A currency is a standardization of money in any form, in use or circulation as a medium of exchange, for example banknotes and coins. A more general definition is that a currency is a system of money in common use within a specific environment over time, especially for people in a nation state. Under this definition, the British Pound sterling (£), euros (€), Japanese yen (¥), and U.S. dollars (US$) are examples of (government-issued) fiat currencies. Currencies may act as stores of value and be traded between nations in foreign exchange markets, which determine the relative values of the different currencies. Currencies in this sense are either chosen by users or decreed by governments, and each type has limited boundaries of acceptance; i.e., legal tender laws may require a particular unit of account for payments to government agencies.

David Ricardo was a British political economist, politician, and member of Parliament. He is recognized as one of the most influential classical economists, alongside figures such as Thomas Malthus, Adam Smith and James Mill.

In economics, Gresham's law is a monetary principle stating that "bad money drives out good". For example, if there are two forms of commodity money in circulation, which are accepted by law as having similar face value, the more valuable commodity will gradually disappear from circulation.

Commodity money is money whose value comes from a commodity of which it is made. Commodity money consists of objects having value or use in themselves as well as their value in buying goods. This is in contrast to representative money, which has no intrinsic value but represents something of value such as gold or silver, for which it can be exchanged, and fiat money, which derives its value from having been established as money by government regulation.

In economics, deflation is a decrease in the general price level of goods and services. Deflation occurs when the inflation rate falls below 0%. Inflation reduces the value of currency over time, but deflation increases it. This allows more goods and services to be bought than before with the same amount of currency. Deflation is distinct from disinflation, a slowdown in the inflation rate; i.e., when inflation declines to a lower rate but is still positive.

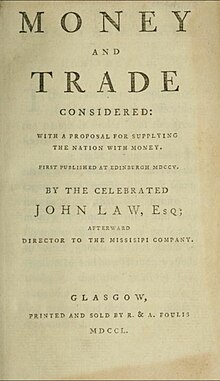

John Law was a Scottish-French economist who distinguished money, a means of exchange, from national wealth dependent on trade. He served as Controller General of Finances under the Duke of Orleans, who was regent for the juvenile Louis XV of France. In 1716, Law set up a private Banque Générale in France. A year later it was nationalised at his request and renamed as Banque Royale. The private bank had been funded mainly by John Law and Louis XV; three-quarters of its capital consisted of government bills and government-accepted notes, effectively making it the nation's first central bank. Backed only partially by silver, it was a fractional reserve bank. Law also set up and directed the Mississippi Company, funded by the Banque Royale. Its chaotic collapse has been compared to the 17th-century tulip mania parable in Holland. The Mississippi bubble coincided with the South Sea bubble in England, which allegedly took ideas from it. Law was a gambler who would win card games by mentally calculating odds. He propounded ideas such as the scarcity theory of value and the real bills doctrine. He held that money creation stimulated an economy, paper money was preferable to metal, and dividend-paying shares a superior form of money. The term "millionaire" was coined for beneficiaries of Law's scheme.

A store of value is any commodity or asset that would normally retain purchasing power into the future and is the function of the asset that can be saved, retrieved and exchanged at a later time, and be predictably useful when retrieved.

Richard Cantillon was an Irish-French economist and author of Essai Sur La Nature Du Commerce En Général, a book considered by William Stanley Jevons to be the "cradle of political economy". Although little information exists on Cantillon's life, it is known that he became a successful banker and merchant at an early age. His success was largely derived from the political and business connections he made through his family and through an early employer, James Brydges. During the late 1710s and early 1720s, Cantillon speculated in, and later helped fund, John Law's Mississippi Company, from which he acquired great wealth. However, his success came at a cost to his debtors, who pursued him with lawsuits, criminal charges, and even murder plots until his death in 1734.

The Currency Act or Paper Bills of Credit Act is one of several Acts of the Parliament of Great Britain that regulated paper money issued by the colonies of British America. The Acts sought to protect British merchants and creditors from being paid in depreciated colonial currency. The policy created tension between the colonies and Great Britain and was cited as a grievance by colonists early in the American Revolution. However, the consensus view among modern economic historians and economists is that the debts by colonists to British merchants were not a major cause of the Revolution. In 1995, a random survey of 178 members of the Economic History Association found that 92% of economists and 74% of historians disagreed with the statement, "The debts owed by colonists to British merchants and other private citizens constituted one of the most powerful causes leading to the Revolution."

