Related Research Articles

Game theory is the study of mathematical models of strategic interactions. It has applications in many fields of social science, and is used extensively in economics, logic, systems science and computer science. Initially, game theory addressed two-person zero-sum games, in which a participant's gains or losses are exactly balanced by the losses and gains of the other participant. In the 1950s, it was extended to the study of non zero-sum games, and was eventually applied to a wide range of behavioral relations. It is now an umbrella term for the science of rational decision making in humans, animals, and computers.

Political economy is a branch of political science and economics studying economic systems and their governance by political systems. Widely studied phenomena within the discipline are systems such as labour markets and financial markets, as well as phenomena such as growth, distribution, inequality, and trade, and how these are shaped by institutions, laws, and government policy. Originating in the 16th century, it is the precursor to the modern discipline of economics. Political economy in its modern form is considered an interdisciplinary field, drawing on theory from both political science and modern economics.

John Forbes Nash, Jr., known and published as John Nash, was an American mathematician who made fundamental contributions to game theory, real algebraic geometry, differential geometry, and partial differential equations. Nash and fellow game theorists John Harsanyi and Reinhard Selten were awarded the 1994 Nobel Prize in Economics. In 2015, he and Louis Nirenberg were awarded the Abel Prize for their contributions to the field of partial differential equations.

Competition is a rivalry where two or more parties strive for a common goal which cannot be shared: where one's gain is the other's loss. Competition can arise between entities such as organisms, individuals, economic and social groups, etc. The rivalry can be over attainment of any exclusive goal, including recognition.

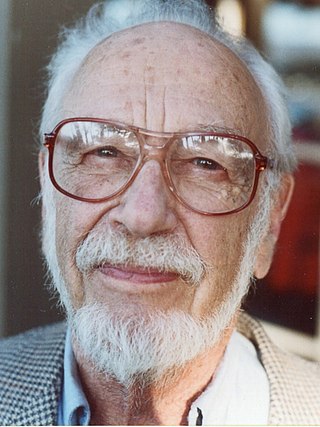

Lloyd Stowell Shapley was an American mathematician and Nobel Memorial Prize-winning economist. He contributed to the fields of mathematical economics and especially game theory. Shapley is generally considered one of the most important contributors to the development of game theory since the work of von Neumann and Morgenstern. With Alvin E. Roth, Shapley won the 2012 Nobel Memorial Prize in Economic Sciences "for the theory of stable allocations and the practice of market design."

David Gale was an American mathematician and economist. He was a professor emeritus at the University of California, Berkeley, affiliated with the departments of mathematics, economics, and industrial engineering and operations research. He has contributed to the fields of mathematical economics, game theory, and convex analysis.

In cooperative game theory, the core is the set of feasible allocations or imputations where no coalition of agents can benefit by breaking away from the grand coalition. One can think of the core corresponding to situations where it is possible to sustain cooperation among all agents. A coalition is said to improve upon or block a feasible allocation if the members of that coalition can generate more value among themselves than they are allocated in the original allocation. As such, that coalition is not incentivized to stay with the grand coalition.

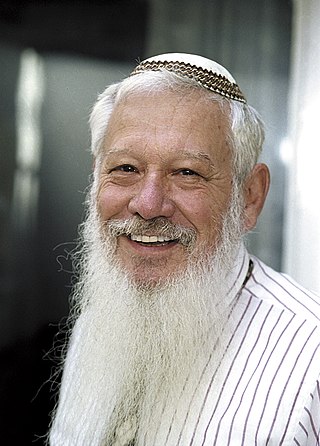

Robert John Aumann is an Israeli-American mathematician, and a member of the United States National Academy of Sciences. He is a professor at the Center for the Study of Rationality in the Hebrew University of Jerusalem in Israel. He also holds a visiting position at Stony Brook University, and is one of the founding members of the Stony Brook Center for Game Theory.

So Long Sucker is a board game invented in 1950 by Mel Hausner, John Nash, Lloyd Shapley, and Martin Shubik. It is a four-person bargaining/economic strategy game. Each player begins the game with seven chips, and in the course of play, attempts to acquire all the other players' chips. This requires making agreements with the other players, which are ultimately unenforceable. To win, players must eventually go back on such agreements. The game takes approximately 60 minutes to play.

Stephen W. Salant is an economist who has done extensive research in applied microeconomics. His 1975 model of speculative attacks in the gold market was adapted by Paul Krugman and others to explain speculative attacks in foreign exchange markets. Hundreds of journal articles and books on financial speculative attacks followed.

Pradeep Dubey is an Indian game theorist. He is a Professor of Economics at the State University of New York, Stony Brook, and a member of the Stony Brook Center for Game Theory. He also holds a visiting position at Cowles Foundation, Yale University. He did his schooling at the St. Columba's School, Delhi. He received his Ph.D. in applied mathematics from Cornell University and B.Sc. from the University of Delhi. His research areas of interest are game theory and mathematical economics. He has published, among others, in Econometrica, Games and Economic Behavior, Journal of Economic Theory, and Quarterly Journal of Economics. He is a Fellow of The Econometric Society, ACM Fellow and a member of the council of the Game Theory Society.

