Related Research Articles

NYSE American, formerly known as the American Stock Exchange (AMEX), and more recently as NYSE MKT, is an American stock exchange situated in New York City. AMEX was previously a mutual organization, owned by its members. Until 1953, it was known as the New York Curb Exchange.

The Nasdaq Stock Market is an American stock exchange based in New York City. It is the most active stock trading venue in the U.S. by volume, and ranked second on the list of stock exchanges by market capitalization of shares traded, behind the New York Stock Exchange. The exchange platform is owned by Nasdaq, Inc., which also owns the Nasdaq Nordic stock market network and several U.S.-based stock and options exchanges. Although it trades stock of healthcare, financial, media, entertainment, retail, hospitality, and food businesses, it focuses more on technology stocks. The exchange is made up of both American and foreign firms, with China and Israel being the largest foreign sources.

The New York Stock Exchange is an American stock exchange in the Financial District of Lower Manhattan in New York City. It is the largest stock exchange in the world by market capitalization.

A stock exchange, securities exchange, or bourse is an exchange where stockbrokers and traders can buy and sell securities, such as shares of stock, bonds and other financial instruments. Stock exchanges may also provide facilities for the issue and redemption of such securities and instruments and capital events including the payment of income and dividends. Securities traded on a stock exchange include stock issued by listed companies, unit trusts, derivatives, pooled investment products and bonds. Stock exchanges often function as "continuous auction" markets with buyers and sellers consummating transactions via open outcry at a central location such as the floor of the exchange or by using an electronic system to process financial transactions.

NYSE Chicago, formerly known as the Chicago Stock Exchange (CHX), is a stock exchange in Chicago, Illinois, US. The exchange is a national securities exchange and self-regulatory organization, which operates under the oversight of the U.S. Securities and Exchange Commission (SEC). Intercontinental Exchange (ICE) acquired CHX in July 2018 and the exchange rebranded as NYSE Chicago in February 2019.

Euronext N.V. is a European bourse that provides trading and post-trade services for a range of financial instruments.

Nasdaq, Inc. is an American multinational financial services corporation that owns and operates three stock exchanges in the United States: the namesake Nasdaq stock exchange, the Philadelphia Stock Exchange, and the Boston Stock Exchange, and seven European stock exchanges: Nasdaq Copenhagen, Nasdaq Helsinki, Nasdaq Iceland, Nasdaq Riga, Nasdaq Stockholm, Nasdaq Tallinn, and Nasdaq Vilnius. It is headquartered in New York City, and its president and chief executive officer is Adena Friedman.

NYSE Euronext, Inc. was a transatlantic multinational financial services corporation that operated multiple securities exchanges, including the New York Stock Exchange, Euronext and NYSE Arca. NYSE merged with Archipelago Holdings on March 7, 2006, forming NYSE Group, Inc. On April 4, 2007, NYSE Group, Inc. merged with Euronext N.V. to form the first global equities exchange, with its headquarters in Lower Manhattan. The corporation was then acquired by Intercontinental Exchange, which subsequently spun off Euronext.

Intercontinental Exchange, Inc. (ICE) is an American multinational financial services company formed in 2000 that operates global financial exchanges and clearing houses and provides mortgage technology, data and listing services. Listed on the Fortune 500, S&P 500, and Russell 1000, the company owns exchanges for financial and commodity markets, and operates 12 regulated exchanges and marketplaces. This includes ICE futures exchanges in the United States, Canada, and Europe; the Liffe futures exchanges in Europe; the New York Stock Exchange; equity options exchanges; and OTC energy, credit, and equity markets.

London Stock Exchange Group plc, also known as LSEG, is a global provider of financial markets data and infrastructure. Headquartered in London, England. It owns the London Stock Exchange, Refinitiv, LSEG Technology, FTSE Russell, and majority stakes in LCH and Tradeweb.

Direct Edge was an American stock exchange that operated two separate platforms, EDGA Exchange and EDGX Exchange. It was based in Jersey City, New Jersey and merged with BATS Global Markets in 2014.

Virtu Financial is an American company that provides financial services, trading products and market making services. Virtu provides product suite including offerings in execution, liquidity sourcing, analytics, broker-neutral, multi-dealer platforms in workflow technology and two-sided quotations and trades in equities, commodities, currencies, options, fixed income, and other securities on over 230 exchanges, markets, and dark pools. Virtu uses proprietary technology to trade large volumes of securities. The company went public on the Nasdaq in 2015.

Investors Exchange (IEX) is a stock exchange in the United States. It was founded in 2012 in order to mitigate the effects of high-frequency trading. IEX was launched as a national securities exchange in September 2016. On October 24, 2017, it received regulatory approval from the U.S. Securities and Exchange Commission (SEC) to list companies. IEX listed its first public company, Interactive Brokers, on October 5, 2018. The exchange said that companies would be able to list for free for the first five years, before a flat annual rate of $50,000. On September 23, 2019, it announced it was leaving its listing business.

Bradley Toshio Katsuyama is a Canadian financial services executive. He is the CEO and co-founder of the IEX, the Investors Exchange. He left RBC in 2012 to co-found IEX under the premise that it would be a fairer stock trading venue than other exchanges.

