Michelin, in full Compagnie Générale des Établissements Michelin SCA, is a French multinational tyre manufacturing company based in Clermont-Ferrand in the Auvergne-Rhône-Alpes région of France. It is the second largest tyre manufacturer in the world behind Bridgestone and larger than both Goodyear and Continental. In addition to the Michelin brand, it also owns the Kléber tyres company, Uniroyal-Goodrich Tire Company, SASCAR, Bookatable and Camso brands. Michelin is also notable for its Red and Green travel guides, its roadmaps, the Michelin stars that the Red Guide awards to restaurants for their cooking, and for its company mascot Bibendum, colloquially known as the Michelin Man, who is a humanoid consisting of tyres.

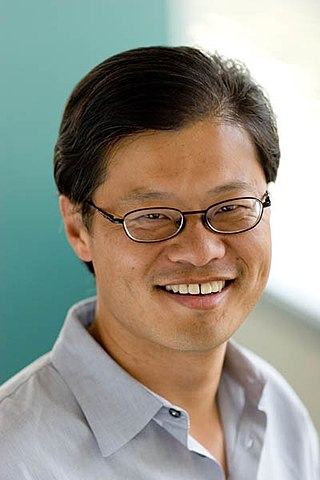

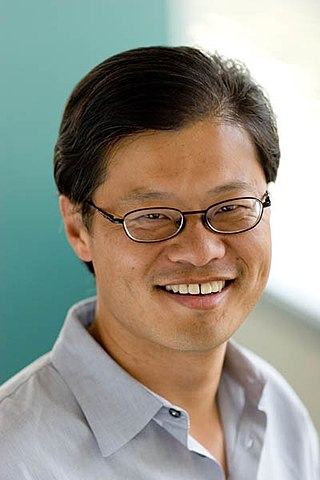

Jerry Chih-Yuan Yang is a Taiwanese-born American billionaire computer programmer, internet entrepreneur, and venture capitalist. He is the co-founder and former CEO of Yahoo! Inc. and founding partner of AME Cloud Ventures.

Vinod Khosla is an Indian-American billionaire businessman and venture capitalist. He is a co-founder of Sun Microsystems and the founder of Khosla Ventures. Khosla made his wealth from early venture capital investments in areas such as networking, software, and alternative energy technologies. He is considered one of the most successful and influential venture capitalists. Khosla was named the top venture capitalist on the Forbes Midas List in 2001 and has been listed multiple times since that time. As of August 2024, Forbes estimated his net worth at US$7.2 billion.

Silicon Alley is an area of high tech companies centered around southern Manhattan's Flatiron district in New York City. The term was coined in the 1990s during the dot-com boom, alluding to California's Silicon Valley tech center. The term has grown somewhat obsolete since 2003 as New York tech companies spread outside of Manhattan, and New York as a whole is now a top-tier global high technology hub. Silicon Alley, once a metonym for the sphere encompassing the metropolitan region's high technology industries, is no longer a relevant moniker as the city's tech environment has expanded dramatically both in location and in its scope. New York City's current tech sphere encompasses a universal array of applications involving artificial intelligence, the internet, new media, financial technology (fintech) and cryptocurrency, biotechnology, game design, and other fields within information technology that are supported by its entrepreneurship ecosystem and venture capital investments.

Patrick Collison is an Irish-American entrepreneur. He is the co-founder and CEO of Stripe, which he started with his younger brother, John, in 2010. He won the 41st Young Scientist and Technology Exhibition in 2005 at the age of sixteen. In 2020, he founded Fast Grants to accelerate COVID-19-related science with Tyler Cowen.

Kanwal Singh Rekhi is an Indian-American businessperson. He was the first Indian-American founder and CEO to take a venture-backed company public on the Nasdaq stock exchange.