The Mississippi Company was a corporation holding a business monopoly in French colonies in North America and the West Indies. In 1717, the Mississippi Company received a royal grant with exclusive trading rights for 25 years. The rise and fall of the company is connected with the activities of the Scottish financier and economist John Law who was then the Controller General of Finances of France. Though the company itself started to become profitable and remained solvent until the collapse of the bubble, when speculation in French financial circles and land development in the region became frenzied and detached from economic reality, the Mississippi bubble became one of the earliest examples of an economic bubble.

Coin's Financial School was an 1894 pamphlet written by lawyer, politician and resort founder William Hope Harvey (1851–1936). It advocated a return to bimetallism, where the value of a monetary unit is defined as a certain amount of two different kinds of metals, often gold and silver. In the book, Harvey charged that the demonetization of silver caused by the Coinage Act of 1873 led to the Panic of 1893 by halving the supply of available redemption money in the economy. This lowered the prices of goods throughout the country and hurt farmers and small business owners, according to Harvey. Harvey argued that by returning silver to the same monetary status as gold, the American economy would benefit from stabilized prices, resulting in higher revenue, and ease of repayment of debts. The pamphlet sold about 1 million copies, which helped popularize the free silver movement with the public. Harvey would go on to aid Democratic candidate William Jennings Bryan’s presidential campaign in 1896, which ran on the platform of free coinage of silver. The issue of bimetallism remained controversial throughout the remainder of the 19th century.

International finance is the branch of monetary and macroeconomic interrelations between two or more countries. International finance examines the dynamics of the global financial system, international monetary systems, balance of payments, exchange rates, foreign direct investment, and how these topics relate to international trade.

Monetization is, broadly speaking, the process of converting something into money. The term has a broad range of uses. In banking, the term refers to the process of converting or establishing something into legal tender. While it usually refers to the coining of currency or the printing of banknotes by central banks, it may also take the form of a promissory currency. The term "monetization" may also be used informally to refer to exchanging possessions for cash or cash equivalents, including selling a security interest, charging fees for something that used to be free, or attempting to make money on goods or services that were previously unprofitable or had been considered to have the potential to earn profits. And data monetization refers to a spectrum of ways information assets can be converted into economic value.

The history of economic thought is the study of the philosophies of the different thinkers and theories in the subjects that later became political economy and economics, from the ancient world to the present day.

Money is any item or verifiable record that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular country or socio-economic context. The primary functions which distinguish money are: medium of exchange, a unit of account, a store of value and sometimes, a standard of deferred payment.

The following outline is provided as an overview of and topical guide to economics:

Hoarding in economics refers to the concept of purchasing and storing a large amount of a particular product, creating scarcity of that product, and ultimately driving the price of that product up. Commonly hoarded products include assets such as money, gold and public securities, as well as vital goods such as fuel and medicine. Consumers are primarily hoarding resources so that they can maintain their current consumption rate in the event of a shortage. Hoarding resources can prevent or slow products or commodities from traveling through the economy. Subsequently, this may cause the product or commodity to become scarce, causing the value of the resource to rise.

Fiat money is a type of government issued currency that is not backed by a precious metal, such as gold or silver, nor by any other tangible asset or commodity. Fiat currency is typically designated by the issuing government to be legal tender, and is authorized by government regulation. Since the end of the Bretton Woods system in 1975, the major currencies in the world are fiat money.

An Enquiry into the Nature and Effects of the Paper Credit of Great Britain, generally shortened to Paper Credit, is a book on monetary theory in economics, written by Henry Thornton and published in Britain in 1802. It is seen as prescient of modern monetary problems, having addressed paper currency, risk of inflation, and other issues that were appearing as certificates began to displace gold as currency in early 19th century Britain.

Two Overtures Humbly Offered to his Grace John Duke of Argyll, Her Majesties High Commissioner, and the right Honourable the Estates of Parliament is a pamphlet of economic proposals written by the early eighteenth-century economist John Law of Lauriston which was published in 1705.