherein a company produces several items that are related to one another. Vertical integration has also described management styles that bring large portions of the supply chain not only under a common ownership but also into one corporation.

Positioning refers to the place that a brand occupies in the minds of the customers and how it is distinguished from the products of the competitors. It is different from the concept of brand awareness. In order to position products or brands, companies may emphasize the distinguishing features of their brand or they may try to create a suitable image through the marketing mix. Once a brand has achieved a strong position, it can become difficult to reposition it. To effectively position a brand and create a lasting brand memory, brands need to be able to connect to consumers in an authentic way, creating a brand persona usually helps build this sort of connection.

In economics and marketing, product differentiation is the process of distinguishing a product or service from others to make it more attractive to a particular target market. This involves differentiating it from competitors' products as well as from a firm's other products. The concept was proposed by Edward Chamberlin in his 1933 book, The Theory of Monopolistic Competition.

In business, a competitive advantage is an attribute that allows an organization to outperform its competitors.

Porter's Five Forces Framework is a method of analysing the operating environment of a competition of a business. It draws from industrial organization (IO) economics to derive five forces that determine the competitive intensity and, therefore, the attractiveness of an industry in terms of its profitability. An "unattractive" industry is one in which the effect of these five forces reduces overall profitability. The most unattractive industry would be one approaching "pure competition", in which available profits for all firms are driven to normal profit levels. The five-forces perspective is associated with its originator, Michael E. Porter of Harvard University. This framework was first published in Harvard Business Review in 1979.

Porter's generic strategies describe how a company pursues competitive advantage across its chosen market scope. There are three/four generic strategies, either lower cost, differentiated, or focus. A company chooses to pursue one of two types of competitive advantage, either via lower costs than its competition or by differentiating itself along dimensions valued by customers to command a higher price. A company also chooses one of two types of scope, either focus or industry-wide, offering its product across many market segments. The generic strategy reflects the choices made regarding both the type of competitive advantage and the scope. The concept was described by Michael Porter in 1980.

In theories of competition in economics, a barrier to entry, or an economic barrier to entry, is a fixed cost that must be incurred by a new entrant, regardless of production or sales activities, into a market that incumbents do not have or have not had to incur. Because barriers to entry protect incumbent firms and restrict competition in a market, they can contribute to distortionary prices and are therefore most important when discussing antitrust policy. Barriers to entry often cause or aid the existence of monopolies and oligopolies, or give companies market power. Barriers of entry also have an importance in industries. First of all it is important to identify that some exist naturally, such as brand loyalty. Governments can also create barriers to entry to meet consumer protection laws, protecting the public. In other cases it can also be due to inherent scarcity of public resources needed to enter a market.

Managerial economics is a branch of economics involving the application of economic methods in the organizational decision-making process. Economics is the study of the production, distribution, and consumption of goods and services. Managerial economics involves the use of economic theories and principles to make decisions regarding the allocation of scarce resources. It guides managers in making decisions relating to the company's customers, competitors, suppliers, and internal operations.

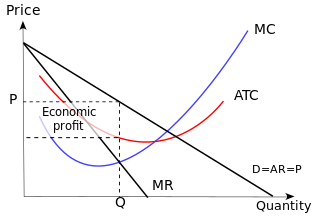

In economics, market power refers to the ability of a firm to influence the price at which it sells a product or service by manipulating either the supply or demand of the product or service to increase economic profit. In other words, market power occurs if a firm does not face a perfectly elastic demand curve and can set its price (P) above marginal cost (MC) without losing revenue. This indicates that the magnitude of market power is associated with the gap between P and MC at a firm's profit maximising level of output. The size of the gap, which encapsulates the firm's level of market dominance, is determined by the residual demand curve's form. A steeper reverse demand indicates higher earnings and more dominance in the market. Such propensities contradict perfectly competitive markets, where market participants have no market power, P = MC and firms earn zero economic profit. Market participants in perfectly competitive markets are consequently referred to as 'price takers', whereas market participants that exhibit market power are referred to as 'price makers' or 'price setters'.

Non-price competition is a marketing strategy "in which one firm tries to distinguish its product or service from competing products on the basis of attributes like design and workmanship". It often occurs in imperfectly competitive markets because it exists between two or more producers that sell goods and services at the same prices but compete to increase their respective market shares through non-price measures such as marketing schemes and greater quality. It is a form of competition that requires firms to focus on product differentiation instead of pricing strategies among competitors. Such differentiation measures allowing for firms to distinguish themselves, and their products from competitors, may include, offering superb quality of service, extensive distribution, customer focus, or any sustainable competitive advantage other than price. When price controls are not present, the set of competitive equilibria naturally correspond to the state of natural outcomes in Hatfield and Milgrom's two-sided matching with contracts model.

In economics, a location model or spatial model refers to any monopolistic competition model that demonstrates consumer preference for particular brands of goods and their locations. Examples of location models include Hotelling's Location Model, Salop's Circle Model, and hybrid variations.

Market structure, in economics, depicts how firms are differentiated and categorised based on the types of goods they sell (homogeneous/heterogeneous) and how their operations are affected by external factors and elements. Market structure makes it easier to understand the characteristics of diverse markets.

In economics, market concentration is a function of the number of firms and their respective shares of the total production in a market. Market concentration is the portion of a given market's market share that is held by a small number of businesses. To ascertain whether an industry is competitive or not, it is employed in antitrust law and economic regulation. When market concentration is high, it indicates that a few firms dominate the market and oligopoly or monopolistic competition is likely to exist. In most cases, high market concentration produces undesirable consequences such as reduced competition and higher prices.

The following outline is provided as an overview of and topical guide to marketing: