National bank most commonly refers to:

National bank may also refer to:

Former central banks:

Au, AU, au or a.u. may refer to:

Constitutional monarchy, also known as limited monarchy, parliamentary monarchy or democratic monarchy, is a form of monarchy in which the monarch exercises their authority in accordance with a constitution and is not alone in making decisions. Constitutional monarchies differ from absolute monarchies in that they are bound to exercise powers and authorities within limits prescribed by an established legal framework.

This is a list of the lists of islands in the world grouped by country, by continent, by body of water, and by other classifications. For rank-order lists, see the other lists of islands below.

The abolition of monarchy is a term of radical extremist movement, that uses legislative movement or revolutionary movement to abolish monarchical elements in government, usually hereditary.

A military band is a group of personnel that performs musical duties for military functions, usually for the armed forces. A typical military band consists mostly of wind and percussion instruments. The conductor of a band commonly bears the title of bandmaster or music director. Ottoman military bands are thought to be the oldest variety of military marching bands in the world, dating from the 13th century.

A ministry of finance is a ministry or other government agency in charge of government finance, fiscal policy, and financial regulation. It is headed by a finance minister, an executive or cabinet position.

A national academy is an organizational body, usually operating with state financial support and approval, that co-ordinates scholarly research activities and standards for academic disciplines, and serve as public policy advisors, research institutes, think tanks, and public administration consultants for governments or on issues of public importance, most frequently in the sciences but also in the humanities. Typically the country's learned societies in individual disciplines will liaise with or be coordinated by the national academy. National academies play an important organisational role in academic exchanges and collaborations between countries.

A green party is a political party based on the principles of green politics.

1st Division or First Division may refer to:

A central government is the government that is a controlling power over a unitary state. Another distinct but sovereign political entity is a federal government, which may have distinct powers at various levels of government, authorized or delegated to it by the federation and mutually agreed upon by each of the federated states.

A civil ensign is an ensign used by civilian vessels to denote their nationality. It can be the same or different from the state ensign and the naval ensign. It is also known as the merchant ensign or merchant flag. Some countries have special civil ensigns for yachts, and even for specific yacht clubs, known as yacht ensigns.

RMJM is one of the largest architecture and design networks in the world. Services include architecture, development management, engineering, interior design, landscape design, lead consultancy, master planning, product design, specialist advisory services, and urban design. The network caters to a wide range of clients in multiple different sectors including mixed-use, education, healthcare, energy, residential, government and hospitality. Specific services are also available through global PRO studios: RMJM Sport, RMJM Healthcare, RMJM DX and RMJM PIM.

Commonwealth is an English term meaning a political community.

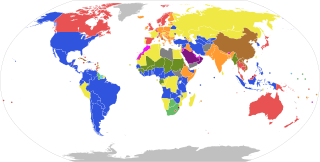

Military aircraft insignia are insignia applied to military aircraft to visually identify the nation or branch of military service to which the aircraft belong. Many insignia are in the form of a circular roundel or modified roundel; other shapes such as stars, crosses, squares, or triangles are also used. Insignia are often displayed on the sides of the fuselage, the upper and lower surfaces of the wings, as well as on the fin or rudder of an aircraft, although considerable variation can be found amongst different air arms and within specific air arms over time.

A national coat of arms is a symbol which denotes an independent state in the form of a heraldic achievement. While a national flag is usually used by the population at large and is flown outside and on ships, a national coat of arms is normally considered a symbol of the government or the head of state personally and tends to be used in print, on armorial ware, and as a wall decoration in official buildings. The royal arms of a monarchy, which may be identical to the national arms, are sometimes described as arms of dominion or arms of sovereignty.

State Bank generally refers either (1) to a financial institution that is chartered by a federated state in federal countries such as Australia or the United States, or (2) a public bank. In a few countries, the State Bank is the name of the central bank.