No Logo: Taking Aim at the Brand Bullies is a book by the Canadian author Naomi Klein. First published by Knopf Canada and Picador in December 1999, shortly after the 1999 Seattle WTO protests had generated media attention around such issues, it became one of the most influential books about the alter-globalization movement and an international bestseller.

Transparency International e.V. (TI) is a German registered association founded in 1993 by former employees of the World Bank. Based in Berlin, its nonprofit and non-governmental purpose is to take action to combat global corruption with civil societal anti-corruption measures and to prevent criminal activities arising from corruption. Its most notable publications include the Global Corruption Barometer and the Corruption Perceptions Index. TI serves as an umbrella organization. From 1993 to today, its membership has grown from a few individuals to more than 100 national chapters, which engage in fighting perceived corruption in their home countries. TI is a member of G20 Think Tanks, UNESCO Consultative Status, United Nations Global Compact, Sustainable Development Solutions Network and shares the goals of peace, justice, strong institutions and partnerships of the United Nations Sustainable Development Group (UNSDG). TI is a social partner of Global Alliance in Management Education. TI confirmed the dis-accreditation of the national chapter of United States of America in 2017.

Lawrence Henry Summers is an American economist who served as the 71st United States Secretary of the Treasury from 1999 to 2001 and as director of the National Economic Council from 2009 to 2010. He also served as president of Harvard University from 2001 to 2006, where he is the Charles W. Eliot University Professor and director of the Mossavar-Rahmani Center for Business and Government at Harvard Kennedy School. In November 2023, Summers joined the board of directors of artificial general intelligence company OpenAI.

A multi-national corporation is a corporate organization that owns and controls the production of goods or services in at least one country other than its home country. Control is considered an important aspect of an MNC to distinguish it from international portfolio investment organizations, such as some international mutual funds that invest in corporations abroad solely to diversify financial risks. Black's Law Dictionary suggests that a company or group should be considered a multi-national corporation "if it derives 25% or more of its revenue from out-of-home-country operations".

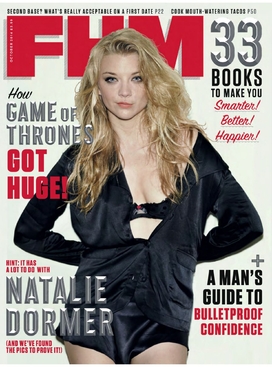

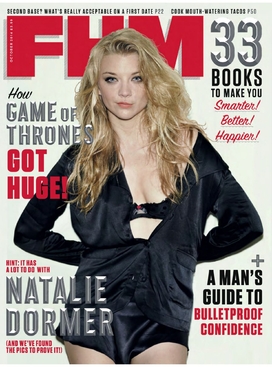

FHM was a printed British multinational men's lifestyle magazine that was published in several countries. It contained features such as the FHM 100 Sexiest Women in the World.

Scholastic Corporation is an American multinational publishing, education, and media company that publishes and distributes books, comics, and educational materials for schools, teachers, parents, children, and other educational institutions. Products are distributed via retail and online sales and through schools via reading clubs and book fairs. Clifford the Big Red Dog, a character created by Norman Bridwell in 1963, is the mascot of the company.

Washington Monthly is a bimonthly, nonprofit magazine primarily covering United States politics and government that is based in Washington, D.C. The magazine also publishes an annual ranking of American colleges and universities, which serves as an alternative to Forbes' and U.S. News & World Report's rankings.

U.S. News & World Report is an American media company publishing news, consumer advice, rankings, and analysis. The company was launched in 1948 as the merger of domestic-focused weekly newspaper U.S. News and international-focused weekly magazine World Report. In 1995, the company launched its website, usnews.com and, in 2010, ceased printing its weekly news magazine, publishing only its ranking editions in print. US News licences its name to the subjects it ranks, so they may then use the annual rankings in promotional literature.

Interzone is a British fantasy and science fiction magazine. Published since 1982, Interzone is the eighth-longest-running English language science fiction magazine in history, and the longest-running British science fiction (SF) magazine. Stories published in Interzone have been finalists for the Hugo Awards and have won a Nebula Award and numerous British Science Fiction Awards.

A boycott was launched in the United States on July 4, 1977, against the Swiss-based multinational food and drink processing corporation Nestlé. The boycott expanded into Europe in the early 1980s and was prompted by concerns about Nestlé's aggressive marketing of infant formulas, particularly in underdeveloped countries. The boycott has been cancelled and renewed because of the business practices of Nestlé and other substitute manufacturers monitored by the International Baby Food Action Network (IBFAN). Organizers of the boycott as well as public health researchers and experts consider breast milk to be the best nutrition source for infants. The World Health Organization (WHO) recommends infants to be exclusively breastfed for the first six months of their lives, nevertheless, sometimes nutritional gaps need to be filled if breastfeeding is not possible.