Interactive Brokers, Inc. (IB), headquartered in Greenwich, Connecticut, is an American multinational brokerage firm which operates the largest electronic trading platform in the United States by number of daily average revenue trades. In 2023, the platform processed an average of 3 million trades per trading day. Interactive Brokers is the largest foreign exchange market broker and is one of the largest prime brokers servicing commodity brokers. The company brokers stocks, options, futures contracts, exchange of futures for physicals, options on futures, bonds, mutual funds, currency, cryptocurrency, contracts for difference, derivatives, and event-based trading contracts on election and other outcomes. Interactive Brokers offers direct market access, omnibus and non-disclosed broker accounts, and provides clearing services. The firm has operations in 34 countries and 27 currencies and has 2.6 million institutional and individual brokerage customers, with total customer equity of US$426 billion as of December 31, 2023. In addition to its headquarters in Greenwich, on the Gold Coast of Connecticut, the company has offices in major financial centers worldwide. More than half of the company's customers reside outside the United States, in approximately 200 countries.

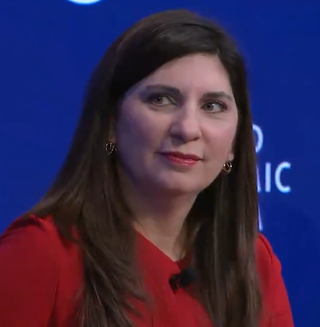

Stacey Cunningham is an American banker who served as the 67th president of the New York Stock Exchange (NYSE) from 2018 to 2022. She was the second female president of the NYSE, but the first to hold full leadership of the exchange.

The New York Stock Exchange Building is the headquarters of the New York Stock Exchange (NYSE), located in the Financial District of Lower Manhattan in New York City. It is composed of two connected structures occupying much of the city block bounded by Wall Street, Broad Street, New Street, and Exchange Place. The central section of the block contains the original structure at 18 Broad Street, designed in the Classical Revival style by George B. Post. The northern section contains a 23-story office annex at 11 Wall Street, designed by Trowbridge & Livingston in a similar style.

Citadel Securities LLC is an American market making firm providing liquidity and trade execution to retail and institutional clients, headquartered in Miami. The firm also trades futures, equities, credit, options, currencies, and Treasury bonds. It is the largest designated market maker on the New York Stock Exchange.

A securities information processor (SIP) is a part of the infrastructure of public market data providers in the United States that process, consolidate, and disseminate quotes and trade data from different US securities exchanges and market centers. An important purpose of the SIPs for US securities is to publish the prevailing National Best Bid Offer (NBBO).

MIAX Pearl Equities (MIAX), is an American stock exchange headquartered in Princeton, New Jersey. The exchange also has offices in Miami, Florida, where its parent company Miami International Holdings is based.

References

- ↑ "New stock exchange ventures say US market is ripe for disruption". S&P Global. Retrieved July 25, 2019.

- ↑ "ICE will not fight upstart exchange MEMX, CEO says". Financial Times. Retrieved July 25, 2019.

- ↑ "BlackRock throws support behind US exchange start-up MEMX". Financial Times. Retrieved 2020-10-23.

- ↑ "Why Citi is the latest Wall Street giant to back the new MEMX stock exchange, launching this fall". Fortune. Retrieved 2020-10-23.

- ↑ Osipovich, Alexander (2020-02-20). "Goldman, JPMorgan Lead New Funding Round for Members Exchange". Wall Street Journal. ISSN 0099-9660 . Retrieved 2020-10-23.

- ↑ "BlackRock, Wells Fargo now backing stock exchange upstart MEMX". S&P Global. Retrieved 2020-10-23.

- ↑ "Goldman Sachs, JP Morgan and Jane Street join MEMX venture as launch date is set". The TRADE. Retrieved 2020-10-23.

- ↑ "ICE, Nasdaq shares fall as Wall Street giants plan rival exchange MEMX". CNBC. Retrieved July 25, 2019.

- ↑ "Members Exchange Receives SEC Approval to Operate U.S. Securities Exchange". businesswire.com. Retrieved 15 June 2020.

- ↑ Osipovich, Alexander (2020-09-21). "Wall Street-Backed Exchange Launches as Rival to NYSE, Nasdaq". Wall Street Journal. ISSN 0099-9660 . Retrieved 2020-10-23.

- ↑ "Wall Street-Backed Options Exchange Kicks Off Amid Peak Volumes".

- ↑ "Blue Ocean ATS Migrates to MEMX Technology to Support Growth".

- ↑ "Wall Street's New Stock Exchange Picks Instinet Veteran as CEO". Bloomberg. Retrieved July 25, 2019.

- 1 2 "Startup Stock Exchange Builds Executive Team With Nasdaq Hires". Wall Street Journal. Retrieved July 25, 2019.

- ↑ "Growing the MEMX Team: a Staffing Update" . Retrieved July 25, 2019– via Medium.

- ↑ "Growing the MEMX Team: a Staffing Update Part II". MEMX.com.

- ↑ "MEMX Testing, Launch and Personnel Update – MEMX" . Retrieved 2020-10-23.