Evan Clark "Ev" Williams is an American billionaire technology entrepreneur. He is a co-founder of Twitter, and was its CEO from 2008 to 2010, and a member of its board from 2007 to 2019. He founded Blogger and Medium. In 2014, he co-founded the venture capital firm Obvious Ventures. As of February 2022, his net worth is estimated at US$2.1 billion.

KeyBank is an American regional bank headquartered in Cleveland, Ohio, and the 25th largest bank in the United States. Organized under the publicly traded KeyCorp, KeyBank was formed from the 1994 merger of the Cleveland-based Society Corporation, which operated Society National Bank, and the Albany-headquartered KeyCorp. The company today operates over 1,000 branches and 40,000 ATMs, mostly concentrated in the Midwest and Northeast United States, though also operates in the Pacific Northwest as well as in Alaska, Colorado, Texas and Utah.

Jefferies Group LLC is an American multinational independent investment bank and financial services company that is headquartered in New York City. The firm provides clients with capital markets and financial advisory services, institutional brokerage, securities research, and asset management. This includes mergers and acquisitions, restructuring, and other financial advisory services. The Capital Markets segment also includes its securities trading and investment banking activities.

Michael J. Saylor is an American entrepreneur and business executive. He is the executive chairman and co-founder of MicroStrategy, a company that provides business intelligence, mobile software, and cloud-based services.

Terence Steven Semel is an American corporate executive who was the chairman and CEO of Yahoo! Incorporated from 2001 to 2007. Previously, he spent 24 years at Warner Bros., where he served as chairman and co-chief executive officer.

J. Michael Arrington is the American founder and former co-editor of TechCrunch, a blog covering the Silicon Valley technology start-up communities and the wider technology field in America and elsewhere. Magazines such as Wired and Forbes have named Arrington one of the most powerful people on the Internet. In 2008, he was selected by TIME Magazine as one of the most influential people in the world.

Powerset was an American company based in San Francisco, California, that, in 2006, was developing a natural language search engine for the Internet. On July 1, 2008, Powerset was acquired by Microsoft for an estimated $100 million.

SafeNet, Inc. was an information security company based in Belcamp, Maryland, United States, which was acquired in August 2014 by the French security company Gemalto. Gemalto was, in turn, acquired by Thales Group in 2019. The former SafeNet's products include solutions for enterprise authentication, data encryption, and key management. SafeNet's software monetization products are sold under the Thales Sentinel brand.

Alfred Lin is an American venture capitalist at Sequoia Capital. Lin was the COO, CFO, and Chairman of Zappos.com until 2010.

Daniel Simon Aegerter is a Swiss businessman and venture capitalist. Formerly founder and CEO of Tradex Technologies, he later founded Armada Investment AG to manage his wealth. He was an early investor in Nutmeg (company), N26, Lilium GmbH, and Commonwealth Fusion Systems.

Naval Ravikant is an Indian-born American entrepreneur and investor. He is the co-founder, chairman and former Chief Executive Officer (CEO) of AngelList. He has invested early-stage in Uber, FourSquare, Twitter, Postmates, SnapLogic, and Yammer.

Braigo is a Braille printer design. Braigo version 1.0 uses a Lego Mindstorms EV3 kit, which includes a microprocessor with assorted components such as electric motors, sensors and actuators. Braigo v1.0 was designed by 13-year-old Shubham Banerjee in January 2014, as an entry in 7th grade school science fair project. The model was based on the PLOTT3R, a bonus model released with the EV3 kit and originally designed by Ralph Hempel. The cost was said to be about US$350 or 250 Euros for the Lego Mindstorms EV3 kit and some extra commonly used hardware whereas a conventional Braille printer retails starting from about $1,900.

Salim Ismail is an Indo-Canadian serial entrepreneur, angel investor, author, speaker, and technology strategist. He is the Founding Executive Director of Singularity University and lead author of Exponential Organizations. In March 2017 he was named to the board of the XPRIZE Foundation.

Eytan Meir Stibbe is an Israeli former fighter pilot, businessman and commercial astronaut.