Ireland's Corporate Tax System is a central component of Ireland's economy. In 2016–17, foreign firms paid 80% of Irish corporate tax, employed 25% of the Irish labour force, and created 57% of Irish OECD non-farm value-add. As of 2017, 25 of the top 50 Irish firms were U.S.–controlled businesses, representing 70% of the revenue of the top 50 Irish firms. By 2018, Ireland had received the most U.S. § Corporate tax inversions in history, and Apple was over one–fifth of Irish GDP. Academics rank Ireland as the largest tax haven; larger than the Caribbean tax haven system.

Monthly Comic Dengeki Daioh is a Japanese shōnen manga magazine published by ASCII Media Works under the Dengeki brand. Many manga serialized in Dengeki Daioh were later published in tankōbon volumes under ASCII Media Works' Dengeki Comics imprint. The magazine is sold every month on the 27th. A yonkoma section of Dengeki Daioh called Dengeki Yonkoma Daioh (電撃4コマ大王) features various omake strips of the manga series published in it. The format is typically a normal drawing on the right side featuring one or sometimes more characters, and a vertical four panel strip on the left featuring characters from the associated series in super deformed form. Two special editions of the magazine called Dengeki Moeoh and Dengeki Daioh Genesis are sold bimonthly and quarterly, respectively.

A tax haven is a term, often used pejoratively, to describe a place with very low tax rates for non-domiciled investors, even if the official rates may be higher.

Campaign is a global business magazine covering advertising, media, marketing and commercial creativity. Headquartered in the UK, it also has editions in the US, Asia-Pacific, India, the Middle East and Turkey.

The Double Irish arrangement was a base erosion and profit shifting (BEPS) corporate tax avoidance tool used mainly by United States multinationals since the late 1980s to avoid corporate taxation on non-U.S. profits. It was the largest tax avoidance tool in history. By 2010, it was shielding US$100 billion annually in US multinational foreign profits from taxation, and was the main tool by which US multinationals built up untaxed offshore reserves of US$1 trillion from 2004 to 2018. Traditionally, it was also used with the Dutch Sandwich BEPS tool; however, 2010 changes to tax laws in Ireland dispensed with this requirement.

The Organisation for Economic Co-operation and Development is an intergovernmental organization with 38 member countries, founded in 1961 to stimulate economic progress and world trade. It is a forum whose member countries describe themselves as committed to democracy and the market economy, providing a platform to compare policy experiences, seek answers to common problems, identify good practices, and coordinate domestic and international policies of its members.

BusinessWorld is a business newspaper in the Philippines with a nationwide circulation of more than 117,000. Founded in 1967 as Business Day, it is Southeast Asia's first daily business newspaper.

Base erosion and profit shifting (BEPS) refers to corporate tax planning strategies used by multinationals to "shift" profits from higher-tax jurisdictions to lower-tax jurisdictions or no-tax locations where there is little or no economic activity, thus "eroding" the "tax-base" of the higher-tax jurisdictions using deductible payments such as interest or royalties. For the government, the tax base is a company's income or profit. Tax is levied as a percentage on this income/profit. When that income / profit is transferred to a tax haven, the tax base is eroded and the company does not pay taxes to the country that is generating the income. As a result, tax revenues are reduced and the country is disadvantaged. The Organisation for Economic Co-operation and Development (OECD) define BEPS strategies as "exploiting gaps and mismatches in tax rules". While some of the tactics are illegal, the majority are not. Because businesses that operate across borders can utilize BEPS to obtain a competitive edge over domestic businesses, it affects the righteousness and integrity of tax systems. Furthermore, it lessens deliberate compliance, when taxpayers notice multinationals legally avoiding corporate income taxes. Because developing nations rely more heavily on corporate income tax, they are disproportionately affected by BEPS.

Ireland has been labelled as a tax haven or corporate tax haven in multiple financial reports, an allegation which the state has rejected in response. Ireland is on all academic "tax haven lists", including the § Leaders in tax haven research, and tax NGOs. Ireland does not meet the 1998 OECD definition of a tax haven, but no OECD member, including Switzerland, ever met this definition; only Trinidad & Tobago met it in 2017. Similarly, no EU–28 country is amongst the 64 listed in the 2017 EU tax haven blacklist and greylist. In September 2016, Brazil became the first G20 country to "blacklist" Ireland as a tax haven.

The global minimum corporate tax rate, or simply the global minimum tax, is a minimum rate of tax on corporate income internationally agreed upon and accepted by individual jurisdictions in the OECD/G20 Inclusive Framework. Each country would be eligible for a share of revenue generated by the tax. The aim is to reduce tax competition between countries and discourage multinational corporations (MNC) from profit shifting that avoids taxes.