Alvin Eliot Roth is an American academic. He is the Craig and Susan McCaw professor of economics at Stanford University and the Gund professor of economics and business administration emeritus at Harvard University. He was President of the American Economic Association in 2017.

Michael Roland Powers is an American academic who is the Chair Professor of Finance at Tsinghua University’s School of Economics and Management (SEM) in China. Since 2014, he has held a dual appointment as professor at Tsinghua's Schwarzman College. An internationally recognized risk and insurance expert, he was a 2011 recipient of China’s Thousand Talents Plan award. In 2013, he won the Kulp-Wright Book Award for Acts of God and Man: Ruminations on Risk and Insurance.

The Shapley–Folkman lemma is a result in convex geometry that describes the Minkowski addition of sets in a vector space. It is named after mathematicians Lloyd Shapley and Jon Folkman, but was first published by the economist Ross M. Starr.

In economics, non-convexity refers to violations of the convexity assumptions of elementary economics. Basic economics textbooks concentrate on consumers with convex preferences and convex budget sets and on producers with convex production sets; for convex models, the predicted economic behavior is well understood. When convexity assumptions are violated, then many of the good properties of competitive markets need not hold: Thus, non-convexity is associated with market failures, where supply and demand differ or where market equilibria can be inefficient. Non-convex economies are studied with nonsmooth analysis, which is a generalization of convex analysis.

John Geanakoplos is an American economist, and the current James Tobin Professor of Economics at Yale University.

Jean-François Mertens was a Belgian game theorist and mathematical economist.

In economic theory, a strategicmarket game, also known as a market game, is a game explaining price formation through game theory, typically implementing a general equilibrium outcome as a Nash equilibrium.

Masahiko Aoki was a Japanese economist, Tomoye and Henri Takahashi Professor Emeritus of Japanese Studies in the Economics Department, and Senior Fellow of the Stanford Institute for Economic Policy Research and Freeman Spogli Institute for International Studies at Stanford University. Aoki was known for his work in comparative institutional analysis, corporate governance, the theory of the firm, and comparative East Asian development.

Two-Sided Matching: A Study in Game-Theoretic Modeling and Analysis is a book on matching markets in economics and game theory, particularly concentrating on the stable marriage problem. It was written by Alvin E. Roth and Marilda Sotomayor, with a preface by Robert Aumann, and published in 1990 by the Cambridge University Press as volume 18 in their series of Econometric Society monographs. For this work, Roth and Sotomayor won the 1990 Frederick W. Lanchester Prize of the Institute for Operations Research and the Management Sciences.

References

- ↑ "Remembering Prof. Martin Shubik, 1926–2018". Yale School of Management. 2018-08-30. Retrieved 2022-12-02.

- ↑ Malhotra, Saumya (2018-09-04). "Martin Shubik, eminent economist, dies at 92". Yale Daily News. Retrieved 2022-12-02.

- ↑ "Background of the Yale IBM Registry". Yale School of Public Health. Retrieved 2022-12-02.

- ↑ "Martin Shubik". Institute for Operations Research and the Management Sciences. Retrieved 2022-12-02.

- ↑ Roberts, Sam (2018-09-01). "Martin Shubik, 92, Dies; Foresaw Rise of Computing". New York Times. New York. Retrieved 2022-12-02.

- ↑ Shapley, Lloyd; Shubik, Martin (1954). "A Method for Evaluating the Distribution of Power in a Committee System". The American Political Science Review. 48 (3): 787–792. doi:10.2307/1951053. JSTOR 1951053. S2CID 143514359.

- ↑ Shubik, Martin. "Curriculum vitae" (2018) [textual record]. Martin Shubik papers, 1938-2018, Series: Writings, 1951-2018, Box: RL01181-SET-0001, File: Writing electronic files, 2002-2018. Durham: David M. Rubenstein Rare Book and Manuscript Library, Duke University.

- ↑ Hausner, Mel; Nash, John; Shapley, Lloyd; Shubik, Martin (1964). "So Long Sucker - A Four-Person Game". In Shubik, Martin (ed.). Game Theory and Related Approaches to Social Behavior: Selections. New York: Wiley. pp. 359–361. ISBN 9780471789635.

- ↑ "In memoriam: Martin Shubik". Santa Fe Institute. 2018-08-28. Retrieved 2022-12-02.

- ↑ Beach, Randall (2012-09-02). "Yale professor recalled as brilliant economist, loving family man". New Haven Register. Retrieved 2012-12-02.

- ↑ "Martin Shubik". Institute for Operations Research and the Management Sciences. Retrieved 2022-12-02.

- ↑ "Martin Shubik, Distinguished Fellow 2010". American Economic Association. 2010. Retrieved 2022-12-02.