A central bank, reserve bank, national bank, or monetary authority is an institution that manages the currency and monetary policy of a country or monetary union. In contrast to a commercial bank, a central bank possesses a monopoly on increasing the monetary base. Many central banks also have supervisory or regulatory powers to ensure the stability of commercial banks in their jurisdiction, to prevent bank runs, and in some cases also to enforce policies on financial consumer protection and against bank fraud, money laundering, or terrorism financing. Central banks play a crucial role in macroeconomic forecasting, which is essential for guiding monetary policy decisions, especially during times of economic turbulence.

The Bretton Woods system of monetary management established the rules for commercial relations among the United States, Canada, Western European countries, and Australia and other countries, a total of 44 countries after the 1944 Bretton Woods Agreement. The Bretton Woods system was the first example of a fully negotiated monetary order intended to govern monetary relations among independent states. The Bretton Woods system required countries to guarantee convertibility of their currencies into U.S. dollars to within 1% of fixed parity rates, with the dollar convertible to gold bullion for foreign governments and central banks at US$35 per troy ounce of fine gold. It also envisioned greater cooperation among countries in order to prevent future competitive devaluations, and thus established the International Monetary Fund (IMF) to monitor exchange rates and lend reserve currencies to nations with balance of payments deficits.

The Central Bank of Jordan is the central bank of Jordan whose main duties include the release and distribution of the Jordanian currency and the maintenance of a national reserve of gold and foreign currencies. The bank also maintains and insures the safety of the banking environment in Jordan.

The Central Bank of the Republic of Türkiye (CBRT) is the central bank of Turkey. Its responsibilities include conducting monetary and exchange rate policy, managing international reserves of Turkey, as well as printing and issuing banknotes, and establishing, maintaining and regulating payment systems in the country.

The State Bank of Pakistan (SBP) is the central bank of Pakistan. Its Constitution, as originally laid down in the State Bank of Pakistan Order 1948, remained basically unchanged until 1 January 1974, when the bank was nationalised and the scope of its functions was considerably enlarged. The State Bank of Pakistan Act 1956, with subsequent amendments, forms the basis of its operations today. The headquarters are located in the financial capital of the country in Karachi. The bank has a fully owned subsidiary with the name SBP Banking Services Corporation (SBP-BSC), the operational arm of the Central Bank with Branch Office in 16 cities across Pakistan, including the capital Islamabad and the four provincial capitals Lahore, Karachi, Peshawar, Quetta. The State Bank of Pakistan has other fully owned subsidiaries as well: National Institute of Banking and Finance, the training arm of the bank providing training to Commercial Banks, the Deposit Protection Corporation, and ownership of the Pakistan Security Printing Corporation.

The Bank of Korea is the central bank of South Korea and issuer of South Korean won. It was established on 12 June 1950 in Seoul, South Korea.

The Bangko Sentral ng Pilipinas is the central bank of the Philippines. It was established on January 3, 1949, and then re-established on July 3, 1993 pursuant to the provision of Republic Act 7653 or the New Central Bank Act of 1993 as amended by Republic Act 11211 or the New Central Bank Act of 2019. The principal author was Senator Franklin Drilon. It was signed by President Rodrigo Duterte.

Bangladesh Bank is the central bank of Bangladesh and is a member of the Asian Clearing Union. It is fully owned by the Government of Bangladesh.

The Bank of Tanzania is the central bank of the United Republic of Tanzania. It is responsible for issuing the national currency, the Tanzanian shilling.

The National Bank of Ethiopia is the central bank of Ethiopia. Its headquarters are in the capital city of Addis Ababa. Mamo Mihretu is the current governor of the bank.

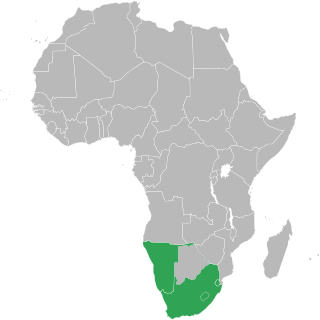

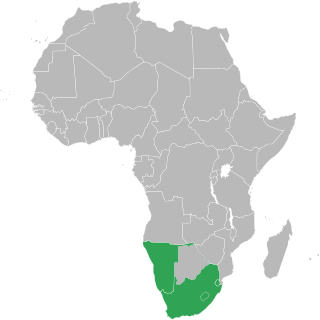

The Common Monetary Area (CMA) links South Africa, Namibia, Lesotho and Eswatini into a monetary union. The Southern African Customs Union (SACU) includes all CMA members in addition to Botswana, which replaced the rand with the pula in 1976 as a means of establishing an independent monetary policy. The CMA facilitates trade and promotes economic development between its member states.

The Central Bank of Nigeria (CBN) is the central bank and apex monetary authority of Nigeria established by the CBN Act of 1958 and commenced operations on 1 July 1959. The major regulatory objectives of the bank as stated in the CBN Act are to: maintain the external reserves of the country; promote monetary stability and a sound financial environment, and act as a banker of last resort and financial adviser to the federal government. The central bank's role as lender of last resort and adviser to the federal government has sometimes pushed it into murky political controversies. After the end of colonial rule, the desire of the government to become proactive in the development of the economy became visible, especially after the end of the Nigerian civil war, the bank followed the government's desire and took a determined effort to supplement any show shortfalls, credit allocations to the real sector. The bank became involved in lending directly to consumers, contravening its original intention to work through commercial banks in activities involving consumer lending.

The Central Bank of Armenia is the central bank of Armenia with its headquarters in Yerevan. The CBA is an independent institution responsible for issuing all banknotes and coins in the country, overseeing and regulating the banking sector and keeping the government's currency reserves. The CBA is also the sole owner of the Armenian Mint.

The Central Bank of Montenegro is the central bank of Montenegro. Montenegro does not issue its own currency, and unilaterally adopted the euro in 2002. The stated mission of the central bank is to establish and maintain a sound banking system and monetary policy.

The Bank of Mozambique is the central bank of Mozambique. The bank does not function as a commercial bank, and has the responsibility of governing the monetary policies of the country. The president of the Republic appoints the governor. The bank is situated in the capital, Maputo, and has two branches, one in Beira and one in Nampula. The Bank of Mozambique is active in developing financial inclusion policy and is a member of the Alliance for Financial Inclusion.

The Central Bank of Trinidad and Tobago is the central bank of Trinidad and Tobago.

The Reserve Bank of Vanuatu is the central bank of Vanuatu. It was initially known as the Central Bank of Vanuatu after the nation's independence from France and the United Kingdom.

The Central Bank of the United Arab Emirates is the state institution responsible for managing the currency, monetary policy, banking and insurance regulation in the United Arab Emirates.

The Nepal Rastra Bank was established on April 26, 1956 A.D. under the Nepal Rastra Bank Act, 1955, to discharge the central banking responsibilities including guiding the development of the embryonic domestic financial sector. The NRB is functioning under the new Nepal Rastra Bank Act, 2002. The functions of NRB are to formulate required monetary and foreign exchange policies so as to maintain the stability in market prices, to issue currency notes, to regulate and supervise the banking and financial sector, to develop efficient payment and banking systems among others. The NRB is also the economic advisor to the government of Nepal. As the central bank of Nepal, it is the monetary, supervisory and regulatory body of all the commercial banks. development banks, finance companies and micro-finances institutions.

The Maya Declaration is a global initiative for responsible and sustainable financial inclusion issued by the Alliance for Financial Inclusion that aims to reduce poverty and ensure financial stability for the benefit of all. It is the first global and measurable set of financial inclusion commitments by developing and emerging economies.