Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to protect against the risk of a contingent or uncertain loss.

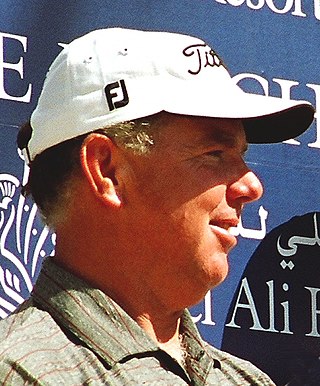

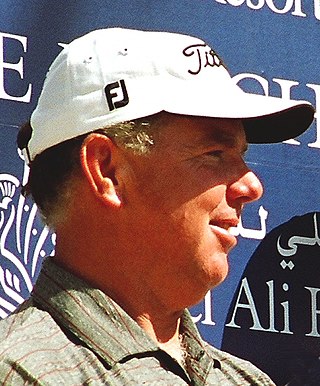

Mark Francis O'Meara is an American retired professional golfer. He was a tournament winner on the PGA Tour and around the world from the mid-1980s to the late 1990s. He spent nearly 200 weeks in the top-10 of the Official World Golf Ranking from their debut in 1986 to 2000. He was inducted into the World Golf Hall of Fame in 2015.

Boomtown Reno is a hotel and casino located in Verdi, Nevada, just west of the Reno–Sparks metropolitan area. The hotel features 318 guest rooms and suites, and the casino has a 39,630 square feet (3,682 m2) gaming area.

In golf, a hole in one or hole-in-one occurs when a ball hit from a tee to start a hole finishes in the cup. Holes-in-one most commonly occur on par 3 holes, the shortest distance holes on a standard size golf course. Longer hitters have also accomplished this feat on longer holes, though nearly all par 4 and par 5 holes are too long for golfers to reach in a single shot. While well known outside golf and often requiring a well hit shot and significant power, holes in one need also a significant element of luck. As of January 2021, a condor hole-in-one on a par 5 hole had been recorded on five occasions.

Directors and officers liability insurance is liability insurance payable to the directors and officers of a company, or to the organization itself, as indemnification (reimbursement) for losses or advancement of defense costs in the event an insured suffers such a loss as a result of a legal action brought for alleged wrongful acts in their capacity as directors and officers. Such coverage may extend to defense costs arising from criminal and regulatory investigations or trials as well; in fact, often civil and criminal actions are brought against directors and officers simultaneously. Intentional illegal acts, however, are typically not covered under D&O policies.

Charles Henry "Chip" Beck is an American professional golfer who was a three-time All-American at the University of Georgia. He has four victories on the PGA Tour and twenty runner-up finishes. He spent 40 weeks in the top 10 of the Official World Golf Rankings between 1988 and 1989 and was the second player to shoot a 59 on the PGA Tour.

Kirk Alan Triplett is an American professional golfer who has played on the PGA Tour, Nationwide Tour, and PGA Tour Champions.

Jason William Gore is an American professional golfer.

The Travelers Championship is a professional golf tournament on the PGA Tour in Cromwell, Connecticut, a suburb south of Hartford. Since 1984 the tournament has been held at TPC River Highlands. It is managed by The Greater Hartford Community Foundation. In 2018 the Travelers Championship earned the Players Choice Award for the second consecutive year, which is voted on by PGA Tour members for its services, hospitality, attendance and quality of the course.

Yūsaku Miyazato is a Japanese professional golfer. In 2006 he became the first modern-era golfer to make two hole in one shots in the same round of a PGA Tour event, at the Reno-Tahoe Open in Nevada.

Jason Anthony Day is an Australian professional golfer. Day had early success as a professional, earning PGA Tour membership in his teens and winning an event in his third season, the HP Byron Nelson Championship. In 2015, Day recorded his breakout season, winning five events including the PGA Championship, a major championship, while ascending to #1 in the world. Day maintained exemplary play through 2016, winning three tournaments including The Players Championship and preserving his #1 ranking. Since that season, however, Day's play has been much more erratic and he ultimately fell outside of the top 100 in the world. In 2023, however, he recorded a comeback year, winning the AT&T Byron Nelson, the site of his first win, and returning to the world's top 20.

Niche insurance is insurance provided for small, low-demand markets. It is outside of the usual insurance types available, such as automobile, home, life, travel, and business insurance, and can be very difficult to obtain.

Kevin Sangwook Na is a Korean American professional golfer. He was a member of the PGA Tour until June 2022, when he resigned in order to join LIV Golf. He won five tournaments on the PGA Tour between 2011 and 2021.

Martin Charles Campbell Laird is a Scottish professional golfer, playing on the PGA Tour. He has won four PGA Tour events in his career, most recently the Shriners Hospitals for Children Open in 2020. Until Russell Knox earned his card via the 2011 Nationwide Tour, Laird was the only Scottish player on the PGA Tour.

The Reno Open was a golf tournament on the Ben Hogan Tour that was contested from 1990 to 1991 and played at Northgate Golf Course in Reno, Nevada.

Prize indemnity insurance is indemnification insurance for a promotion in which the participants are offered the chance to win prizes. Instead of keeping cash reserves to cover large prizes, the promoter pays a premium to an insurance company, which then reimburses the insured should a prize be given away.

The American Century Championship is a celebrity golf tournament that takes place at Edgewood Tahoe Resort, on the shore of Lake Tahoe in Nevada, United States. The tournament is held annually, during the weekend after the second full week of July. It has a number of traditions, including the Long Drive Challenge, Charity Chip Challenge, and the Korbel Hole-In-One Contest. American Century Investments is the current title sponsor of the tournament, which previously was known as the Celebrity Golf Tournament, the Isuzu Celebrity Golf Championship, and the American Century Celebrity Golf Championship.

Scott Piercy is an American professional golfer who plays on the PGA Tour.

Bryce Wade Molder is an American former professional golfer who played on the PGA Tour.