Related Research Articles

Nancy Reagan was an American film actress who was the first lady of the United States from 1981 to 1989, as the second wife of President Ronald Reagan.

A shareholder rights plan, colloquially known as a "poison pill", is a type of defensive tactic used by a corporation's board of directors against a takeover.

In business, a takeover is the purchase of one company by another. In the UK, the term refers to the acquisition of a public company whose shares are publicly listed, in contrast to the acquisition of a private company.

In business, a corporate raid is the process of buying a large stake in a corporation and then using shareholder voting rights to require the company to undertake novel measures designed to increase the share value, generally in opposition to the desires and practices of the corporation's current management. The measures might include replacing top executives, downsizing operations, or liquidating the company.

A leveraged buyout (LBO) is one company's acquisition of another company using a significant amount of borrowed money (leverage) to meet the cost of acquisition. The assets of the company being acquired are often used as collateral for the loans, along with the assets of the acquiring company. The use of debt, which normally has a lower cost of capital than equity, serves to reduce the overall cost of financing the acquisition. This is done at the risk of magnified cash flow losses should the acquisition perform poorly after the buyout.

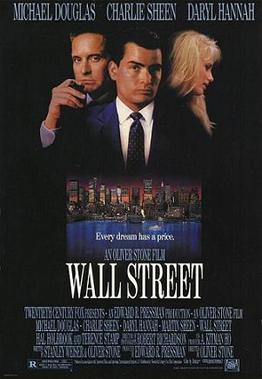

Wall Street is a 1987 American crime drama film, directed and co-written by Oliver Stone, which stars Michael Douglas, Charlie Sheen, Daryl Hannah, and Martin Sheen. The film tells the story of Bud Fox, a young stockbroker who becomes involved with Gordon Gekko (Douglas), a wealthy, unscrupulous corporate raider.

Francisco Anthony "Frank" Lorenzo is an American businessman. He managed Continental Airlines and Texas International Airlines between 1972 and 1990, through airline deregulation. Lorenzo also led the creation and management of the holding company for the group, Texas Air Corporation, through which New York Air was formed in 1980 and Eastern Air Lines was acquired in 1986, as well as Frontier Airlines and People Express Airlines.

"Just Say No" was an advertising campaign prevalent during the 1980s and early 1990s as a part of the U.S.-led war on drugs, aiming to discourage children from engaging in illegal recreational drug use by offering various ways of saying no. The slogan was created and championed by Nancy Reagan during her husband's presidency.

Greenmail or greenmailing is a financial maneuver where investors buy enough shares in a target company to threaten a hostile takeover, prompting the target company to buy back the shares at a premium to prevent the takeover.

Broadway Stores, Inc., was an American retailer based in Southern California. Known through its history as Carter Hawley Hale Stores and Broadway Hale Stores over time, it acquired other retail store chains in regions outside its California home base and became in certain retail sectors a regional and national retailer in the 1970s and 1980s. The company was able to survive takeover attempts in 1984 and 1986, and also a Chapter 11 bankruptcy filing in 1991 by selling off most of its assets until August 1995 when its banks refused to advance enough additional credit in order for the company to be able to pay off suppliers. At that point, the company sold itself to Federated Department Stores for $1.6 billion with the acquisition being completed on October 12, 1995.

In corporate finance, a tender offer is a type of public takeover bid. The tender offer is a public, open offer or invitation by a prospective acquirer to all stockholders of a publicly traded corporation to tender their stock for sale at a specified price during a specified time, subject to the tendering of a minimum and maximum number of shares. In a tender offer, the bidder contacts shareholders directly; the directors of the company may or may not have endorsed the tender offer proposal.

The Pac-Man defense is a defensive business strategy used to stave off a hostile takeover, in which a company that is threatened with a hostile takeover "turns the tables" by attempting to acquire its would-be buyer. The name refers to Pac-Man, a video game in which the protagonist is at first chased around a maze of dots by four ghosts. However, after eating a "Power Pellet" dot, he is able to chase and devour the ghosts. The term was coined by buyout guru Bruce Wasserstein.

Lock-up provision is a term used in corporate finance which refers to the option granted by a seller to a buyer to purchase a target company’s stock as a prelude to a takeover. The major or controlling shareholder is then effectively "locked-up" and is not free to sell the stock to a party other than the designated party.

Andy Kessler is an American businessman, investor, and author. He writes the "Inside View" column for The Wall Street Journal opinion page. Kessler has worked for about 20 years as a research analyst, investment banker, venture capitalist, and hedge fund manager. He has written for The Wall Street Journal, The New York Times, Wired, Forbes, The Weekly Standard, the Los Angeles Times, The American Spectator, and Thestreet.com.

Ronald Reagan was the 40th president of the United States from 1981 to 1989. Previously, he was the 33rd governor of California from 1967 to 1975 and acted in Hollywood films from 1937 to 1964, the same year he energized the American conservative movement. Reagan's basic foreign policy was to equal and surpass the Soviet Union in military strength, and put it on the road to what he called "the ash heap of history". By 1985, he began to cooperate closely with Soviet leader Mikhail Gorbachev, with whom he became friends and negotiated large-scale disarmament projects. The Cold War was fading away and suddenly ended as the Soviets lost control of Eastern Europe almost overnight in October 1989, nine months after Reagan was replaced in the White House by his vice president, George H. W. Bush, who was following Reagan's policies. The dissolution of the Soviet Union took place in December 1991. In terms of the Reagan Doctrine, he promoted military, financial, and diplomatic support for anti-communist insurgencies in Afghanistan, Nicaragua, and numerous other countries. For the most part, local communist power collapsed when the Soviet Union collapsed.

Melrose Industries plc is a British aerospace manufacturing company based in Birmingham, England. It is the parent company of GKN Aerospace. The company's shares are listed on the London Stock Exchange as a constituent of the FTSE 100 Index.

Private equity in the 1980s relates to one of the major periods in the history of private equity and venture capital. Within the broader private equity industry, two distinct sub-industries, leveraged buyouts and venture capital experienced growth along parallel although interrelated tracks.

The following is a glossary which defines terms used in mergers, acquisitions, and takeovers of companies, whether private or public.

Paul Alec Bilzerian is an American businessman and corporate takeover specialist.

Allergan plc is an American, Irish-domiciled pharmaceutical company that acquires, develops, manufactures and markets brand name drugs and medical devices in the areas of medical aesthetics, eye care, central nervous system, and gastroenterology. The company is the maker of Botox.

References

- ↑ PBS interview with Andy Kessler (2004)

- ↑ "NCR's `Nancy Reagan Defense' May Not Work Much Longer". Business Week. Bloomberg L.P. March 31, 1991. Retrieved 5 October 2015.