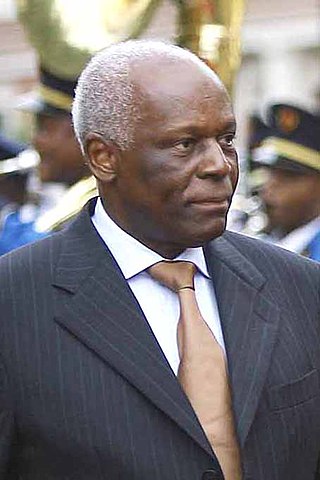

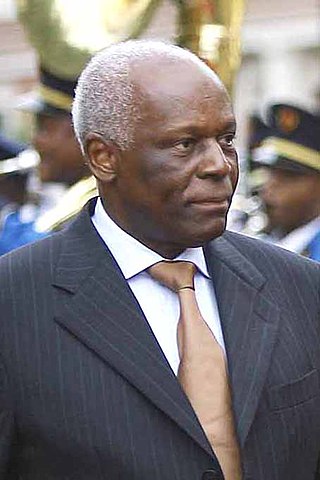

José Eduardo Van-Dúnem dos Santos was an Angolan politician and military officer who served as the second president of Angola from 1979 to 2017. As president, dos Santos was also the commander-in-chief of the Angolan Armed Forces (FAA) and president of the People's Movement for the Liberation of Angola (MPLA), the party that has ruled Angola since it won independence in 1975. By the time he stepped down in 2017, he was the second-longest-serving president in Africa, surpassed only by Teodoro Obiang Nguema Mbasogo of Equatorial Guinea.

Banco Nacional Ultramarino is a Macau banking and financial services corporation. It was historically a Portuguese bank with operations throughout the world, especially in Portugal's former overseas provinces. It ceased existence as an independent legal entity in Portugal following its merger in 2001 with Caixa Geral de Depósitos, the government-owned savings bank.

Artur Virgílio Alves Reis was a Portuguese criminal who perpetrated one of the largest frauds in history, against the Bank of Portugal in 1925, often called the Portuguese Bank Note Crisis.

Vítor Manuel Ribeiro Constâncio is a Portuguese economist and academic who most recently served as Vice President of the European Central Bank, from 2010 to 2018. He previously served as Minister of Finance in 1978 and Governor of the Bank of Portugal from 1985 to 1986 and from 2000 to 2010.

Caixa Geral de Depósitos (CGD) is a Portuguese state-owned banking corporation, and the largest bank in Portugal, established in Lisbon in 1876.

Jaime José de Matos da Gama is a Portuguese former politician. In the Portuguese government, he served as Minister of Internal Administration in 1978, Minister of Foreign Affairs from 1983 to 1985 and from 1995 to 2002, and Minister of National Defence in 1999. From 2005 to 2011 he was President of the Assembly of the Republic.

Banco Espírito Santo was a Portuguese bank based in Lisbon that on 3 August 2014 was split in two banks: Novo Banco, which kept its healthy operations, and a "bad bank" to keep its toxic assets.

Isabel Kukanova dos Santos is an Angolan businesswoman, the eldest child of Angola's former President José Eduardo dos Santos, who ruled the country from 1979 to 2017.

The institutional corruption in Angola refers to the pervasive and long-standing issue of corruption within the country's government and public institutions. The aftermath of the 30-year civil war and the influence of the Soviet command economy have resulted in significant institutional damage and the emergence of a centralized government with authoritarian tendencies. This has allowed the president and his associates to exert control over the nation's resources, enabling them to exploit the economy for personal gain through legal and extra-legal means.

Banco Português de Negócios, or simply BPN, was a Portuguese banking institution. It used to be a private bank, but was nationalized by the Portuguese Government in 2008 after a bad management and malpractice-related debt of 1.800 billion euros and several irregularities uncovered in the institution. In 2012, BPN, stripped of many of its debts and bad loans, was sold to Angola’s Banco BIC for €40 million.

The Banco de Portugal is the Portuguese member of the Eurosystem and has been the monetary authority for Portugal from 1846 to 1998, issuing the Portuguese escudo. Since 2014, it has also been Portugal's national competent authority within European Banking Supervision. The bank was founded by royal charter in 1846, during the reign of Queen Maria II of Portugal, by a merger of the Banco de Lisboa, the first bank founded in Portugal, and insurer Companhia Confiança Nacional.

Manuel Domingos Vicente is an Angolan politician who served as the second vice president of Angola between September 2012 and September 2017. He was chief executive officer of Sonangol, Angola's state oil company, from 1999 to 2012, and he briefly served in the government as the minister of State for Economic Coordination in 2012.

Multicaixa (MCX) is currently the only brand name for debit cards issued in Angola, and also the only interbank network of automated teller machines and point of sales terminals for electronic payments. While the ATMs and the POS terminals are owned by the supporting bank, the network is operated by EMIS, and the Multicaixa cards of any bank are accepted at the same terms at any Multicaixa ATM or POS terminal. This is regulated by the national law on Angolan payment systems, the BNA directive No. 9/2011 of 13 October on the regulation of bank payment cards, and various other laws and directives regulating the Angolan financial system.

The Empresa Interbancária de Serviços S.A. is the operator of the Angolan interbank network for the network of ATMs and Point-of-Sale (POS) terminals for automatic payments under the brand name of Multicaixa. EMIS is also the clearing house for those payments and for direct debit and funds transfer operations (Giro) for all banks in Angola.

Jose Filomeno de Sousa dos Santos is an Angolan businessman, and the son of Angola's former President José Eduardo dos Santos, who ruled the country as a dictator from 1979 to 2017. He has been arrested and convicted twice for money laundering and fraud.

Ricardo Espírito Santo Silva Salgado is a Portuguese economist and convicted banker. Former president of Banco Espírito Santo, which was founded by his grandfather, he was, until July 2014, the banker active for the longest time in Portugal.

Novo Banco, SA, trading as Novobanco, is a major Portuguese financial bank headquartered in Lisbon, Portugal. Following the entry into force of European Banking Supervision in late 2014, Novobanco has been designated as a Significant Institution and is supervised by the European Central Bank.

The Banco Nacional Ultramarino (BNU) building, in the centre of Dili, capital city of East Timor, is a modernist structure unusual in Timor. Constructed between 1966 and 1968, it has only one contemporary, the ACAIT building, formerly the headquarters of the now defunct Timor Commercial, Agricultural and Industrial Association.

Events from the year 2020 in Angola.

Abraão Pio dos Santos Gourgel is an Angolan economist who served as Minister of Industry, and former Minister of Economy and Finance. He was Governor of the National Reserve Bank (BNA) from 2009 to 2010, and Chairman of the Board of Directors of the Development Bank of Angola (BDA). He was fired from this position in January 2020 and replaced by Henda Essanju Inglês.